Every year, millions of Americans who receive Social Security benefits eagerly await a critical announcement—the Cost-of-Living Adjustment (COLA). This year, October 15, 2025, is the big day when the Social Security Administration (SSA) will reveal the official COLA for 2026. This adjustment could directly affect the amount of money you receive monthly starting January 2026, shielding your benefits from inflation and helping you keep up with rising living costs.

Whether you’re a retiree, a disabled worker, a survivor, or receive Supplemental Security Income (SSI), understanding the importance of this date and how the COLA works can empower you to plan financially with clarity and confidence.

What Is the October 15 Social Security Deadline?

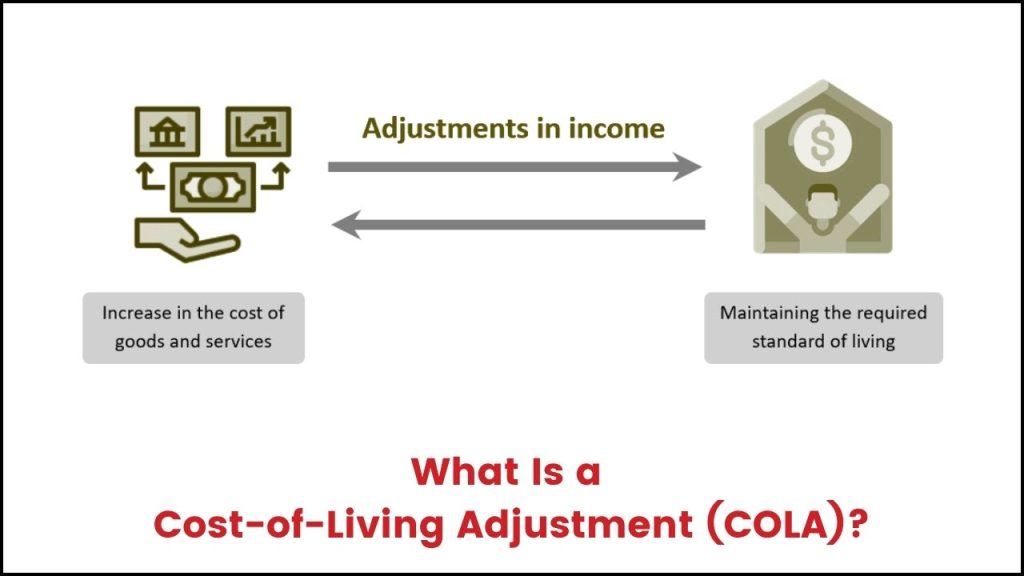

The SSA traditionally announces the next year’s Cost-of-Living Adjustment (COLA) on October 15. The COLA is an automatic increase in Social Security and Supplemental Security Income benefits designed to keep up with inflation, ensuring the purchasing power of your benefits doesn’t diminish as prices rise for everyday essentials.

This annual COLA is based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W)—a government measure of inflation. The SSA calculates the change by comparing the average CPI-W for the third quarter (July, August, September) of the current year to the same period of the previous year.

Based on this, the SSA sets a percentage increase to your benefits effective the following January.

Social Security Deadline Alert

| Topic | Details |

|---|---|

| Official Announcement Date | October 15, 2025 |

| What Gets Announced? | 2026 Cost-of-Living Adjustment (percentage increase in benefits) |

| How Is COLA Calculated? | Change in Consumer Price Index for Urban Wage Earners & Clerical Workers (CPI-W) from Q3 2024 to Q3 2025 |

| Projected 2026 COLA | Approximately 2.6% to 2.7% (subject to change) |

| Who Benefits? | Social Security retirement, disability, survivor benefits, and Supplemental Security Income (SSI) recipients |

| Why Important? | Determines the increase in monthly benefits starting January 2026 |

| Official SSA Website | ssa.gov/cola |

October 15, 2025, is a pivotal date for all Social Security beneficiaries. This is when the government announces the 2026 Cost-of-Living Adjustment (COLA), which determines how much your benefits will increase in response to inflation.

Understanding the COLA process and its impact allows you to better plan for the year ahead, adjust your budget, and protect your financial well-being from rising living costs. By staying informed, using official resources, and preparing for the announced changes, you can make confident and proactive financial decisions.

