The government has confirmed a one-off S1300 Government Payout will be issued to millions of eligible households in September 2025. The payment is designed to provide financial relief amid persistent cost-of-living pressures, with officials outlining specific income and residency requirements for qualification.

S1300 Government Payout expected in September 2025

| Key Fact | Detail/Statistic |

| Payment Amount | S1300 per eligible household |

| Payment Window | 15 September – 30 September 2025 |

| Primary Beneficiaries | Low-to-middle income individuals and families |

| Payment Method | Automatic bank deposit for most tax filers |

What is the S1300 Government Payout and Why is it Being Issued?

The government has finalised plans for a targeted cost-of-living support payment this autumn. The programme will distribute S1300 to qualifying households to help them manage the continued high cost of essentials such as energy, food, and housing.

This initiative follows data from the National Statistics Office (NSO), which indicated that while headline inflation has eased, core living costs remain significantly elevated for many. In a press conference on Friday, Finance Minister Johnathan Price stated the payment aims to provide “direct and timely relief” to those most affected.

“We recognise that many families are still navigating a challenging economic environment,” Minister Price said. “This S1300 Government Payout is a part of our ongoing commitment to support households as we work towards broader economic stability.”

Who is Eligible for the September 2025 Payment?

The government has published detailed eligibility criteria to ensure the support reaches its intended recipients. Eligibility is primarily determined by household income from the 2024 tax assessment year and residency status.

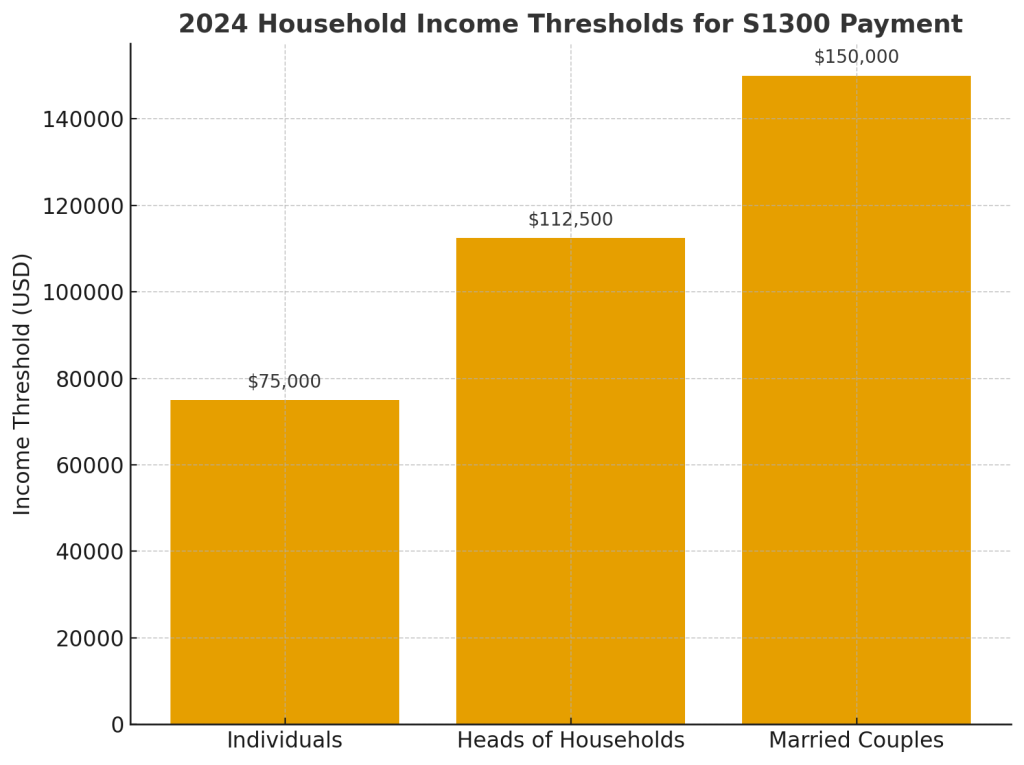

Income Thresholds

To qualify for the full S1300 payment, a household’s adjusted gross income for the 2024 tax year must fall below certain thresholds:

- S75,000 for individuals.

- S112,500 for heads of households.

- S150,000 for married couples filing jointly.

Officials have not announced plans for a tapered or partial payment for those with incomes slightly above these limits.

Other Key Requirements

In addition to income, applicants must meet the following conditions:

- Residency: Must have been a legal resident for the entire 2024 calendar year.

- Tax Status: Cannot be claimed as a dependant by another taxpayer.

- Identification: Must possess a valid National Insurance or Social Security Number.

These criteria are intended to prevent fraud and ensure the funds are distributed within the domestic economy, according to a statement from the Ministry of Finance.

How and When Will the Payment Be Delivered?

The government aims to make the distribution of the September 2025 payment as seamless as possible, using existing tax information for the majority of recipients.

Automatic Payments for Tax Filers

For most eligible individuals and families, no action will be required. The Revenue Service will use the bank account details from 2024 tax returns to issue the payment as a direct deposit. These automatic payments are scheduled to be sent out between 15 September and 30 September 2025.

A spokesperson for the Revenue Service advised citizens to check that their bank details on file are current to avoid delays.

Manual Application for Non-Filers

Individuals who are not typically required to file a tax return, such as some low-income retirees or recipients of certain government benefits, may need to submit a simplified application. The government will launch an online portal on 1 September 2025 for this purpose. The deadline for applications through this portal will be 1 November 2025.

Expert Analysis: Economic Impact and Household Relief

Economists have offered varied perspectives on the payout. Dr. Alina Sharma, a senior economist at the Capital Economics Institute, noted that while the payment will provide significant short-term relief, its broader economic effects must be monitored.

“For families struggling with high bills, this S1300 will be a crucial lifeline. It will undoubtedly boost consumer spending in the third quarter,” Dr. Sharma explained. “However, the key question is whether this injection of cash will add to inflationary pressures. The government’s challenge is to balance immediate support with long-term fiscal prudence.”

Consumer advice charities have broadly welcomed the move. The director of National Debt Helpline, a non-profit organisation, called it a “positive step” but urged the government to consider more permanent solutions for low-income households, such as uprating social benefits in line with inflation.

The final batch of payments is expected to be completed by mid-November, covering those who apply through the non-filer portal. The Ministry of Finance has stated this is the final planned direct payment of this kind for the 2025 fiscal year.

2.9 Million Singaporeans to Receive $600 Cost-of-Living Payout: Check Eligibility

Eligible Singaporeans to Receive $200–$400 in September for Cost-of-Living Support

Singapore $1,080 Payment for Senior Citizens in 2025: Check Eligibility Criteria and Payment Dates

FAQs

1. Do I need to apply for the S1300 Government Payout?

If you filed a tax return for 2024 and meet the eligibility criteria, you should receive the payment automatically. Only non-filers need to apply via the official government portal.

2. When will I receive the money?

Automatic payments are scheduled to be deposited between 15 and 30 September 2025. Payments for those who apply manually may arrive later, typically in October or November.

3. Is this payment taxable?

No. According to the Ministry of Finance, this payment is considered a tax-free rebate and will not count as taxable income for the 2025 tax year.

4. What if I recently changed my bank account?

You should update your bank details with the Revenue Service through their official website as soon as possible to ensure the payment is sent to the correct account.