Across the UK, thousands of pensioners face potential tax bills exceeding £3,000 if they fail to provide specific documentation requested by HM Revenue & Customs (HMRC). The so-called “£3,000 tax bill” scare stems from pensioners not submitting accurate information about their savings and pensions when HMRC seeks confirmation. Timely submission of these documents is vital to prevent costly tax code errors and payment interruptions.

Pensioners Risk £3,000 Tax Bills

| Key Fact | Detail / Statistic |

|---|---|

| £3,000 is not a tax threshold | It is a legacy figure from older benefit rules; current Pension Credit disregards the first £10,000 in savings |

| Essential document: Pension Life Certificate | Must be submitted annually to continue pension payments, failure can suspend pensions |

| Increased documentary requirements | From September 2025, HMRC demands more proof for higher-rate pension tax relief claims. GOV.UK Newsletter |

| Risk of self-assessment tax returns | From next year, some pensioners may be required to file returns, exposing them to further tax liabilities |

What Is the “£3,000 Tax Bill” Warning About?

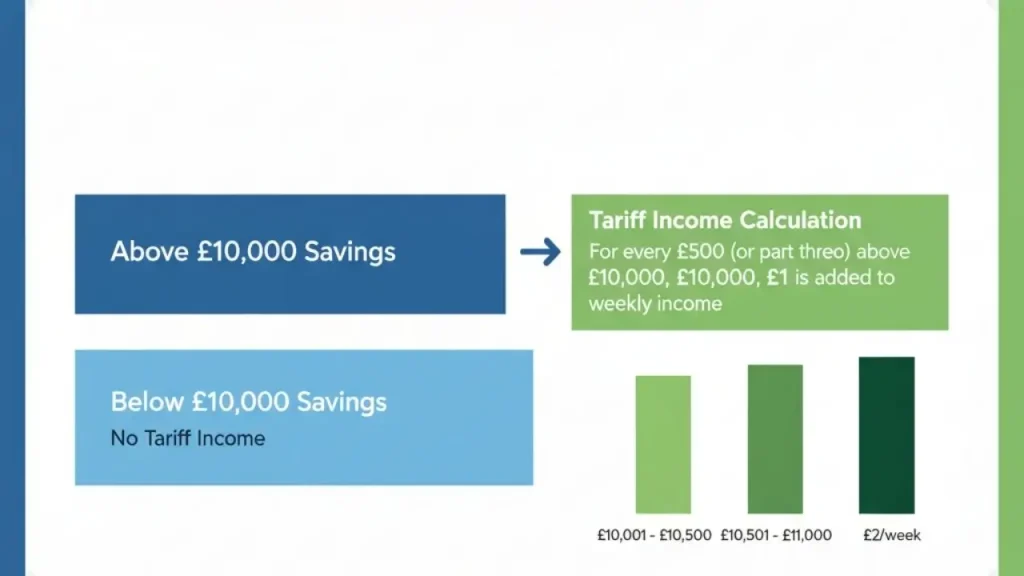

The figure of £3,000 has triggered anxiety among pensioners, often misunderstanding it as a direct tax threshold. According to HMRC and tax experts, the £3,000 number is a holdover from older or local benefit calculations and not a current tax rule. The modern benchmark for pensioners’ savings, especially regarding Pension Credit—the UK’s means-tested top-up benefit—ignores savings up to £10,000. Above this, pensioners face a “tariff income” penalty, typically £1 per week for every £500 over that threshold, impacting benefit calculations but not directly causing an immediate tax bill.

HMRC’s recent letters flagged at £3,000 relate mainly to verifying savings interest and bank data, ensuring pensioners’ tax codes and benefit calculations are accurate, not immediate tax demands. Failure to respond or provide necessary documents, however, could result in HMRC applying incorrect tax codes, leading to unexpected tax bills sometimes exceeding £3,000 due to underpaid tax liabilities accumulating.

Why Does HMRC Need This Document?

HMRC’s increased data sharing with financial institutions has improved its oversight of pensioners’ income and savings from banks and building societies. This allows cross-checking personal tax codes and savings details more accurately. To ensure tax codes reflect actual income and pension benefits, HMRC sends pensioners letters requesting confirmation of savings interest or evidence supporting pension tax relief claims.

Since 1 September 2025, new rules have tightened documentary evidence requirements for pensioners claiming higher or additional tax relief, meaning more pensioners must submit supporting documents to avoid incorrect tax deductions.

Crucial Documents Pensioners Must Submit

One particularly vital document for pensioners is the Life Certificate (known as the Jeevan Pramaan Patra in some countries), which proves the pensioner is still alive and eligible for payments. Failing to submit this annually can cause suspension or delay of pension payments, affecting financial stability. Alongside this, pensioners must provide:

- Proof of savings income and interest (bank/building society statements).

- Personal identification documents (Aadhaar card, birth certificate, voter ID).

- Pension Payment Order (PPO) number or equivalent.

- Declarations related to income and tax relief claims.

Failure to supply these documents within deadlines can cause pension payment disruptions or trigger tax code adjustments that result in unexpected tax bills.

SSS Pensioners to Get ₱1,000 Hike from Sept 2025: Status & Payout Guide

State Pensioners Could Claim 15 Years’ Back Pay: But You Must Act

Millions of UK Drivers Could Receive £950 Payouts as Car Finance Mis-selling

The Emerging Challenge: Pensioners and Self-Assessment Tax Returns

From next year, some pensioners might be required to file self-assessment tax returns for the first time to properly declare their pension income and pay any tax due. This represents a significant change for many who have not previously managed tax affairs actively. Experts warn this could lead to considerable confusion and unexpected tax liabilities unless pensioners seek professional advice or support from HMRC promptly.

What Pensioners Should Do Now

Financial experts and HMRC advise that pensioners receiving these letters or notices should:

- Respond promptly with accurate savings interest figures.

- Provide any requested documentation, including bank statements and tax relief proofs, by stated deadlines.

- Submit the Life Certificate annually to continue receiving pension payments without interruption.

- Consult HMRC or qualified tax advisors if unsure about their tax situation or new self-assessment requirements.

Failing to act could lead to incorrect tax calculations, unexpected charges, and potential disruption in pension payments.

The UK government and HMRC continue efforts to balance accurate tax collection with protecting vulnerable pensioners. As tax reporting and benefit verification systems tighten, pensioners are urged to stay informed and proactive in their document submissions. This ensures continued access to their rightful benefits without incurring avoidable tax penalties.