The Ministry of Social Development (MSD) has confirmed the full payment schedule for New Zealand Superannuation, providing certainty for hundreds of thousands of retirees. The NZ Pension Dates 2025 will continue the established cycle of fortnightly payments on Tuesdays, with eligibility criteria remaining stable for the upcoming year.

NZ Pension Dates 2025

| Key Fact | Detail |

| Payment Frequency | Payments are made every two weeks, on a Tuesday. Ministry of Social Development (MSD) |

| Eligibility Age | The age of eligibility for NZ Superannuation remains 65. |

| Annual Rate Review | Payment rates are reviewed and typically adjusted for inflation on 1 April each year. |

| Public Holiday Payments | If a payment date falls on a public holiday, the payment is generally made on the last business day before. Work and Income |

Confirmed NZ Pension Dates 2025 Schedule

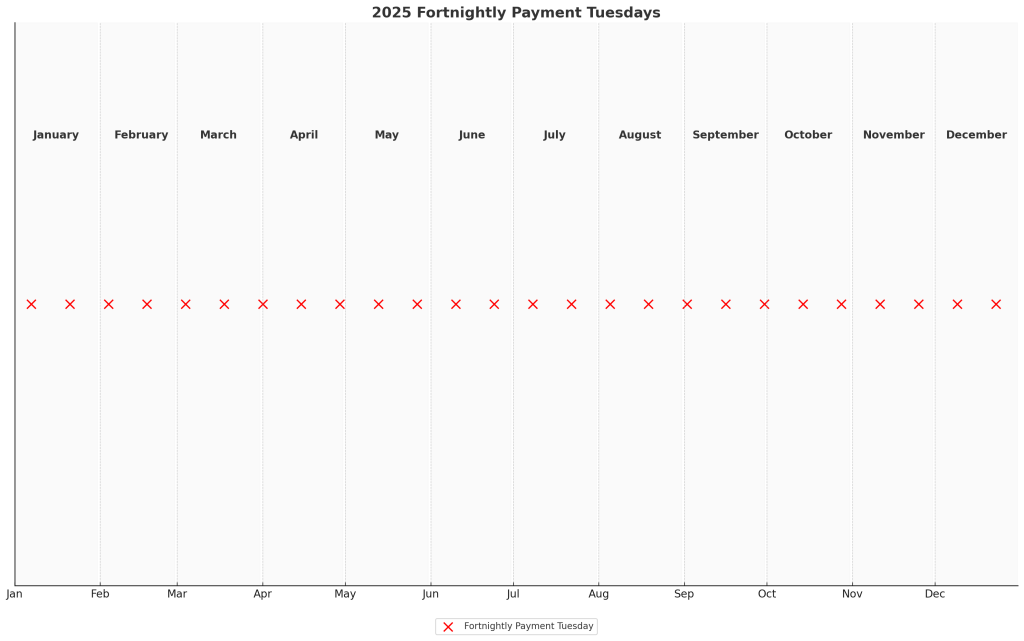

The government has finalised the fortnightly payment calendar for NZ Superannuation recipients. Payments are consistently processed to be in recipients’ bank accounts every second Tuesday. This regular schedule is designed to help retirees manage their finances with predictability.

According to the official payment cycle from the Ministry of Social Development, the following dates are the confirmed Tuesdays for NZ Superannuation payments in 2025:

- January: 7, 21

- February: 4, 18

- March: 4, 18

- April: 1, 15, 29

- May: 13, 27

- June: 10, 24

- July: 8, 22

- August: 5, 19

- September: 2, 16, 30

- October: 14, 28

- November: 11, 25

- December: 9, 23

Public Holiday Adjustments

In cases where a scheduled payment Tuesday falls on a national public holiday, Work and Income processes the payment earlier. For 2025, the key public holidays like Christmas Day and New Year’s Day do not fall on a payment Tuesday, so the schedule is expected to proceed without changes. However, recipients are always advised to check their bank accounts on the morning of the payment day.

Understanding Pension Eligibility NZ in 2025

The eligibility criteria for receiving NZ Superannuation in 2025 remain unchanged, providing stability for those approaching retirement age. An MSD spokesperson confirmed that the core requirements are based on age and residency.

Age and Residency Requirements

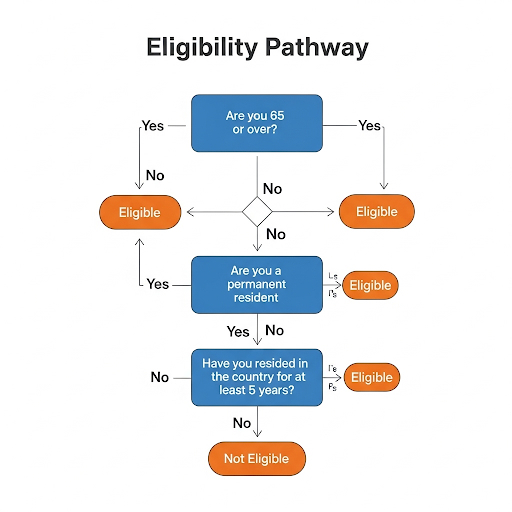

To qualify for pension eligibility NZ, an applicant must meet several key conditions:

- Age: You must be 65 years of age or older.

- Residency Status: You need to be a New Zealand citizen, a permanent resident, or hold a residence class visa.

- Time in New Zealand: You must have lived in New Zealand for at least 10 years since you turned 20. Five of those years must be since you turned 50.

These residency rules ensure that the pension supports those who have spent a significant portion of their adult lives contributing to New Zealand. There are some exceptions for people who have lived in countries with social security agreements with New Zealand.

Payment Rates and How to Apply

NZ Superannuation rates are not fixed permanently. They are reviewed annually by the government to account for inflation and wage growth, with any adjustments typically taking effect on 1 April. Payments are made directly into a recipient’s nominated bank account.

The amount you receive depends on your personal situation, including whether you are single, married or in a civil union, and your living arrangements. As NZ Super is considered taxable income, the final amount is also affected by the tax code you are on.

Prospective retirees can apply up to 12 weeks before their 65th birthday. The MSD recommends applying early to ensure payments can begin as soon as you are eligible. Applications can be completed online through the Work and Income website or by contacting them directly.

The long-term sustainability of the NZ Superannuation scheme, particularly the age of eligibility, remains a topic of political discussion. However, officials have stressed that any potential changes would be subject to extensive public consultation and would not affect those currently receiving or about to receive the pension under the 2025 rules. For now, the system remains a stable pillar of retirement for New Zealanders.

New MOT Rules for September 2025: What Drivers Need to Know

This Simple Plan Could Save Your Local Pension; But Does Reform UK Have It Right?

FAQs

1. What time of day is NZ Super paid into my bank account?

Payments are processed overnight, so the funds are typically available in your bank account on the morning of the scheduled payment Tuesday. Exact times can vary between banks.

2. How are the NZ Super payment rates decided?

The government reviews the rates annually before 1 April. The rates are indexed to 66% of the Net Average Wage for a couple, and adjustments are also made based on the Consumer Price Index (CPI).

3. Can I receive NZ Superannuation if I am still working?

Yes. NZ Super is not income-tested. You can receive the full amount you are entitled to regardless of any income you earn from paid work, savings, or investments.

4. What happens to my pension if I travel or live overseas?

Your eligibility to receive payments while overseas depends on how long you are away and which country you are in. For short trips, payments usually continue. For longer stays, or if you move permanently, different rules apply, and you must inform Work and Income of your travel plans.