A growing number of UK pensioners are receiving unexpected tax demands from HM Revenue & Customs (HMRC). The situation arises as the rising State Pension closes in on the frozen tax-free personal allowance, pushing many with even small additional incomes into a taxable bracket and creating a surprise HMRC tax bill.

The Widening Tax Net for Pensioners

The core issue stems from two conflicting government policies: a commitment to increasing the State Pension annually via the “triple lock” and a multi-year freeze on the personal tax allowance. The full new State Pension for the 2024/25 tax year rose by 8.5% to £11,502, according to the Department for Work and Pensions (DWP). However, the standard tax-free personal allowance—the amount of income a person can receive before paying income tax—remains frozen at £12,570, a policy set to continue until 2028.

This leaves just £1,068 of tax-free income available for pensioners receiving the full new State Pension. Any income beyond this from other sources, such as a workplace pension, part-time earnings, or savings interest, is subject to income tax. This effect, known as “fiscal drag,” pulls more people into the tax system without any changes to tax rates.

“Millions of pensioners have been dragged into the tax net for the first time in their lives,” stated Adam Pope, a tax expert at Spencer West, in a report covered by The Telegraph. He noted that the frozen thresholds effectively act as a “stealth tax” on those with fixed or modestly growing incomes.

Who is affected by the HMRC tax bill?

This tax issue primarily impacts individuals who receive the full new State Pension and have additional sources of income. This includes:

- Recipients of workplace or private pensions: Even a small private pension can push total income over the £12,570 threshold.

- Pensioners with part-time jobs: Earnings from employment are added to the State Pension income.

- Those with significant savings interest: Interest earned on savings outside of an ISA is taxable income.

- Individuals receiving rental income from a property.

It is crucial to note that the State Pension itself is paid gross, without any tax deducted at source. HMRC calculates the total tax owed and typically collects it by adjusting the tax code applied to a person’s other income streams, such as a private or occupational pension. This can result in a noticeable reduction in monthly payments from those pensions.

Understanding Your Tax Code

HMRC has been issuing P2 coding notices to affected pensioners to alert them to changes in how their tax will be calculated. The standard tax code for the 2024/25 tax year for someone with one job or pension is 1257L. This indicates that the individual is entitled to the full £12,570 tax-free personal allowance.

However, if HMRC anticipates that a pensioner’s total income will exceed this amount, it will issue a modified tax code to ensure the correct tax is collected. For instance, a code might be changed to collect tax owed on the State Pension through a workplace pension provider.

Officials advise everyone, particularly pensioners with multiple income sources, to carefully review any correspondence from HMRC. You can check your tax code using the official government portal on the GOV.UK website or by contacting HMRC directly. If you believe your tax code is incorrect, you should notify HMRC immediately to prevent paying the wrong amount of tax.

The government maintains that freezing tax thresholds is a necessary step to stabilise the nation’s finances. A spokesperson for the Treasury has previously stated that the freeze helps to “pay for the extra support we provided to families and businesses during the pandemic.”

