A new campaign demanding a UK State Pension at 60 has gained significant public support, forcing a parliamentary debate on the feasibility and fairness of the current retirement age. The petition, which has surpassed 100,000 signatures, pits calls for an earlier retirement against stark government warnings about the immense financial cost and demographic pressures facing the nation.

The Heart of the Debate

A petition on the official UK Parliament website, initiated by Michael Thompson, urges the government to allow people to claim their State Pension from the age of 60. The campaign argues that individuals who have worked and paid National Insurance for over 40 years deserve this right. It highlights the physical strain on those in manual jobs and the widespread expectation of an earlier retirement that has been upended by successive policy changes.

Having crossed the 100,000-signature threshold, the Petitions Committee has confirmed the matter will be scheduled for debate in Parliament. This ensures that Members of Parliament will publicly address the concerns raised by a significant portion of the electorate, bringing the contentious issue of the State Pension age back into the political spotlight.

Financial Realities Clash with Public Demand

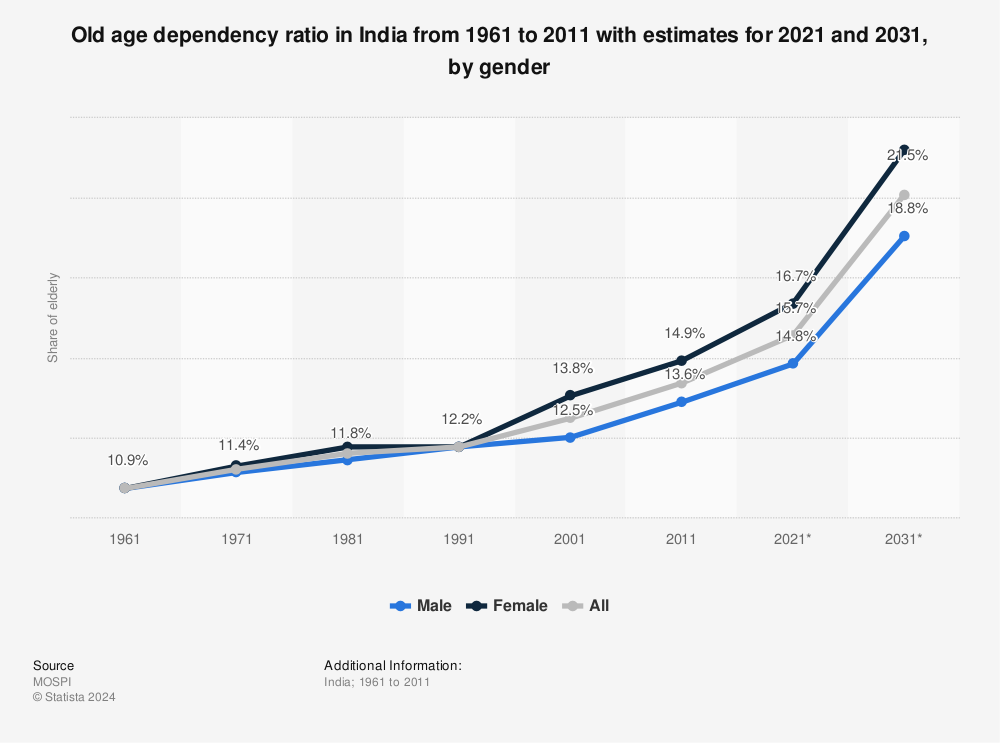

The core of the government’s opposition to lowering the retirement age is its projected cost. The current system is funded by today’s workers, and with people living longer, the financial burden on the state is growing.

The Government’s Stance on Affordability

The Department for Work and Pensions (DWP) issued a formal response to the petition, stating that such a policy would be fiscally unsustainable. “Reversing the changes to State Pension age would introduce significant and unaffordable costs, estimated to be over £200 billion for the period between now and the late 2040s,” a government spokesperson clarified in a previous statement on the matter.