Remember, the SSA is a reliable source for your benefits information—always access updates securely via their official website and beware of scams.

Understanding How the Cost-of-Living Adjustment Works

Since 1975, the Social Security COLA has been an important safeguard preventing inflation from eroding the value of your benefits. Without COLA, rising costs of housing, food, medicine, and other essentials would mean fewer goods and services for the same benefit dollar amount each year.

The Calculation Process

- SSA tracks CPI-W data for July, August, and September each year.

- They compare this average to the same months from the year before.

- If inflation caused by rising prices increased, the percentage change determines the COLA.

- For example, if the average CPI-W increases by 2.7%, Social Security benefits will rise by roughly the same percentage starting the next January.

- If inflation is flat or negative, there may be no COLA that year.

Projected COLA for 2026

Though the official number is announced October 15, leading economists and advocacy groups forecast a COLA of around 2.6% to 2.7% for 2026. This projection reflects moderate inflation trends seen in 2024 and early 2025.

Why This Is Crucial for Beneficiaries

Millions of Social Security recipients rely on these annual cost-of-living increases to maintain their standard of living. Without it, benefits lose value over time, especially as uncontrollable expenses like medical costs typically rise faster than general inflation.

Why October 15, 2025 Is a Date to Mark on Your Calendar

This deadline is much more than a bureaucratic formality—it’s your financial compass for the year ahead. Knowing your exact COLA allows you to:

- Plan your 2026 household budget, factoring in the new benefit amount.

- Adjust health care and prescription drug spending, considering any expected changes in Medicare premiums.

- Manage taxes effectively, as increases in benefits might affect your tax bracket.

- Identify potential changes early in your financial situation and avoid surprises.

What Happens After October 15?

Shortly after the SSA announces the COLA, beneficiaries will start to receive official notices. Most recipients can view their personalized COLA notices online in their My Social Security account message center or receive these by mail.

Practical Advice for Social Security Recipients

- Stay Informed: Keep an eye on SSA announcements around mid-October through trusted sources like the official SSA website ssa.gov.

- Check Your My Social Security Account: Most benefit holders can securely access their updated COLA notice through their online SSA account.

- Beware of Scams: SSA will never ask you to update your banking or personal information via phone calls or emails. Protect your information from fraudulent schemes.

- Adjust Your Budget: Once you know your COLA increase, update your monthly household budget accordingly, especially for expenses such as electricity, food, healthcare, and housing.

- Understand the Impact on Medicare: Sometimes, Medicare Part B premium increases can offset the COLA bump. Keep updated on Medicare premium changes announced alongside the COLA.

Examples to Illustrate the Impact

Example 1:

Jane is a retired schoolteacher receiving $1,500 monthly Social Security benefits in 2025. If the SSA announces a 2.7% COLA for 2026, her benefits would increase by about $40.50. Starting January 2026, Jane will receive approximately $1,540.50 monthly—helping her keep pace with rising living costs.

Example 2:

Mark, a Social Security Disability beneficiary, currently receives $1,200 monthly. With a 2.7% COLA, his checks will increase by about $32.40, starting next year, raising his monthly benefits to $1,232.40 to counter inflation’s effects.

Social Security Payments Up to $5,108 Arriving Tomorrow as SSA Confirms Major Change

Garnishments Draining Your Social Security? Here’s How to Stop Losing Half Your Check

Social Security Payments Are Arriving This Week — Find Out If You’re Getting Yours

FAQs About Social Security Deadline Alert

Why is October 15 the key deadline?

Because SSA announces the official Cost-of-Living Adjustment (COLA) for the upcoming year on that date. This determines how much your benefits will increase starting January 1.

Could the COLA be zero?

Yes. If inflation is negligible or negative (prices stay flat or decrease), the COLA may be zero, meaning no increase in benefits. This happened in years like 2010, 2011, and 2016.

How is the COLA linked to inflation?

The COLA is based on the percentage change in the Consumer Price Index for Urban Wage Earners (CPI-W), a government measure used to track inflation.

What should I do if my Medicare premiums increase?

Higher Medicare premiums could offset your COLA increase. It’s important to include this in your budgeting plans for the new year.

How can I check my updated Social Security benefit?

Log in to your My Social Security account on the official SSA website (ssa.gov) to view personalized COLA notices and benefit information.