The UK State Pension age is set to begin its scheduled increase from 66 to 67 starting in 2026, a move that will affect millions of people born in the early 1960s. This legislated change, driven by increasing life expectancy, continues a long-term government strategy to ensure the sustainability of the state pension system.

The upcoming change is part of a phased timetable laid out in the Pensions Act 2014. It will be the first increase since the pension age for both men and women was equalised and then raised to 66 in October 2020. Understanding the specific dates is crucial for those planning their retirement finances.

UK Retirement Age Set to Rise in 2026

| Key Fact | Detail |

| The Change | State Pension age is rising from 66 to 67. Pensions Act 2014 |

| Timeline | The increase will be phased in between May 2026 and March 2028. |

| Directly Affected Group | Individuals born between 6 April 1960 and 5 March 1961. GOV.UK |

The Timetable: How the UK State Pension Age Will Rise

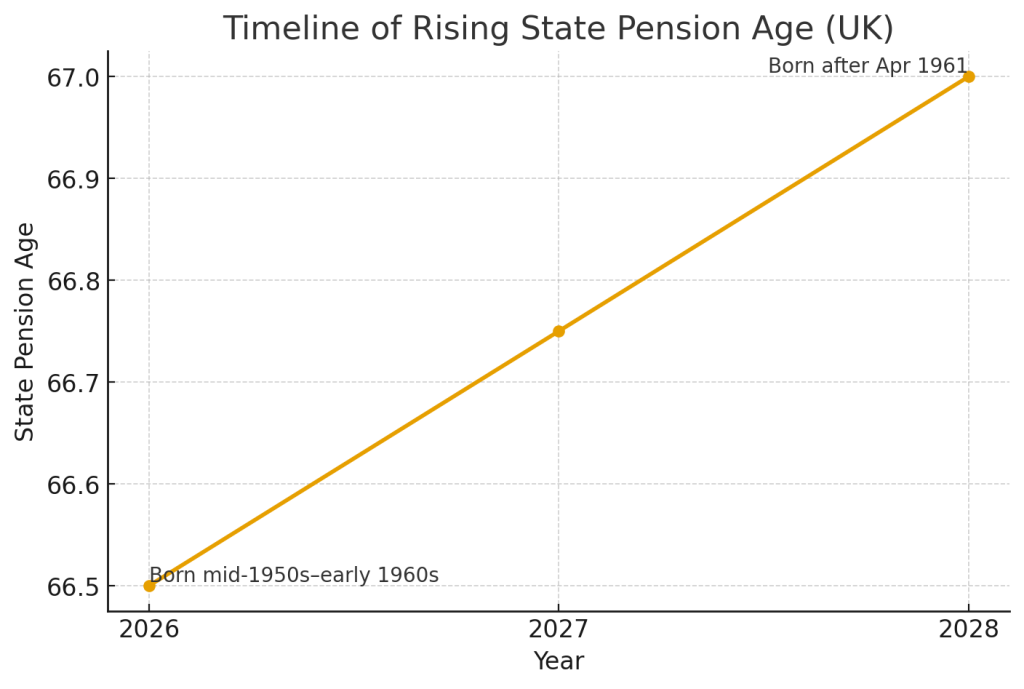

The increase to 67 will not happen overnight. Instead, it will be introduced gradually over a two-year period. This phased approach means that an individual’s specific State Pension age will depend on their exact date of birth.

According to the official schedule from the Department for Work and Pensions (DWP), the age will climb by a few months at a time. For example, someone born in early April 1960 will be able to claim their pension at 66 and a few months, while someone born in early 1961 will have to wait until they turn 67.

Who is affected?

- People born between 6 April 1960 and 5 May 1960: Your State Pension age will be 66 years and 1 month.

- People born between 6 May 1960 and 5 June 1960: Your State Pension age will be 66 years and 2 months.

- This pattern continues, with the age increasing incrementally for each subsequent birth month.

- People born between 6 March 1961 and 5 April 1977: Your State Pension age is currently 67.

The government provides an official online calculator for individuals to check their precise State Pension age.

