Shadow Chancellor Rachel Reeves is facing mounting criticism for repeatedly declining to clarify the Labour Party’s position on reinstating the pension lifetime allowance. This ambiguity over the Reeves pension tax reform plans has created significant uncertainty for savers and has provided the Conservative Party with a potent line of attack ahead of the next general election.

Reeves Faces Backlash for Dodging Pension Tax Reform

| Key Fact | Details |

| Labour’s Unclear Stance | The party has not committed to keeping or scrapping the current pension tax rules, specifically the abolition of the lifetime allowance (LTA). BBC News |

| The Original Policy | Chancellor Jeremy Hunt abolished the £1.07 million pension LTA in his March 2023 budget to encourage older workers, especially senior NHS doctors, to remain in the workforce. UK Government |

| Initial Labour Pledge | Labour immediately pledged to reverse the abolition, labelling it a “tax cut for the rich.” |

| Conservative Criticism | The Conservatives now accuse Labour of planning a “retirement tax” that would create chaos for pension savers. |

Labour’s Ambiguous Position Fuels Political Debate

The Labour Party’s evolving position on the pension lifetime allowance has become a significant political issue. Initially, the party was unequivocal in its opposition to Chancellor Jeremy Hunt’s decision to abolish the cap on tax-free pension savings. However, in recent months, Ms. Reeves has consistently deflected questions on whether a Labour government would reintroduce it, stating only that she has “no plans” to do so, a phrase that falls short of a firm commitment.

This strategic ambiguity is viewed by many political analysts as an attempt by Labour to avoid making unfunded spending or tax commitments before the election. However, it has opened the door for fierce criticism. The Conservative Party claims this lack of clarity signals a future “tax raid” on pensions. Speaking to reporters, Jeremy Hunt stated that Labour “ought to be straight with people,” arguing that reintroducing the LTA would be “incredibly disruptive” and would punish aspiration.

The Context of the Lifetime Allowance

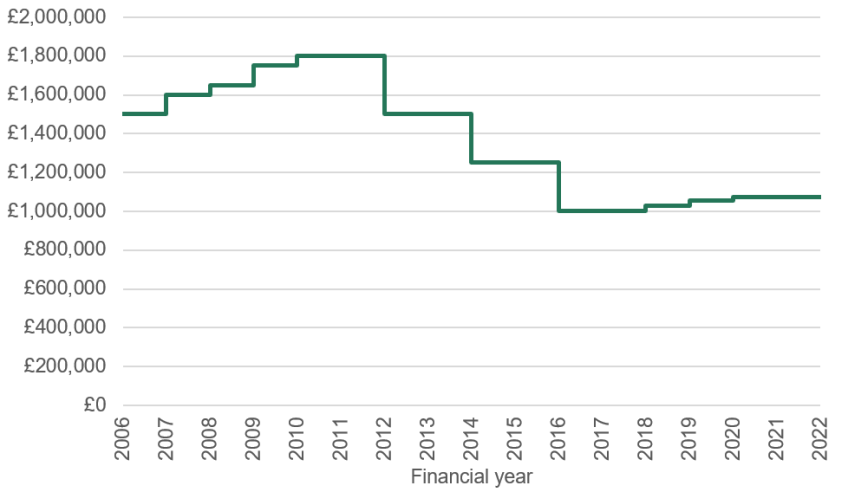

The pension lifetime allowance was a cap on the total amount an individual could accumulate in their pension pots without facing significant extra tax charges. Before its abolition, the cap stood at £1,073,100. The Conservative government argued that scrapping the LTA was essential to address workforce shortages, particularly by preventing senior public sector workers like NHS consultants from taking early retirement to avoid breaching the tax threshold.

The Labour Party policy at the time was to criticise the move as a giveaway that disproportionately benefited the wealthiest savers. The party argued that targeted measures, rather than a blanket removal of the cap, could have addressed the issue of doctor retention more fairly and at a lower cost to the taxpayer.

Expert Analysis Highlights Complexity and Consequences

Pensions experts and financial analysts have warned that reinstating the lifetime allowance would be administratively complex and could create fresh uncertainty for those planning their retirement. The Institute for Fiscal Studies (IFS), a non-partisan research institute, has noted that reintroducing the cap would not be a simple reversal. New legislation would be required, and protections would likely be needed for those who have made financial decisions based on the current rules.

Paul Johnson, Director of the IFS, commented in a recent analysis that “flipping back and forth on major, long-term tax policy is no way to build confidence in the system.” He added that while the initial abolition was costly, reintroducing it would create “a new set of losers and a great deal of complexity.” The pensions industry has largely echoed these concerns, calling for a period of stability in pension legislation, regardless of which party is in power.

The ongoing debate leaves millions of people, particularly those with larger pension pots, in a state of limbo. Financial advisers report that clients are hesitant to make long-term investment decisions due to the uncertainty surrounding the Reeves pension tax reform issue.

As the general election draws closer, pressure will likely intensify on Labour to provide a definitive statement on their intentions. For now, the party appears content to maintain its strategic ambiguity, balancing the risk of alienating aspirational voters against its core message of fiscal responsibility.

Rachel Reeves Targets Costly Pension Perk: Will Savers Lose Out?

Inheritance Tax Warning: Reeves Pressured to Lift Gifting Allowance to £9,000

Wealth Tax Branded a ‘Mistake’ by Rachel Reeves Despite £20bn Budget Push

FAQs

What was the UK pension lifetime allowance (LTA)?

The LTA was a limit on the total value of tax-advantaged pension savings an individual could build up over their lifetime. Until it was abolished in April 2024, the limit was £1,073,100. Funds withdrawn above this amount were subject to a significant tax charge.

Why is Labour’s policy on the LTA unclear?

Labour initially promised to reverse the Conservative policy that abolished the LTA. However, the party has since softened its language, with Shadow Chancellor Rachel Reeves now stating she has “no plans” to reintroduce it, which is not a firm commitment. This is seen as part of a broader pre-election strategy to avoid making specific tax-and-spend promises.