LONDON – Financial experts and government officials are urging UK workers to consider a straightforward action that could significantly boost their long-term wealth: consolidating their pension pots. This focus on pension consolidation comes as new figures reveal that an estimated £26.6 billion is languishing in forgotten or “lost” pensions, potentially depriving millions of a more comfortable retirement.

UK Pension Landscape

| Key Fact | Detail / Statistic |

| The Problem | An estimated £26.6 billion is held in lost or dormant pension pots. Association of British Insurers (ABI) |

| The Cause | The average worker changes jobs around 11 times, often leaving a small pension pot behind each time. Department for Work and Pensions (DWP) |

| The Proposed Solution | Combining multiple pension pots into a single, manageable account to reduce fees and improve oversight. |

| Government Action | Consultation on a “Lifetime Provider” or “pot for life” model to simplify the system for savers. |

The £26 Billion Problem: A Nation of Lost Retirement Savings

The scale of the UK’s lost pensions issue is substantial. The Association of British Insurers (ABI) reports that there are nearly 2.8 million dormant pension pots, with an average value of almost £9,500 each. These funds become “lost” for simple administrative reasons, such as individuals changing their name or address after moving jobs and failing to update their previous pension providers.

“Modern working lives are far more dynamic than in the past, but the pension system has not kept pace,” said a spokesperson for the Pensions and Lifetime Savings Association (PLSA). “This creates a trail of small, forgotten pots that not only are difficult to track but can also be eroded by fees over time, significantly impacting an individual’s final retirement savings.”

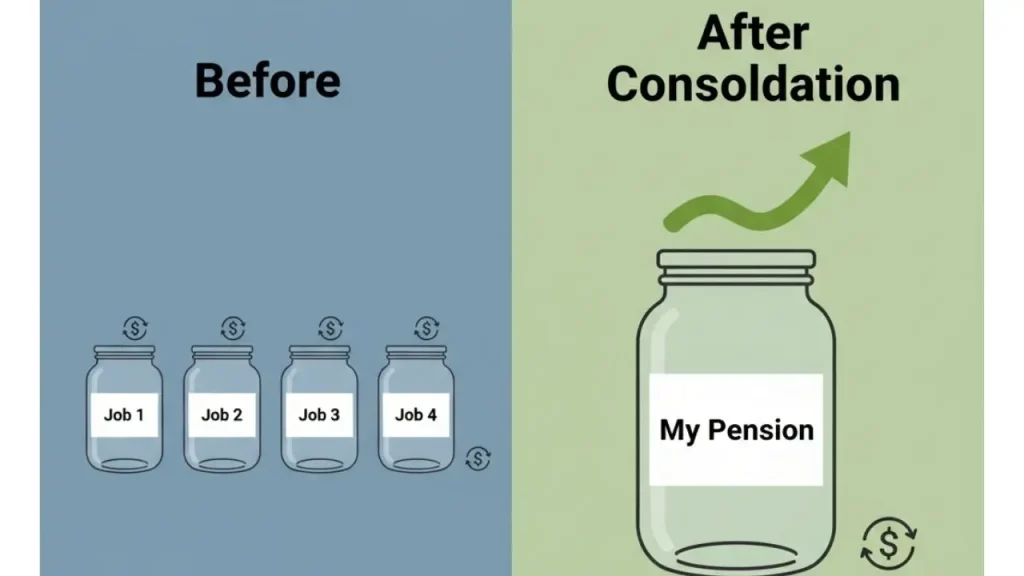

This fragmentation means many savers are unaware of the total value of their retirement assets and may be paying multiple sets of administrative charges on small, underperforming funds.

What is Pension Consolidation and How Does It Work?

Pension consolidation is the process of transferring multiple, separate pension pot balances into a single, existing or new pension scheme. The primary goal is to simplify management, reduce overall fees, and potentially achieve better investment returns by pooling assets into a larger, more strategically managed fund.

The process typically involves:

- Locating all existing pension pots.

- Choosing a new or existing scheme to consolidate into.

- Initiating the transfer process with the providers.

While the action itself—often just completing a single form—is simple, experts stress the importance of careful consideration. Savers must check for prohibitive exit fees or the loss of valuable benefits, such as Guaranteed Annuity Rates (GARs), which are sometimes attached to older pension schemes.

Government Proposes ‘Pot for Life’ to Overhaul the System

Recognising the systemic nature of the problem, the UK government has launched a consultation on radical reforms. In his Autumn Statement, Chancellor Jeremy Hunt announced plans to explore a “Lifetime Provider” model, often dubbed a “pot for life.”

Under this proposed system, a worker would choose their own pension provider, and future employers would pay contributions directly into that single, personal pot. This would effectively eliminate the automatic creation of a new pension pot with every new job.

“We want to make it easier for people to keep track of their hard-earned savings,” a HM Treasury spokesperson stated in a press release. “Simplifying the system ensures that individuals have greater ownership and a clearer view of their financial future, empowering them to make better decisions for their retirement.”

The proposal has been met with both support for its potential to solve the small pots issue and caution from industry bodies concerned about market competition and the practicalities of implementation.

What Savers Can Do Now

While major legislative changes may be years away, individuals can take proactive steps today. The government’s free Pension Tracing Service is a valuable tool for locating contact details of former employers’ pension schemes.

Before deciding to consolidate, it is highly recommended that individuals:

- Request detailed statements from all their pension providers.

- Compare administrative fees, fund performance, and investment options.

- Seek independent financial advice, especially if their pots are large or if they suspect valuable guarantees may be attached.

“Consolidation is a powerful tool, but it is not a universal solution for everyone,” advises a consumer guidance expert from Which? “The key is to be informed. Understanding what you have and where it is located is the essential first step towards taking control of your retirement savings.”

The ongoing national conversation about pensions highlights a clear consensus: a small amount of administrative effort today can prevent significant financial loss tomorrow. By taking action to trace and potentially consolidate their funds, savers can ensure their money is working as hard as possible for their future.

DWP Issues 4 Urgent Scam Warnings — Don’t Fall for These Traps

UK State Pension at 60? The New Campaign That’s Shaking Up Retirement Rules

Rachel Reeves Faces Backlash for Dodging Pension Tax Reform; Here’s What’s Really Going On

FAQs

1. How do I find my lost pension pots?

You can use the UK government’s free Pension Tracing Service online. You will need the name of your former employer or the pension scheme provider. The service provides contact details, but it does not tell you if you have a pension or its value.

2. Is pension consolidation always a good idea?

Not always. Some older pension schemes come with valuable benefits, like a Guaranteed Annuity Rate (GAR) or a larger tax-free lump sum, which would be lost upon transfer. High exit fees can also sometimes outweigh the benefits. It is crucial to check these details or seek financial advice.

3. What are the main benefits of consolidating my pensions?

The primary benefits include easier management of a single account, potentially lower overall administrative fees, a clearer view of your total retirement savings, and the ability to implement a more unified investment strategy.