Thousands of individuals, particularly students, who took on temporary summer employment could be due hundreds of pounds in overpaid income tax, according to an analysis of UK tax regulations. The potential for a tax refund for a summer job arises from how the Pay As You Earn (PAYE) system processes short-term contracts, often placing workers on an emergency tax code that results in incorrect deductions.

Worked a Summer Job

| Key Factor | Details |

| Primary Cause | Being placed on an ’emergency tax code’ (e.g., 1257L W1/M1) which taxes you as if your temporary earnings were your regular monthly income all year. |

| Eligibility Trigger | Total annual earnings for the tax year (6 April – 5 April) are below the Personal Allowance of £12,570. |

| Action Required | May be automatic, but a manual claim using form P50 can speed up the process if you are not working again in the same tax year. HMRC |

Why Summer Workers Often Overpay Tax

Many temporary workers are incorrectly taxed due to the standard operation of the UK’s PAYE system. The system is designed for consistent, year-round employment, which does not align with the nature of a short-term summer job.

Understanding the Personal Allowance

Every individual in the UK is entitled to a Personal Allowance, which is the amount of income they can earn each year before paying any income tax. For the current 2025/26 tax year, this amount is £12,570, as set by HM Revenue & Customs (HMRC).

Typically, this allowance is divided equally across the year’s pay periods. For a monthly paid employee, this equates to roughly £1,048 of tax-free income per month. However, if a person only works for two or three months over the summer and their total earnings for the entire tax year remain below £12,570, they should not have paid any income tax at all.

The Role of the ‘Emergency Tax Code’

When an employer does not have a new employee’s P45 form from a previous job, they are required to put the new starter on an emergency tax code. These codes, often ending in W1 (week 1) or M1 (month 1), instruct the payroll software to tax the employee based only on what they earn in that specific pay period, without considering any previous earnings or the full annual Personal Allowance.

“The system presumes the worker will continue earning at that rate for the rest of the year,” explained Sarah Jones, a senior tax adviser at a UK accounting firm. “For a student earning £1,500 in a month, the system might deduct tax as if they were earning £18,000 a year, pushing them over the Personal Allowance threshold and triggering a deduction that isn’t actually due.”

How to Check if You Are Owed a Tax Refund for a Summer Job

Determining if you have overpaid tax is a straightforward process that involves reviewing key documents provided by your employer.

Reviewing Your Payslips and P45 Form

The first step is to examine your final payslip from your summer job. Look for your tax code – if it includes “W1,” “M1,” or “X,” you were on an emergency code. The payslip will also show a “tax paid” figure. If you have paid tax and believe your total annual income will be under £12,570, you are likely due a refund.

When you leave the job, your employer must give you a P45 form. This document summarises your total pay and the tax you’ve deducted during your employment. It is a critical document for reclaiming overpaid tax or for giving to your next employer.

Using the Official HMRC Online Checker

HMRC provides an official online tool on the GOV.UK website that allows individuals to check if they might have paid too much tax. Users can input details from their P45 or final payslip to get an estimate.

The Process to Claim Tax Back from HMRC

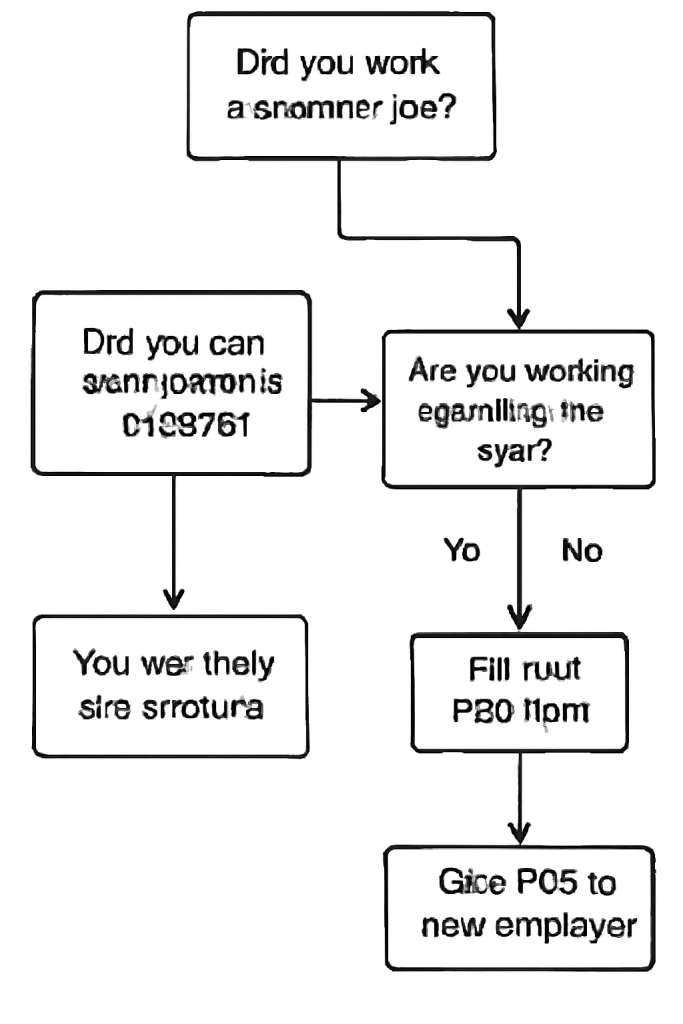

There are two primary routes to getting your money back, depending on your circumstances following the summer job.

Automatic Refunds vs. Manual Claims

For many, the process is automatic. After the tax year ends on 5 April, HMRC runs a reconciliation of all taxpayers’ records. If an overpayment is identified, they will send a P800 tax calculation letter, usually between June and October, followed by a cheque.

However, waiting for this automatic process can mean a delay of many months. If you worked a summer job and do not plan to work again before the end of the tax year, you can file a manual claim to receive your HMRC tax refund more quickly.

Submitting a P50 Form

To make a manual claim, you must complete and submit a P50 “Claim for repayment of tax” form. This form can be filled out and submitted online via the GOV.UK portal or printed and posted. You will need details from your P45 to complete it.

“Filing a P50 is the most proactive step a temporary worker can take,” advises Citizens Advice. “It informs HMRC that your employment has ceased for the tax year and allows them to process your refund directly, often within a few weeks.”

It is crucial to use the official GOV.UK website. Third-party tax reclaim companies often advertise these services but will take a significant percentage of your refund as a fee for a process you can complete for free.

What To Do Next

The window for claiming a tax refund is generous; you can claim for the previous four tax years. However, financial experts advise acting promptly to ensure documents are not lost and the funds are recovered as soon as possible. Anyone who has left a job should ensure they receive their P45 and keep it in a safe place.

If you have lost your P45, you should contact your former employer to request a replacement statement of earnings. While they are not required to provide a duplicate P45, they can provide the necessary figures for you to proceed with a claim to HMRC.

Car Tax in the UK September 2025: Everything You Need to Know

K Housing Benefit In September 2025 – Check Benefit Amounts, Eligibility Criteria

FAQs

Q: How long does it take to get a tax refund after submitting a P50?

A: According to HMRC, processing times can vary, but most claims submitted online are processed within two to four weeks. Postal claims may take longer.

Q: What if I had more than one job during the tax year?

A: If you have another job lined up, you should give your P45 from the summer job to your new employer. They will use this to put you on the correct tax code, and any overpayment from your summer job should be automatically adjusted in your subsequent pay packets.

Q: Is there a deadline to claim a tax refund?

A: Yes. You have four years from the end of the tax year in which you overpaid to claim a refund. For example, to claim for the 2024-2025 tax year, you have until 5 April 2029.