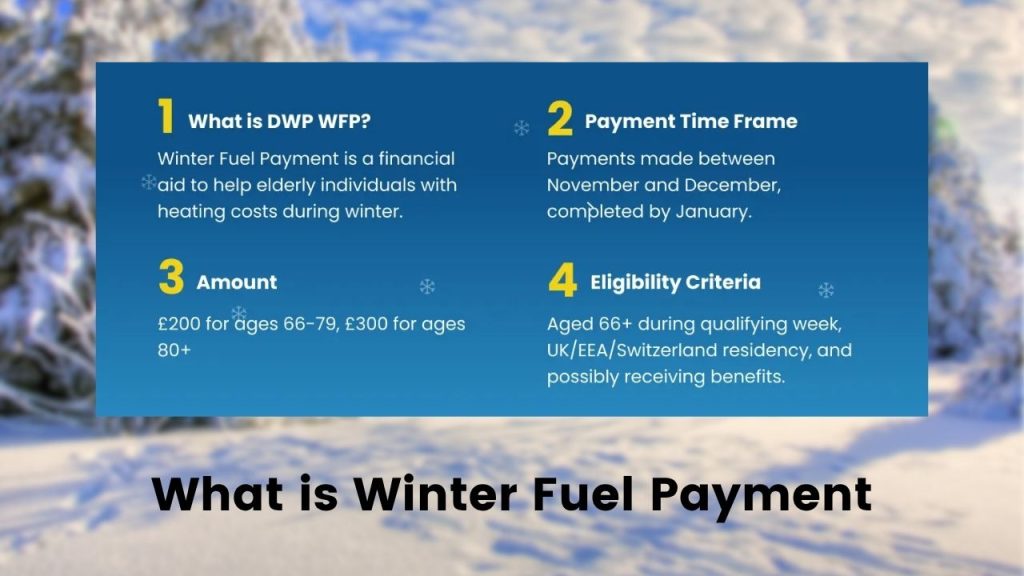

The Winter Fuel Payment is an important financial support payment from the UK government to help older people with the costs of heating their homes during the colder months. For the winter of 2025/26, this payment continues to assist eligible people, particularly those over State Pension age, with amounts ranging from £100 to £300 depending on age and circumstances. However, new eligibility rules have been introduced, and certain groups will no longer receive this payment.

In this article, we will explain who qualifies for the Winter Fuel Payment, who does not, and provide practical guidance on eligibility, payments, claiming processes, and what alternatives might exist. This article aims to be clear and straightforward, suitable for understanding by a wide audience while providing trusted, expert insights.

Five Groups Who Won’t Receive DWP Winter Fuel Payment in 2025

| Aspect | Details |

|---|---|

| Eligibility Age | Born on or before 21 September 1959 (State Pension age threshold) |

| Payment Amounts | £100 to £300 depending on age and household circumstances |

| Payment Period | Payments made between November and December 2025 |

| Income Threshold for Recoupment | Income over £35,000 results in payment being reclaimed by HMRC tax system |

| Main Groups Excluded | Prisoners, long-term hospital patients, some care home residents with benefits, non-residents, higher earners |

The Winter Fuel Payment remains an essential support for many older people to cope with winter heating costs in 2025/26. Yet, significant changes mean some groups are excluded, and high-income households will see payments reclaimed via tax. Understanding eligibility, how to claim, and what alternative support exists is crucial for maximizing available help.

The key takeaway is to check your status early, watch for official communication from the Department for Work and Pensions (DWP), and apply if needed before the deadline of 31 March 2026. With energy costs expected to remain high, this payment can make a difference in managing winter expenses safely and comfortably.

What Is the Winter Fuel Payment?

The Winter Fuel Payment is a tax-free financial support provided by the government to help people of State Pension age with heating bills during winter. It is an annual payment intended to ease the burden of energy costs due to colder weather.

The government usually pays between £100 and £300 depending on factors such as age (those aged 80 or over receive more) and household circumstances. The payment is generally automatic but must sometimes be claimed by eligible people who do not receive other qualifying benefits.

Eligibility Criteria for Winter Fuel Payment in 2025/26

To qualify for the Winter Fuel Payment this year, the official rules state you must:

- Be born on or before 21 September 1959, which makes you of State Pension age.

- Be living in England or Wales during the qualifying week (15 to 21 September 2025).

- Have a genuine and sufficient link to the UK (exceptions apply for residents abroad).

