Understanding your State Pension is more important than ever in 2025. Recent headlines have caused surprise — and concern — by claiming that some pension payments have tripled to as much as £36,000 a year under a new system introduced by the UK’s Department for Work and Pensions (DWP). But what does this really mean? Is everyone getting this large boost, or is this an exception? And what does this mean for your retirement planning?

In this article, you’ll find a clear, step-by-step explanation of the current State Pension system in the UK, the recent changes, and who really benefits from these high payments. Whether you’re close to retirement, advising clients, or simply curious, this guide breaks down the facts into easy, actionable insights with trusted data and official sources linked throughout.

State Pension Shock

| Highlight | Explanation |

|---|---|

| Standard New State Pension (2025/26) | £230.25 per week (~£12,014 annually) for those reaching State Pension age after April 6, 2016. |

| Old Basic State Pension | £176.45 per week (~£9,175 annually) for pre-2016 retirees, under the old system. |

| Triple Lock Increase | State Pension rises each year by the highest of average earnings growth, inflation (CPI), or 2.5%. |

| £36,000 Payments | Only about 324 pensioners receive payments this high due to historic schemes, deferrals, and “protected payments.” |

| Minimum Qualifying Years | At least 10 years of National Insurance contributions or credits needed for any State Pension entitlement. |

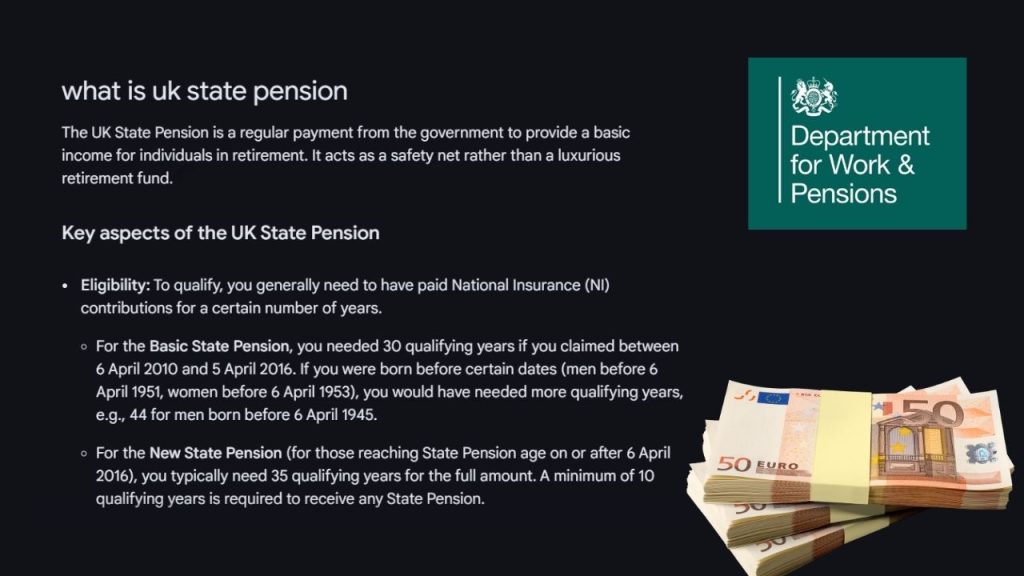

What Is the State Pension and How Does It Work in 2025?

The State Pension is the UK government’s way of providing a guaranteed income to retirees. It forms a base for your retirement income, supplemented by private pensions, savings, or investments.

In 2016, the UK introduced the new State Pension system for people reaching State Pension age on or after 6 April 2016. It replaced the previous system that was more complex, involving the Basic State Pension plus additional components like SERPS (State Earnings Related Pension Scheme).

Basic Facts:

- To get any State Pension, you need at least 10 qualifying years of National Insurance (NI) contributions.

- The full new State Pension requires 35 qualifying years.

- For the tax year 2025/26, this full payment is £230.25 per week, adding up to roughly £12,014 per year.

- People who reached State Pension age before 2016 receive the old basic State Pension, which is £176.45 a week or about £9,175 annually.

The Controversy: Why Are Some State Pensions Tripled to £36,000?

A small group of pensioners is receiving significantly higher payments, some over £692 per week or about £36,000 annually, three times the standard full rate. This noise in the media comes from a mix of factors:

1. Historical Pension Schemes

- These pensioners qualified before April 2016 and are still covered by the old State Pension rules.

- Many also qualify for additional payments from SERPS, which was replaced by the new State Pension but still benefits pensioners who earned entitlements before the switch.

2. Pension Deferral Boosts

- Some retirees have chosen to defer collecting their State Pension beyond the State Pension age.

- Previously, deferring State Pension payments built up a 10.4% annual increase, leading to much larger weekly payments when they eventually claimed.

3. Protected or “Starting Amount” Payments

- Some pensioners have a “starting amount” that is higher than the new State Pension because their calculations from previous contributions or contracted-out elements are protected.

- This “protected payment” amount stays in place rather than being lowered to the flat rate of the new system, resulting in higher payments.

What This Means for Most People

For the majority of the UK population, the State Pension remains around £12,000 a year if you qualify fully under the new system. It’s a solid foundation but not a windfall—your personal savings and workplace or private pensions play a crucial role in building a comfortable retirement.

If you’re planning retirement or advising clients:

- Check your National Insurance record regularly (you can do this online via the official gov.uk portal) to understand how much State Pension you are likely to get.

- Consider making voluntary contributions if you have gaps in your NI record to boost your pension.

- Explore delaying your pension claim if you want to increase your entitlement through deferral credits.

- Remember that if your income exceeds your personal tax allowance, your State Pension is taxable, so budget accordingly.

How the Triple Lock Works to Protect Your Pension

The government guarantees that the State Pension amount will go up each year by whichever is highest among:

- Growth in average earnings

- Inflation (measured by the Consumer Prices Index or CPI)

- A guaranteed minimum of 2.5%

This “triple lock” aims to keep pensioners financially secure by ensuring pensions keep pace with the cost of living or wage growth. For 2025/26, this meant a 4.1% increase in the State Pension, reflecting average earnings growth.

State Pension Alert: DWP Says This Payment Should Cover One Key Expense

Extra £909 a Month for Disabled Brits — Full DWP Eligibility Criteria Revealed

DWP Bank Holiday Payment Shake-Up: Who’s Getting Paid Early in August 2025?

FAQs About State Pension Shock

Who can claim the new State Pension?

Anyone reaching State Pension age on or after 6 April 2016 qualifies for the new flat-rate pension system, requiring a minimum of 10 years of National Insurance contributions or credits.

What if I have gaps in my National Insurance record?

You may be able to fill gaps by paying voluntary National Insurance contributions or receiving NI credits if you had periods of caring responsibilities, illness, or receiving certain benefits.

How do I know how much my State Pension will be?

The government provides an online State Pension forecast tool at gov.uk/check-state-pension, where you can see your estimated payments based on your NI record.

Can I increase my State Pension?

Yes, by deferring claiming it after you reach State Pension age. Currently, deferring adds an 1% increase to your weekly payments for every 9 weeks you wait.

Will my State Pension be taxed?

Yes, State Pension income is taxable if you exceed your personal allowance threshold. However, tax is typically collected through other pensions or self-assessment.