Social Security changes 2026 are on the horizon, impacting millions of Americans who rely on this crucial program for retirement income. Whether you’re already receiving benefits or planning for your future, these updates will affect how much you receive, when you can claim your benefits, and how much you contribute through taxes. Understanding these changes now can help you prepare and make informed financial decisions.

In this article, we will clearly break down the six key Social Security changes coming in 2026, explain what they mean for you, and give you practical advice to navigate the updates confidently.

Six Key Changes to Social Security Coming in 2026

| Change | Details & Impact |

|---|---|

| Cost-of-Living Adjustment (COLA) | Estimated 2.6% to 2.7% increase in benefits |

| Full Retirement Age (FRA) | Increases to 67 for those born in 1960 or later |

| Social Security Tax Wage Cap | Rise from $176,100 to $183,600 in taxable earnings |

| Medicare Tax | No cap, applies to all wages including high earners |

| Benefit Maximums | Monthly maximum benefit rises slightly with COLA |

| Earnings Record Accuracy | Importance of verifying earnings record before retirement |

Social Security is changing in important ways in 2026. The rise in full retirement age to 67, modest benefit increase through cost-of-living adjustment, and higher wage cap for Social Security taxes are key updates to understand. By checking your earnings record, planning when to claim benefits, and knowing how taxes impact your income, you can better prepare to maximize your Social Security.

For official details and updates, visit the Social Security Administration website.

What Is Social Security and Why Does It Matter?

Social Security is a government program that provides financial support to retirees, disabled workers, and survivors of deceased workers. It draws funding mainly from payroll taxes paid by workers and employers. For many Americans, this is the backbone of their retirement income, making these changes highly important.

Knowing how Social Security works and what updates are coming can help you plan better for your retirement years.

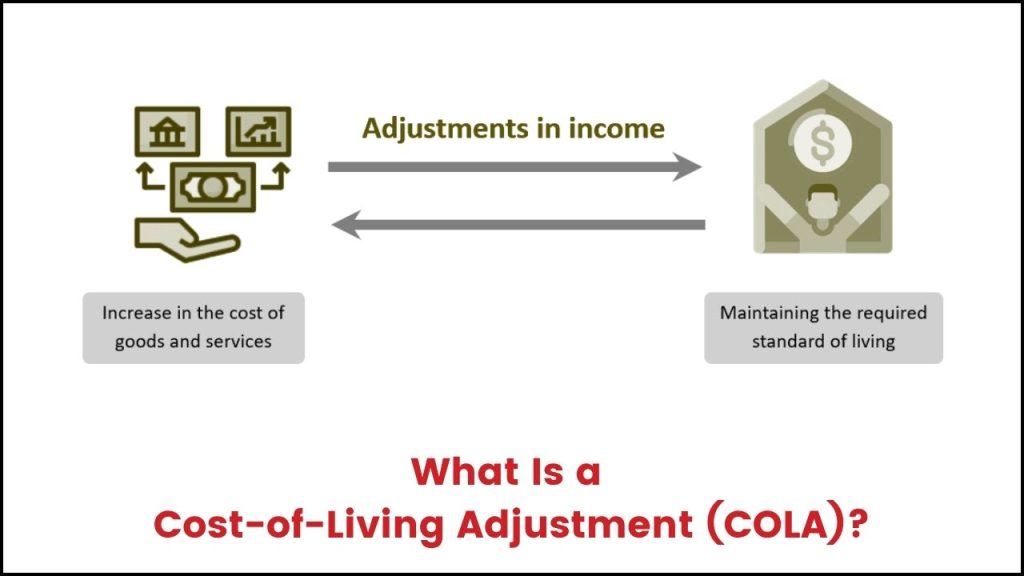

1. Cost-of-Living Adjustment (COLA): What to Expect in 2026

Each year, Social Security benefits are adjusted to help keep pace with inflation, called the Cost-of-Living Adjustment (COLA).

- For 2026, the COLA is projected to be around 2.6% to 2.7%, a modest increase compared to recent years.

- This adjustment helps benefits maintain purchasing power amid rising living costs.

If your Social Security check was $1,000 in 2025, expect an increase of approximately $26 to $27 per month in 2026 due to COLA.

2. Full Retirement Age (FRA) Rises to 67

The full retirement age is the age at which you can collect your full Social Security benefits without any reduction.

- Beginning January 1, 2026, the FRA will be 67 years for people born in 1960 or later.

- This increase reflects ongoing changes to account for longer life expectancies.

You can still claim benefits as early as 62, but your benefits will be reduced permanently if you do so before your FRA.

3. Increase in the Social Security Tax Wage Cap

Social Security taxes only apply to income up to a certain level, known as the wage cap. This cap changes yearly.

- In 2026, the taxable earnings cap will rise from $176,100 to $183,600.

- This means workers earning above this new limit will pay Social Security taxes only on earnings up to $183,600.

A higher cap means some workers will pay more in Social Security taxes next year.

4. Medicare Taxes Continue Without a Cap

Unlike Social Security taxes, Medicare taxes apply to all wages with no upper limit.

- The Medicare tax rate remains 1.45% on all wages.

- An additional 0.9% Medicare surtax applies to higher earners ($200,000 single filers and $250,000 joint filers).

This means high earners continue to pay Medicare taxes on all their income regardless of how much they make.

5. Slight Increase in the Maximum Social Security Benefit

The maximum monthly Social Security benefit increases with COLA and wage growth.

- In 2025, the maximum benefit at age 70 was about $5,108 per month.

- This maximum will increase slightly in 2026, allowing some retirees to collect more if they meet the criteria.

To get the maximum benefit, you need to work and pay Social Security taxes on high earnings for at least 35 years and delay claiming benefits until age 70.

6. Verify Your Earnings Record for Accuracy

How much you receive depends on your earnings history reported to Social Security.

- It’s essential to check your earnings record regularly to catch any errors or missing data.

- Incorrect earnings records can reduce the benefits you receive when you retire.

- You can review your record securely online on the Social Security Administration’s official website.

Social Security Deadline Alert: Important October 15 Date Every Recipient Must Know

Social Security Jackpot: Up to $5,108 Deposited This Week — Are You Eligible?

Social Security Checks Arriving in 3 Days—What to Do If Yours Doesn’t Show Up

FAQs About Six Key Changes to Social Security Coming in 2026

When will the official 2026 Social Security COLA be announced?

The official COLA is announced in October 2025, based on third-quarter inflation data.

How does the increased full retirement age affect me?

If you were born in 1960 or later, your full retirement age is now 67. Claiming benefits before that reduces the monthly amount.

Can I still retire early at 62?

Yes, but your benefits will be permanently reduced compared to waiting until your full retirement age.

Will my Social Security taxes increase in 2026?

If your income exceeds the taxable maximum, you will pay taxes on a higher cap of $183,600 in 2026.

Does Medicare tax apply to all my income?

Yes, Medicare taxes apply on your entire earnings with no wage limit.