LONDON – The UK property market has registered its most significant annual price drop in over a year, fuelling a fierce debate over the underlying causes. While persistently high mortgage rates remain the primary driver according to most economists, a controversial property tax proposal from Labour’s Shadow Chancellor, Rachel Reeves, has entered the political crossfire, with the government claiming the plan is creating damaging market uncertainty.

UK House Prices Post Steepest Fall in a Year

| Key Fact | Detail / Statistic |

| Annual Price Decline | Average house prices fell 2.1% in the year to August 2025. Nationwide Building Society |

| Primary Economic Driver | Bank of England base rate remains at a 16-year high of 5.25%. |

| Labour’s Tax Proposal | Plans to reform council tax bands, which have not been updated since 1991. The Labour Party |

Nationwide Data Confirms Market Downturn

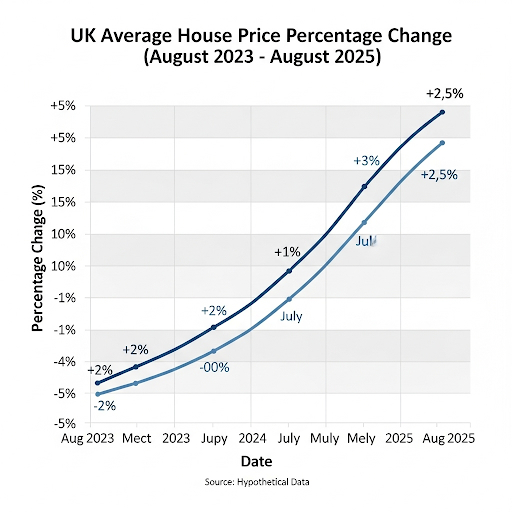

New figures released by the Nationwide Building Society show that UK house prices fell by 2.1 per cent in the 12 months to August, marking the sharpest decline since July 2024. The average price of a home now stands at £257,800, a significant adjustment from the market’s peak during the post-pandemic boom.

Robert Gardner, Nationwide’s Chief Economist, stated that the slowdown is a direct consequence of reduced affordability. “The resilience of the market is being tested by elevated mortgage rates,” Gardner said in the report. “Buyer confidence has weakened, and housing activity has remained subdued throughout the summer.”

Regional disparities are also becoming more pronounced. While London and the South East have seen more substantial price corrections, areas in Scotland and the North of England have demonstrated greater resilience, according to the Nationwide data.

Spotlight on the Rachel Reeves Property Tax Proposal

Amid the economic headwinds, a political debate has intensified over Labour’s proposed tax reforms. The Rachel Reeves property tax plan involves a potential revaluation of council tax bands in England, which have not been reassessed since their introduction in 1991. Proponents argue this would make local taxation fairer, aligning property values with the current market.

In a recent speech, Ms. Reeves stated the goal was to “ensure the tax system is fair and fit for the twenty-first century.” The Labour Party insists that the changes would not be a “wealth tax” but a necessary modernisation to ensure those in more valuable properties contribute proportionately more.

Economists Weigh in: Tax Fears vs. Economic Reality

The Conservative government has seized upon the proposal, linking it directly to the current house price slump. Chancellor Jeremy Hunt accused Labour of “plotting tax hikes that would penalise hardworking families,” suggesting that the mere prospect of these changes is deterring potential buyers and creating instability in the UK property market.

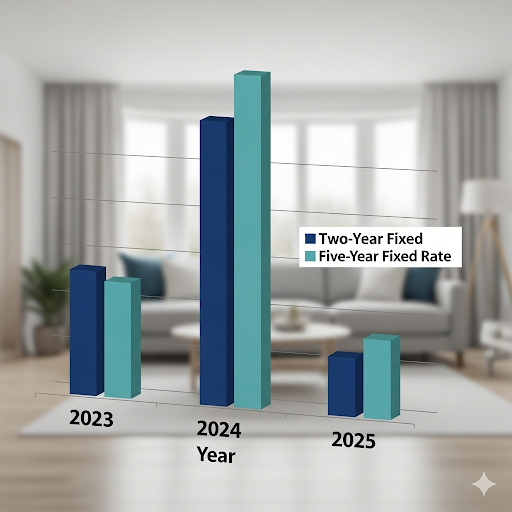

However, most independent property analysts and economists argue that the government’s focus on the tax plan is a distraction from the core issue. They maintain that the primary cause of the market’s downturn is the sharp increase in borrowing costs since the Bank of England began raising its base rate to combat inflation.

“While political uncertainty ahead of an election can cause some short-term hesitation, it is dwarfed by the impact of affordability,” said Dr. Anna Clare, a housing market specialist at the London School of Economics. “A buyer’s ability to secure a mortgage is the fundamental factor, and with rates where they are, purchasing power has been significantly eroded.”

Analysts at the Institute for Fiscal Studies (IFS) noted in a recent report that while a council tax revaluation would create both “winners and losers,” its immediate impact on overall market prices before implementation would be minimal compared to macroeconomic factors.

The current market conditions reflect a broader economic adjustment. The combination of high inflation, which has strained household budgets, and the corresponding monetary policy response has ended a decade-long period of cheap borrowing. As the country heads towards a general election expected within the next year, the debate over the housing market and the fairness of property taxation is set to become an even more prominent political battleground.

FAQ

What is the proposed Rachel Reeves property tax plan?

The plan primarily involves a revaluation of England’s council tax bands. These bands are based on property values from 1991, and Labour argues that updating them would create a fairer system of local taxation based on current property worth.

Why are UK house prices falling?

Most economists agree that the main reason for the house price slump is the rise in mortgage rates. Higher rates, set by the Bank of England to control inflation, make borrowing more expensive, reducing what buyers can afford and cooling demand.

How do mortgage rates affect the UK property market?

Mortgage rates directly influence housing affordability. When rates are low, borrowing is cheap, which can drive up demand and prices. When rates are high, monthly payments increase, pricing many potential buyers out of the market and leading to lower demand and falling prices.