Three new SSDI payments will start next week for over 7 million Americans according to the Social Security Administration’s August 2025 payment schedule. If you receive Social Security Disability Insurance (SSDI), it’s important to know when you will get your payments, whether you are eligible, and how the benefit amounts are calculated so you can plan your finances with confidence.

Three New SSDI Payments Start Next Week for 7+ Million Americans

| Topic | Details |

|---|---|

| Number of Americans Affected | Over 7 million SSDI beneficiaries |

| August 2025 Payment Dates | Born 1st–10th: August 13, Born 11th–20th: August 20, Born 21st+: August 27 |

| Early SSDI Recipients | SSDI recipients before May 1997 or combined SSI receive payment August 1 |

| Payment Frequency | Monthly |

| Benefit Range (2025) | $967 to $5,108 depending on work history and age at claim |

| Eligibility Criteria | Disability lasting 12 months or more, sufficient work credits, under full retirement age |

| Official SSA Resource | My Social Security Account |

Knowing the August 2025 payment schedule and eligibility criteria for SSDI benefits is essential for more than 7 million Americans depending on this income. By understanding when payments arrive, how amounts are determined, and where to check your details, you can better manage your finances and avoid surprises.

Stay informed through the official Social Security Administration resources and keep your information up to date so your benefits are paid accurately and on time.

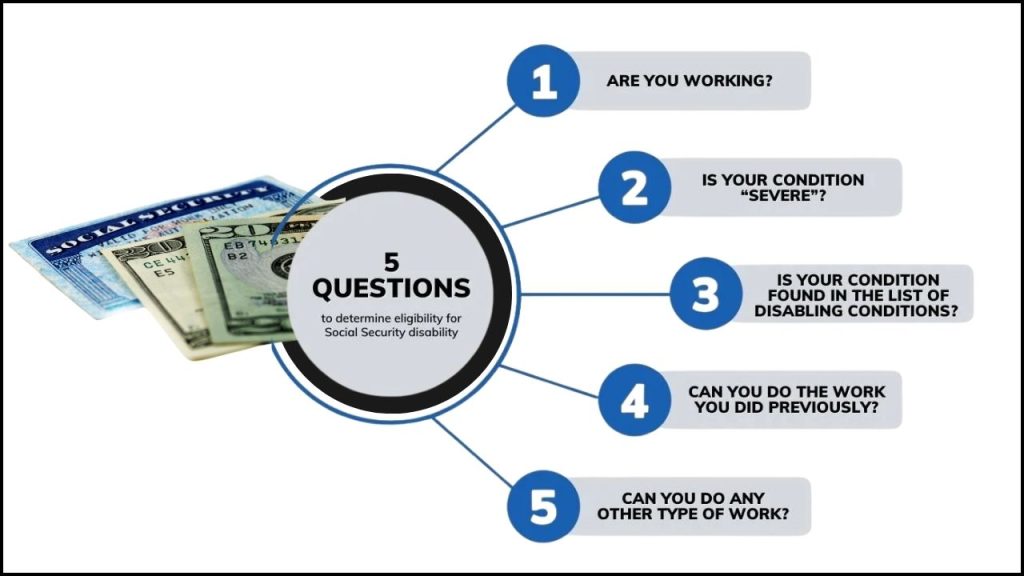

What Is SSDI and Who Is Eligible?

Social Security Disability Insurance (SSDI) is a federal program that provides monthly payments to individuals who are unable to work due to a medically proven disability. To be eligible for SSDI, you must meet these key criteria:

- Medical Disability: Your disability must prevent “substantial gainful activity” and be expected to last at least 12 months or result in death.

- Work History: You need enough work credits earned by paying Social Security taxes. In 2025, one credit is earned for every $1,810 in wages. Generally, 40 credits are required, with 20 earned in the last 10 years. Younger individuals may need fewer credits.

- Age: You must be under the full retirement age. Once you reach full retirement age, SSDI benefits convert to retirement payments without change in amount.

If you qualify, you will receive monthly benefits calculated based on your earnings history and age.

August 2025 SSDI Payment Schedule

The Social Security Administration issues payments in August 2025 on different Wednesdays depending on your birth date:

- If your birthday falls between the 1st and 10th, payment is on Wednesday, August 13.

- If your birthday falls between the 11th and 20th, payment is on Wednesday, August 20.

- If your birthday is on or after the 21st, payment is on Wednesday, August 27.

A special payment date of Friday, August 1 applies if you started receiving SSDI before May 1997 or if you receive both SSDI and Supplemental Security Income (SSI).

This monthly schedule helps beneficiaries plan monthly budgets reliably.

How Much Will You Receive?

SSDI benefit amounts vary widely depending on your work history, age at claiming, and past earnings. In 2025:

- Benefits range from a minimum of $967 to a maximum of $5,108 per month.

- The average monthly benefit is around $1,907.

- Those who delay benefits until age 70 and have a strong work record receive higher amounts.

Your individual payment reflects your unique earnings record and disability status.

How to Check Your Benefit and Payment Details

You can find your exact SSDI payment dates and benefit amount by:

- Logging into or creating a My Social Security account at www.ssa.gov/myaccount.

- Viewing your latest monthly payment estimate and scheduled payment date.

- Checking your record of earnings and contributions.

If your payment is late, allow at least three business days for direct deposits to arrive. Contact the SSA at 1-800-772-1213 or your local office if delays exceed this.

Practical Tips for SSDI Beneficiaries

- Plan Your Budget: Knowing your payment schedule helps manage essential expenses.

- Regularly Monitor Your Account: Stay updated on potential changes or notifications.

- Keep Disability Records Handy: Maintain current medical documentation in case the SSA requests verification.

- Watch for Overpayment Notices: The SSA may recoup overpayments by deducting from future benefits.

- Seek Help if Needed: Consult disability advocates or attorneys for appeals or complex cases.

2026 Social Security COLA Could Surprise Everyone — But There’s One Big Catch

You Might Be Missing Out on $4,442 in Social Security Each Year — Here’s Why

New Bill Could Block Social Security Changes Unless Congress Says Yes

FAQs About Three New SSDI Payments Start Next Week for 7+ Million Americans

Who qualifies for SSDI?

Anyone with a medically confirmed disability lasting 12 months or longer (or expected death), sufficient work credits, and under full retirement age.

When will my August 2025 SSDI payment arrive?

Between August 1 and August 27, depending on your birthday and whether you started receiving benefits before May 1997.

What is the payment range for SSDI in 2025?

Between $967 and $5,108 monthly, depending on work history and age at claim.

What if my payment is late?

Wait three business days for direct deposits. Then contact the SSA if you still haven’t received it.