LONDON – Lidl shoppers across the United Kingdom are encountering a new payment system for in-store tyre inflation services that includes a temporary £13.95 hold on their payment cards. The supermarket confirmed this change, clarifying that the amount is a pre-authorisation hold and not the final fee for the service. The new Lidl tyre inflation charge system has raised questions among consumers about how the process works and how long their funds will be held.

Understanding the Pre-Authorisation System

The new payment method, implemented at machines operated by the third-party company Air-Serv, requires customers to use a debit or credit card. When a card is used, the system temporarily reserves £13.95 from the user’s bank account. This is known as a pre-authorisation hold.

After the service is complete, the actual cost—typically starting from £1 for 10 minutes of use—is deducted, and the remainder of the hold is released back to the customer. However, the time it takes for the funds to become available again depends on the customer’s bank, a process that can take several business days.

Why Lidl Implemented the Hold

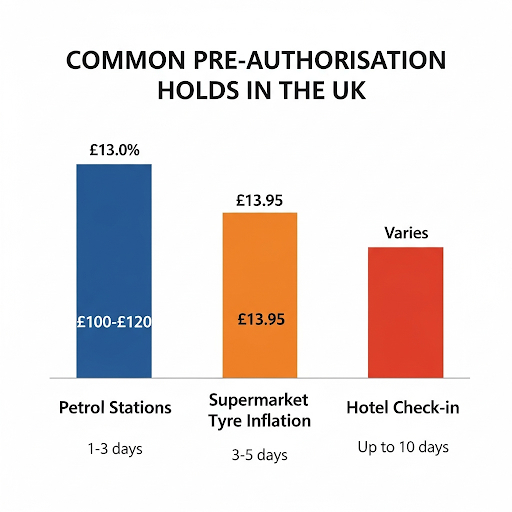

Lidl has stated that this system is standard industry practice for self-service payment terminals. The pre-authorisation check ensures that customers have sufficient funds to cover the cost of the service before they begin. This model is widely used at pay-at-the-pump petrol stations, car rental agencies, and hotels across the country.

In a statement reported by several UK news outlets, Lidl clarified the process. “The £13.95 is a pre-authorisation, and the final amount is only charged to the customer’s account once the service is finished,” a spokesperson explained. The move represents a shift from older, coin-operated machines to a more modern, card-based system, aimed at reducing cash handling and preventing drive-offs.

Impact on Shoppers and Consumer Reaction

The primary concern raised by shoppers relates to the delay in the release of the held funds. For individuals managing a tight budget, having nearly £14 of their available balance temporarily inaccessible can cause significant financial inconvenience. Consumer forums and social media have seen numerous posts from customers who were surprised by the hold and concerned about the time it took for their money to be returned.

Martyn James, a consumer rights expert, commented on the broader issue of pre-authorisation holds. “While these holds are a legitimate way for businesses to protect themselves, the process needs to be far more transparent,” he advised. “Retailers must clearly signpost that this is a temporary hold, not the final charge, and provide a realistic timeframe for the money to be returned.”

A Growing Trend in Automated Retail

The payment system at Lidl’s tyre pumps is part of a larger trend in the UK towards automated and cashless services. These systems, while efficient for businesses, place a greater onus on consumers to understand the mechanics of digital payments, including temporary holds.

Consumer advocacy groups like Which? have previously called for greater clarity from both merchants and banks regarding pre-authorisation holds. They recommend that customers who experience lengthy delays in having a hold released should contact their bank directly, as the financial institution is ultimately responsible for processing the final transaction and releasing the reserved funds.

As more services become automated, shopper awareness of processes like the pre-authorisation hold will be crucial. Lidl, for its part, maintains that the system is secure and efficient, reflecting modern payment standards designed to offer convenience while ensuring service costs are covered.

FAQ

1. Is Lidl charging £13.95 to inflate tyres?

No. The final cost for the service is much lower, typically starting at £1. The £13.95 is a temporary pre-authorisation hold to ensure you have enough funds in your account. The correct, lower amount is what is ultimately charged.

2. How long will it take to get the rest of my money back?

The release of the remaining funds depends on your bank’s processing times. It typically takes between 3 to 5 business days, but can sometimes be quicker or longer.

3. Is this payment system used anywhere else?

Yes. This type of pre-authorisation hold is standard practice at most pay-at-the-pump petrol stations, car hire services, and hotels throughout the UK and globally.