The Rationale Behind the Retirement Age Changes

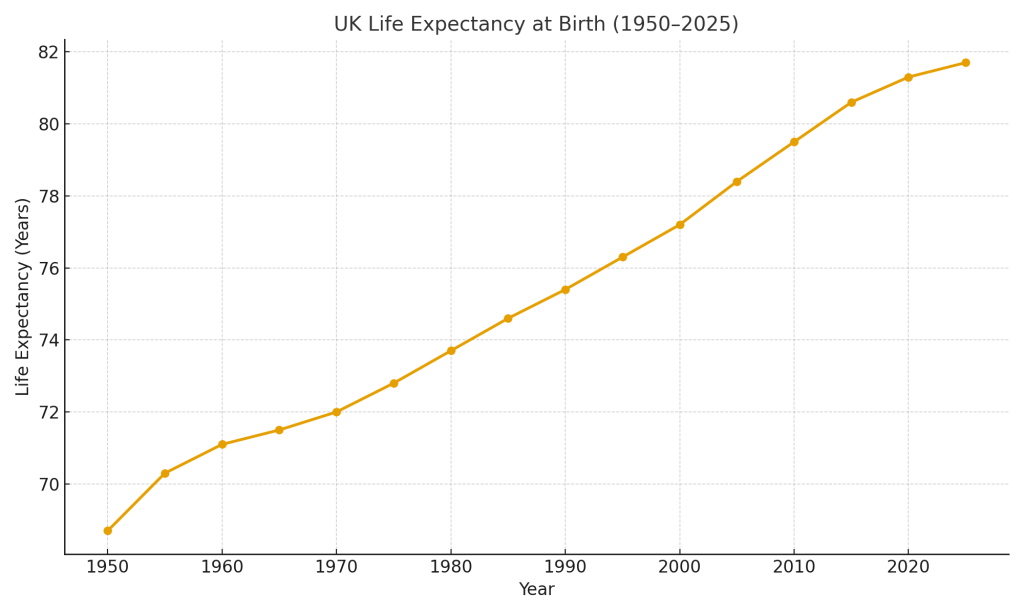

Successive governments have argued that increases in the State Pension age are necessary to manage the nation’s finances in an era of demographic change. The primary drivers are significant increases in average life expectancy and the goal of maintaining fiscal sustainability.

The principle, as outlined in government reviews, is that individuals should expect to spend a broadly consistent proportion of their adult life in retirement. As people live longer, the period during which they can claim a state pension naturally extends, increasing costs for the taxpayer.

In a statement regarding the policy, the DWP has previously noted that these changes are about “maintaining the link between the age at which we can expect to receive State Pension and our longevity, and ensuring the State Pension remains sustainable for future generations.”

Future Increases and The Path to 68

The rise to 67 is not the final scheduled change. Under current legislation, the UK State Pension age is due to rise again, to 68, between 2044 and 2046. However, this timetable has been the subject of considerable debate.

A 2023 government review considered proposals to accelerate the rise to 68 to the late 2030s. Ultimately, the government decided to postpone a final decision, citing recent volatility in life expectancy data following the COVID-19 pandemic.

Mel Stride, the Secretary of State for Work and Pensions, told Parliament in March 2023, “I am mindful that a different decision might be appropriate once the long-term impact of the pandemic and other global factors, such as inflation, are clearer.” This indicates that the timetable for future increases remains under active review and could be subject to change based on new economic and demographic data.

The decision on when to implement the next rise will likely fall to a future government, ensuring that the pension age rise remains a key topic in British public policy.

UK House Prices Plunge; Is Reeves’ New Property Tax Plan to Blame?

Lidl Just Changed the Rules; What the New £13.95 Payment Means for Every UK Shopper

FAQs

1. How can I find my exact State Pension age?

You can find your precise State Pension age by using the official UK government checker tool on the GOV.UK website. You will need to enter your date of birth.

2. Do these retirement age changes affect both men and women?

Yes. The State Pension age for men and women was equalised at 65 in 2018. All subsequent increases, including the rise to 67, apply equally to everyone regardless of gender.

3. What is my State Pension age if I was born after March 1961?

Under the current law, if you were born between 6 April 1961 and 5 April 1977, your State Pension age is 67. If you were born after this period, your State Pension age is currently scheduled to be 68, though the exact timing for that increase is subject to review.