BHUBANESWAR, ODISHA – In a significant cyber fraud incident, Common Service Center (CSC) operators in Odisha have fallen victim to a sophisticated QR code scam, resulting in a collective loss estimated at ₹5 lakh (approximately USD 6,000). The attack highlights the persistent vulnerabilities within digital payment ecosystems, particularly for those operating at the grassroots level of India’s digital inclusion initiatives. This incident underscores the urgent need for enhanced cybersecurity protocols and user awareness among operators providing essential public services.

Rising Tide of Cybercrime in Odisha

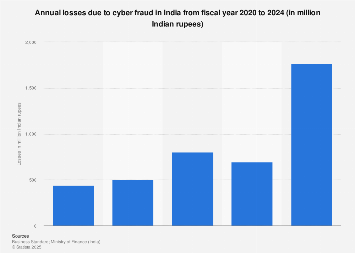

Odisha has witnessed a substantial increase in cybercrime activities. In 2024 alone, financial fraud complaints in the state surged by over 140%, with 43,740 incidents reported compared to 18,081 in 2023, according to data presented in the state assembly. The monetary value of these frauds exceeded ₹415.90 crore (approximately USD 50 million) in 2024, a more than 400% increase from the previous year, as reported by The Times of India on March 10, 2025. This surge underscores the growing challenge posed by cybercriminals targeting individuals and small businesses across the state.

How the QR Code Scam Unfolded

The modus operandi of the recent QR code scam involved fraudsters impersonating legitimate entities or individuals to trick CSC operators into scanning malicious QR codes. Common Service Centers, established under India’s Digital India program, act as access points for delivering various electronic services to rural and remote areas, including utility payments, banking, and government services. This makes them a critical node for digital transactions and, unfortunately, a target for cybercriminals.

Sources indicate that the scammers used social engineering tactics, sending messages that appeared to be from official sources or known contacts, prompting operators to scan a QR code for “verification” or “payment receipt.” Once scanned, these malicious QR codes either initiated unauthorized transactions from the operator’s linked bank accounts or installed malware on their devices, granting fraudsters access to sensitive financial information.

“These scams often prey on trust and urgency,” stated Dr. Sanjeev Kumar, a cybersecurity expert from the Indian Institute of Technology Bhubaneswar. “The fraudsters exploit the convenience factor of QR codes, which are widely accepted for quick transactions, making it easier for victims to overlook red flags.”

Vulnerability of CSC Operators

Common Service Centers are pivotal to the Digital India mission, bridging the digital divide by providing essential services to underserved populations. However, the operators, often local entrepreneurs, may not always possess advanced cybersecurity knowledge. This knowledge gap, combined with the volume of transactions they handle daily, makes them susceptible to sophisticated phishing and QR code-based attacks.

The Ministry of Electronics and Information Technology (MeitY) has provided guidelines for CSCs, emphasizing password security and safe online practices. Despite these measures, the decentralized nature of CSC operations can make comprehensive oversight and immediate response to emerging threats challenging.

“Many CSC operators are focused on service delivery and may not have the resources or constant training to identify evolving cyber threats,” explained Priya Sharma, a social worker involved with rural digital literacy programs. “Cyber awareness campaigns need to be ongoing, practical, and in local languages to truly protect them.”

Official Response and Preventive Measures

Authorities in Odisha have initiated investigations into the recent Odisha cyber attack. The state’s Crime Branch has been actively advising citizens on safeguarding themselves against digital frauds, including locking SIM cards to prevent unauthorized UPI transactions after phone theft, as reported by The New Indian Express on July 7, 2025. For the current QR code scam, law enforcement agencies are tracing the digital footprints of the fraudsters and collaborating with banks to mitigate further losses.

Victims of such frauds are urged to report incidents immediately to the National Cybercrime Reporting Portal (https://cybercrime.gov.in) or dial the helpline number 1930. Prompt reporting increases the chances of freezing fraudulent transactions and recovering lost funds.

Key cybersecurity measures recommended for CSC operators and the public include:

- Verify the Source: Always confirm the legitimacy of any QR code before scanning, especially if it arrives via unsolicited messages or emails.

- Inspect Physical QR Codes: Look for signs of tampering, such as stickers placed over existing codes, or unusual placements in public areas.

- Check URLs: After scanning, carefully review the URL to ensure it is the legitimate website before entering any sensitive information. Look for misspellings or suspicious domain names.

- Use Trusted Apps: Employ reputable QR code scanner apps that offer security features, or use the built-in camera app on smartphones.

- Two-Factor Authentication (2FA): Enable 2FA for all financial and online accounts to add an extra layer of security.

- Employee Training: For businesses and service centers, regular cybersecurity training for employees is crucial to recognize and avoid phishing attempts, malware, and social engineering tactics.

Aspirants Duped of Rs 65 Lakh, Accused Arrested in Berhampur

Odisha Crime Branch Cracks ₹7.5 Crore IPO Scam, Arrests Punjab Man

Cuttack Administration Enforces ‘No Attendance, No Pay’ Policy on Mahanga Officials

Towards a More Secure Digital Future

The recent Odisha cyber attack underscores the dynamic nature of cyber threats in India’s rapidly expanding digital economy. While the government is pushing for greater digital adoption, ensuring robust security infrastructure and widespread cyber literacy are paramount. Efforts are underway to strengthen cyber police stations and enhance forensic capabilities to tackle these evolving crimes.

As digital transactions become increasingly commonplace, the collective responsibility of individuals, businesses, and government agencies to uphold strong cybersecurity practices is more critical than ever to protect against financial losses and maintain public trust in digital services.