The Ministry of Social Development (MSD) will issue its regular fortnightly NZ Superannuation payment to hundreds of thousands of eligible New Zealanders throughout September 2025. This guide provides a clear overview of the payment schedule, current rates, and key eligibility criteria to help retirees manage their finances effectively.

NZ Superannuation Payment for September 2025

| Key Fact | Detail |

| September Payment Dates | Payments will be made on Tuesday, 2 September; Tuesday, 16 September; and Tuesday, 30 September 2025. Ministry of Social Development |

| Eligibility Age | 65 years or older. |

| Annual Rate Review | Payment rates are adjusted annually on 1 April to reflect inflation and wage growth. Ministry of Social Development |

| Administering Body | The Ministry of Social Development, through Work and Income. |

September 2025 Pension Payment Dates

New Zealand Superannuation is paid every two weeks. For September 2025, payments will be deposited into recipients’ nominated bank accounts on the following Tuesdays:

- 2 September 2025

- 16 September 2025

- 30 September 2025

Each payment covers the 14-day period leading up to the payment date. The Ministry of Social Development advises that payments should appear in bank accounts on the payment day, though the exact time can vary between financial institutions. There are no national public holidays in September that would alter this schedule.

How Much Will You Receive?

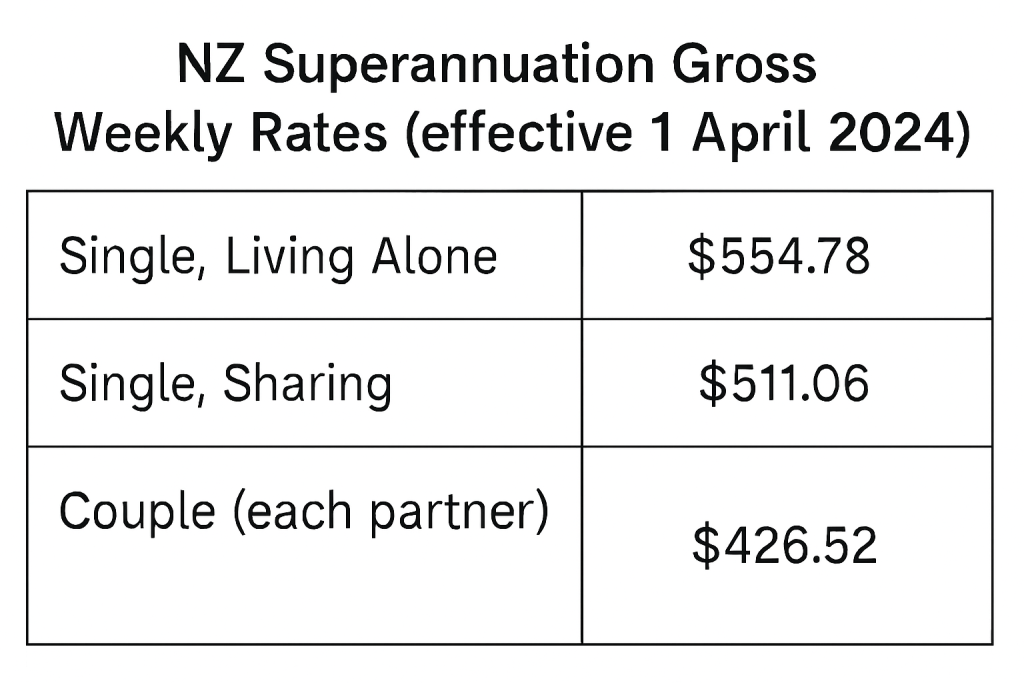

The amount of your NZ Superannuation payment depends on your living situation and your tax code. The government adjusts the rates on 1 April each year to account for changes in the Consumers Price Index (CPI) and average wages.

While the exact rates for September 2025 will be confirmed after the 1 April 2025 adjustment, the figures established in April 2024 provide a close estimate.

The Impact of Your Tax Code

The net amount you receive in your bank account is determined by your tax code, which is set with Inland Revenue (IRD). Most superannuitants use the ‘M’ tax code, but your correct code may differ if you have other sources of income, such as from part-time work or investments.

“It is crucial for retirees to ensure they are on the correct tax code,” advises a spokesperson for Age Concern New Zealand. “Using the wrong code can lead to either an overpayment that you have to pay back or an underpayment that affects your weekly budget. We recommend checking your details on the IRD’s website or speaking with a financial advisor.”

Overseas Pension Considerations

If you receive a pension from another country, it may affect your NZ Superannuation payment. Under the Direct Deduction Policy, the amount of your overseas pension is typically deducted from your New Zealand entitlement. This policy is administered by the Ministry of Social Development to ensure equitable treatment for all superannuitants.

Confirming Your Eligibility

The criteria for receiving NZ Super are straightforward and are not based on your income or assets.

Core Requirements

To be eligible, you must be:

- Aged 65 or over.

- A New Zealand citizen or permanent resident.

- Normally living in New Zealand at the time of your application.

- Have lived in New Zealand for at least 10 years since you turned 20, with five of those years being since you turned 50.

The SuperGold Card

Upon approval for NZ Super, most recipients are automatically issued a SuperGold Card. This card provides access to various business discounts across the country and government-funded concessions, most notably for off-peak public transport. The card is a key entitlement designed to help seniors stay active and engaged in their communities.

Managing Your Payments and Details

All aspects of the NZ Superannuation payment are managed by the Ministry of Social Development via its Work and Income service centres. Recipients can manage many of their own details online through the MyMSD portal, which allows them to view payment details, declare wages, and update contact information.

It is a legal requirement to inform the Ministry of any change in circumstances. This includes changes to your relationship status, living situation, or if you plan to travel overseas for more than 26 weeks, as these factors can affect your payment entitlement.

For any queries, recipients should contact Work and Income directly. Keeping your information current helps ensure you receive your correct entitlement without interruption.

This Simple Plan Could Save Your Local Pension; But Does Reform UK Have It Right?

UK House Prices Plunge; Is Reeves’ New Property Tax Plan to Blame?

FAQs

1. When are the NZ Super payments made in September 2025?

Payments are scheduled for three Tuesdays: 2 September, 16 September, and 30 September 2025.

2. Is the NZ Superannuation payment income or asset tested?

No. Eligibility for the standard NZ Superannuation payment is not tested against your income or the value of your assets.

3. How do I get a SuperGold Card?

You are typically sent one automatically after your application for NZ Super is approved. If you do not receive one, you can apply for it through the SuperGold website or by contacting the Ministry of Social Development.

4. What happens if a payment date falls on a public holiday?

If a Tuesday payment date is a national or regional public holiday, Work and Income usually processes the payment on the preceding business day. There are no public holidays affecting the September 2025 payment dates.