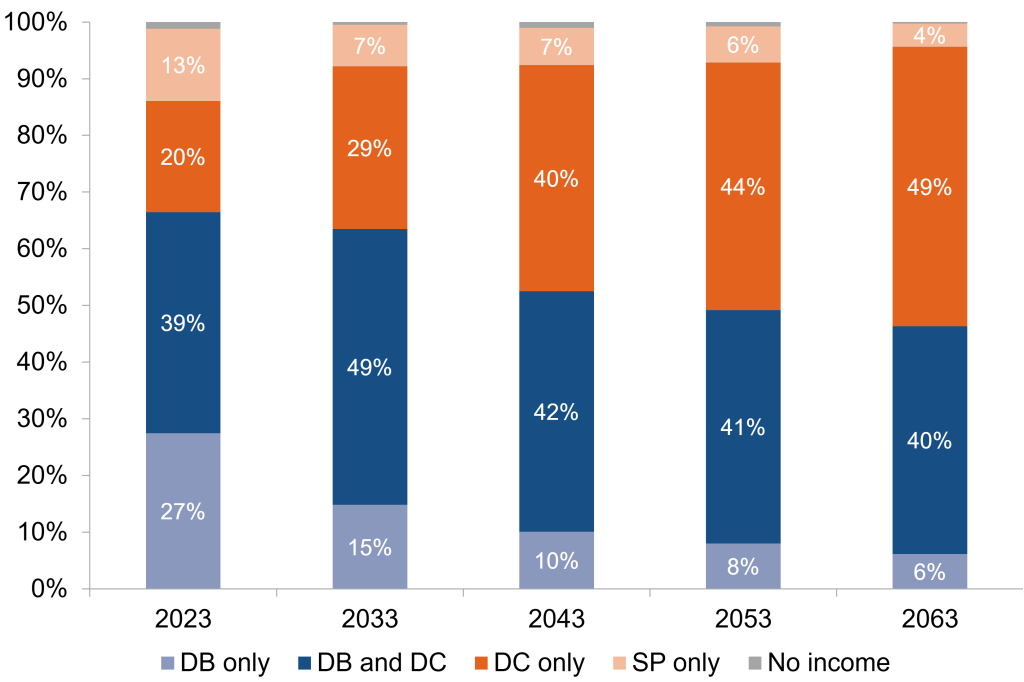

As the personal allowance remains static until 2028 and the State Pension is expected to continue rising, this issue is projected to affect an increasing number of pensioners in the coming years. Financial experts urge future retirees to factor potential tax liabilities into their retirement planning.

UK Government Confirms £1,634 Annual Cost of Living Support for Households

Six Million UK Households to Receive Cost-of-Living Payments Starting October

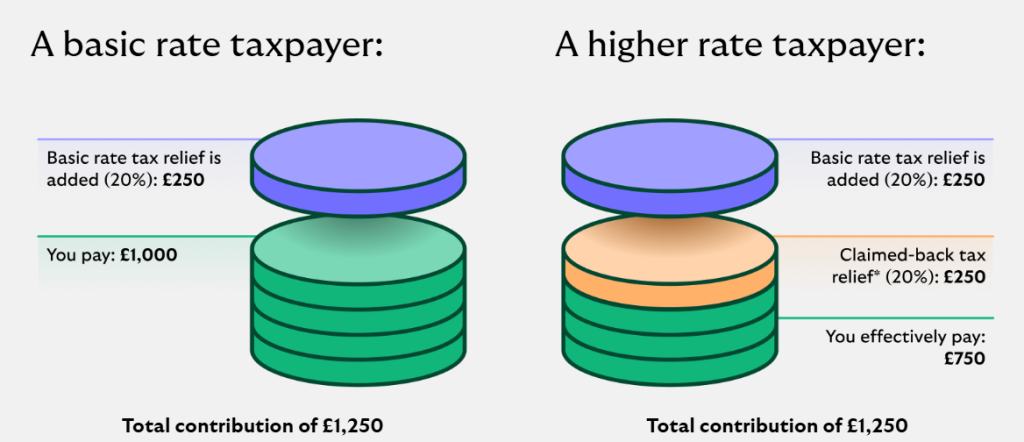

Reeves’s £50bn Problem: Cut Pension Tax Relief to Balance the Books

FAQs

Why is my State Pension being taxed now?

Your State Pension has always been taxable income, but it is paid without tax being deducted. If your total annual income, including the State Pension and any other earnings, exceeds the personal allowance of £12,570, that excess income is subject to tax.

How do I pay the tax owed?

You do not pay tax directly from your State Pension payment. HMRC will collect it by reducing your tax-free allowance on another source of income, such as a private pension or wages. This is done by issuing a new tax code to that income provider.

What should I do if I think my tax code is wrong?

You should contact HMRC as soon as possible. You can use the online service on the GOV.UK website to check your income tax details and inform HMRC of any corrections.