Ford Motor Company reported its best-ever month for electric vehicle sales, a surge largely attributed to consumers purchasing vehicles before stricter new rules for the U.S. federal electric vehicle tax credit took effect. The automaker saw significant gains across its EV lineup, highlighting a volatile but growing demand in the American market.

Ford Just Had Its Best EV Month Yet

| Key Fact | Detail / Statistic |

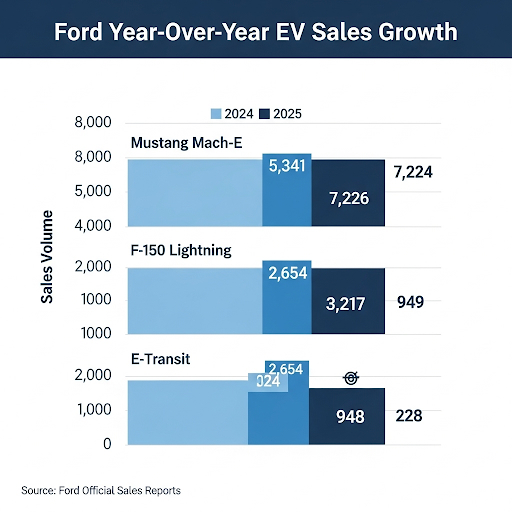

| Record EV Sales | Sales of Ford’s electric vehicles rose by 197.3 per cent year-over-year. |

| Key Driver | Changes to the U.S. EV tax credit, halving the potential rebate for certain models. |

| Mustang Mach-E | Sales for the electric SUV increased by 103 per cent, making it a top seller. |

| F-150 Lightning | The electric pickup truck remains the best-selling electric truck in the U.S. |

Record Sales Driven by Tax Credit Urgency

Ford Motor Company announced that its electric vehicle division, Model e, experienced unprecedented growth last month. According to a press release from the company, the robust performance makes Ford the second-best-selling EV brand in the United States, behind only Tesla.

The primary catalyst for this spike in Ford EV sales appears to be a well-publicised change in federal incentives. “We saw a significant pull-forward of demand in the final weeks of the quarter,” said Andrew Frick, vice president of sales, distribution, and trucks at Ford Blue. “Our customers are savvy, and they moved to take advantage of the full tax credit before the new battery sourcing guidance came into effect.”

Understanding the Electric Vehicle Tax Credit Deadline

The urgency among buyers stems from new battery component and critical mineral sourcing requirements mandated by the U.S. government’s Inflation Reduction Act (IRA). As of the deadline, the potential $7,500 tax credit for consumers was effectively halved for several popular models that did not meet the stringent criteria.

How the Rules Affect Ford Models

Under the new Treasury Department guidelines, electric vehicles must meet two separate requirements to qualify for the full credit:

- Critical Minerals: A specific percentage of the battery’s critical minerals must be extracted or processed in the U.S. or a country with a U.S. free-trade agreement.

- Battery Components: A percentage of the battery components must be manufactured or assembled in North America.

Beginning on the deadline, certain configurations of the Mustang Mach-E saw their potential tax credit fall from $7,500 to $3,750 because their battery composition did not meet the new mineral and component thresholds. This impending reduction created a powerful incentive for prospective buyers to finalise their purchases. The F-150 Lightning and the E-Transit van were also affected by similar changes.

Model Performance and Market Position

The Mustang Mach-E was a standout performer, with sales climbing 103 per cent compared to the same period last year. The vehicle has gained traction as a principal competitor to the Tesla Model Y.

Meanwhile, the F-150 Lightning continues its dominance in the nascent electric pickup truck segment. Ford has been steadily increasing production of the Lightning at its Rouge Electric Vehicle Center in Michigan to meet sustained demand, according to company statements.

Analysts note that while the sales figures are impressive, the reliance on a tax credit deadline raises questions about sustained momentum. “This is a classic example of demand being pulled forward,” said Stephanie Brinley, an associate director at S&P Global Mobility, in a recent industry analysis. “The real test for Ford will be maintaining this sales pace in the coming months under the new, less favourable subsidy environment.”

The automaker has stated it is working with its battery supply chain partners to meet the new sourcing requirements in the future, which could restore the full tax credit for its vehicles. However, no specific timeline for this has been officially announced.

7 Million People in UK Just Got Bad News About Their Retirement; Here’s What Happened

FAQs

1. Which Ford electric vehicles are still eligible for a U.S. tax credit?

As of the recent deadline, certain models of the F-150 Lightning and Mustang Mach-E are eligible for a partial credit of $3,750. Eligibility can depend on the specific battery configuration and the vehicle’s manufacturing date. Consumers should consult the official government resource at FuelEconomy.gov for the most current information.

2. Why were the tax credit rules changed?

The changes are part of the Inflation Reduction Act, which aims to bolster domestic manufacturing and reduce reliance on foreign supply chains, particularly from China, for critical battery components and minerals.

3. How have other automakers been affected?

Nearly all automakers have been affected. Some vehicles from manufacturers like General Motors and Tesla retained the full credit, while many models from Hyundai, Nissan, and others lost eligibility entirely because they are not assembled in North America.