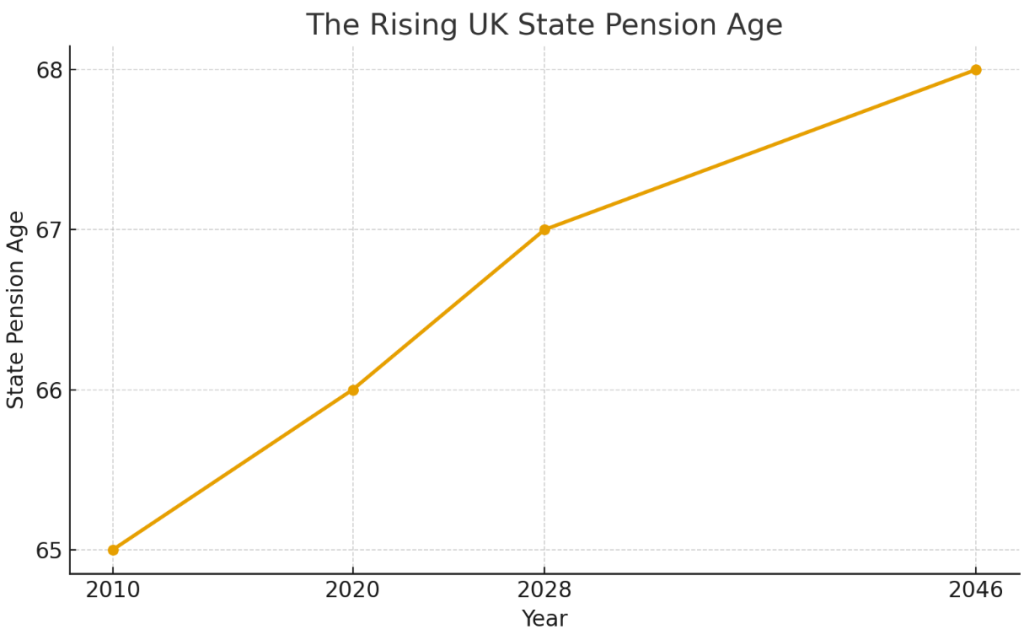

Officials argue that the current State Pension age of 66, which is legislated to rise to 67 by 2028, is essential to ensure the long-term viability of the pension system. Economic experts echo these concerns. The Institute for Fiscal Studies (IFS), a leading independent think tank, has consistently warned that an ageing population requires either higher taxes, lower spending, or a later retirement age to balance the books.

The Human Cost of Working Longer

Campaigners argue that fiscal arguments overlook the human impact. They point to growing pension inequality, where individuals in physically demanding careers or those with chronic health conditions are forced to work longer despite declining health.

“It feels like the goalposts are constantly being moved,” said one signatory on the petition’s comment page. “Forty-five years in a physically demanding job should be enough. My body is worn out, and retiring at 68 feels like a fantasy.” This sentiment reflects a widespread feeling that the social contract regarding retirement has been broken.

The Legacy of the WASPI Campaign

This new movement shares emotional ground with the well-known WASPI campaign (Women Against State Pension Inequality). The WASPI campaign has focused specifically on women born in the 1950s who argue they were not given adequate notice that their State Pension age would be increasing from 60 to 65, and then 66, in line with men’s. They claim this lack of communication caused severe financial and emotional distress.

While the WASPI campaign focuses on transitional arrangements for a specific cohort, the call for a UK State Pension at 60 is a universal demand affecting all future retirees. However, the energy and public awareness generated by WASPI have undoubtedly helped create a fertile ground for this new, broader campaign.

The upcoming parliamentary debate will force a direct confrontation between these two opposing views. For the government, it is a matter of long-term economic stability. For hundreds of thousands of citizens, it is a question of fairness, health, and the right to a dignified retirement after a lifetime of work. How Parliament navigates this challenge will be closely watched by millions approaching their later years.

State Pensioners Could Claim 15 Years’ Back Pay: But You Must Act

Rachel Reeves Targets Costly Pension Perk: Will Savers Lose Out?

FAQs

1. What is the current UK State Pension age?

The State Pension age in the UK is currently 66 for both men and women. It is scheduled to rise to 67 between 2026 and 2028 and is expected to increase to 68 in the future.

2. Why was the State Pension age increased from 60/65?

The increases were implemented primarily due to rising life expectancy. As people are living longer, they are drawing a pension for a greater number of years. Successive governments have argued that raising the age is necessary to ensure the pension system remains affordable and sustainable for future generations.

3. How is this campaign different from the WASPI campaign?

The WASPI campaign focuses on seeking compensation for women born in the 1950s who were not properly informed about the rise in their State Pension age. This new campaign is broader, calling for the State Pension age to be lowered to 60 for everyone, regardless of when they were born.