- If your taxable income exceeds £35,000, the payment will be clawed back via the tax system later.

Payments are often automatically made to people receiving certain benefits such as the State Pension, Pension Credit, Universal Credit, Attendance Allowance, Disability Living Allowance, and others.

Five Groups Who Will Not Receive the Winter Fuel Payment in 2025/26

While the payment assists many, five key groups are excluded from receiving the Winter Fuel Payment this year due to government regulations:

1. Prisoners

Individuals who are in prison for the entire qualifying week (15 to 21 September 2025) will not receive the Winter Fuel Payment. The government excludes prisoners as they have their accommodation provided without fuel costs.

2. People Receiving Long-term Free Hospital Care

If a person is hospitalized receiving free in-patient treatment during the entire qualifying week, they are excluded from eligibility for this payment. This is because their heating costs are presumably covered by the hospital.

3. Residents of Care Homes Receiving Income-Related Benefits

Those living in care homes during the qualifying week and who receive means-tested benefits such as Pension Credit, Universal Credit, Income Support, income-based Jobseeker’s Allowance, or Employment and Support Allowance will not be eligible to receive the payment. This is a significant exclusion reflecting the nature of care home support.

4. People with Income Over £35,000

People who earn more than £35,000 (gross taxable income) will not lose the payment immediately but will have it reclaimed through the tax system (HMRC). This effectively excludes higher earners from benefiting from the Winter Fuel Payment.

5. Those Living Outside Eligible Areas Without a Sufficient Link

Individuals living outside England or Wales, notably Scotland (which has a separate scheme called the Pension Age Winter Heating Payment), or those without a genuine social security connection to the UK, will not qualify. Living abroad generally excludes people unless they meet specific criteria demonstrating a strong connection to the UK.

How Much Will the Winter Fuel Payment Be?

The exact amount depends on the recipient’s age and household composition:

- If you or your partner are 80 or older, you can receive up to £300.

- If you are under 80 but over State Pension age, the standard amount is £200.

- When households have more than one qualifying person, payments might be split or reduced based on shared residency.

If one person in a household gets means-tested benefits, one payment covers the household.

How and When to Claim the Winter Fuel Payment?

For most eligible individuals, payment is automatic. If you receive qualifying benefits such as the State Pension or Pension Credit, you will receive the payment without needing to apply.

If you do not get a qualifying benefit but meet the age and residency criteria, you may need to make a claim. The claim can be made:

- Online through the official government website

- By post using a claim form

- By phone, where assistance is available for hearing-impaired or non-English speakers using textphone or British Sign Language relay services

The payment is usually made between November and December 2025, and letters will be sent out from the Department for Work and Pensions (DWP) confirming payment amounts and dates. The deadline for claiming is 31 March 2026.

Alternatives and Additional Support for Heating Bills

If you do not qualify for the Winter Fuel Payment or need extra assistance, you might be eligible for other forms of help, including:

- Cold Weather Payment: Given during very cold spells if you receive certain means-tested benefits.

- Warm Home Discount: A £150 discount on electricity bills for those on Pension Credit or on a low income.

- Household Support Fund: Support programs run by local councils for vulnerable households in need of financial help.

Scotland offers the Pension Age Winter Heating Payment as an alternative to the Winter Fuel Payment.

DWP Winter Fuel Payment – 5 Groups Who Won’t Get The £300

PIP Payments May Increase To £800 a Month Under DWP Inflation Lock – Check Details

FAQs About Five Groups Who Won’t Receive DWP Winter Fuel Payment in 2025

Who is eligible for the Winter Fuel Payment in 2025/26?

You must be born on or before 21 September 1959, live in England or Wales during the qualifying week, and not fall into any excluded groups (such as prisoners or care home residents receiving certain benefits).

What if I live in Scotland or abroad?

People living in Scotland are not eligible but may apply for Scotland’s Pension Age Winter Heating Payment. Those living abroad might qualify if they have a genuine and sufficient link to the UK but generally must claim the payment.

How is the Winter Fuel Payment reclaimed from higher earners?

If your income exceeds £35,000 a year, HMRC will take back the payment via the tax system after it has been paid.

Can I refuse or opt out of the Winter Fuel Payment?

Yes, you can choose to opt out if you do not want to receive the payment.

What happens if I live in a care home?

If you receive certain means-tested benefits and live in a care home from 23 June to 21 September 2025, you will not get the payment. Otherwise, you may be entitled to a reduced amount.