The topic of SNAP benefits in Kentucky and federal coverage until 2028 has stirred much conversation among residents, policymakers, and community advocates alike. With recent federal legislation influencing how states will fund the Supplemental Nutrition Assistance Program (SNAP), it’s important to understand what this means for Kentucky and its residents who rely on this critical food assistance program. This article will break down the key facts, explain the implications, and provide practical guidance for those interested in learning more about SNAP coverage and the upcoming changes in Kentucky.

What is SNAP?

The Supplemental Nutrition Assistance Program (SNAP) is a federal program that helps millions of Americans, including Kentuckians, buy the food they need for good health. Administered by the U.S. Department of Agriculture (USDA), SNAP provides benefits to eligible low-income individuals and families, which they can use to purchase groceries. Since its inception over 50 years ago, the federal government has fully funded the cost of SNAP benefits, while states have contributed to program administration.

Feds Confirm Full SNAP Benefits Coverage For Kentucky Until 2028

| Aspect | Details | Reference |

|---|---|---|

| Current Federal SNAP Coverage | 100% of benefits funded by federal government | USDA, KY DCBS |

| SNAP Administrative Cost Share | Kentucky pays 50% now, increasing to 75% in 2026 | KY State Budget Director |

| SNAP Payment Error Rate (2024) | 9.1% (national average 10.9%) | USDA Quality Control Data |

| Error Rate Threshold | Below 6% = no state cost sharing, above 6% = 5% to 15% cost share | Kentucky Legislature and USDA |

| Potential State Cost Starting 2028 | $57 million to $286 million annually depending on error rate | Interim Joint Committee on Appropriations 2025 |

| Estimated SNAP Federal Funding (2024) | Over $1.2 billion to benefit Kentuckians | USDA |

| Official SNAP Kentucky Website | Kentucky DCBS SNAP Info | State of Kentucky |

Kentucky is currently fortunate to have full federal funding for SNAP benefits, providing essential food support to hundreds of thousands of residents. However, changes in federal law mean that Kentucky must prepare financially to take on greater administrative costs starting in 2026 and possibly benefit costs starting in 2028 if the state’s payment error rates do not remain below 6%. These adjustments underscore the importance of maintaining accurate administration and effective policies. For SNAP recipients and advocates, understanding and adapting to these changes is crucial. Staying informed and engaged can help protect this vital safety net.

Current Federal Coverage for Kentucky SNAP Benefits

As of now, Kentucky’s SNAP recipients are receiving full federal coverage for their food benefits, with the government covering 100% of the cost. For fiscal year 2024, Kentucky received more than $1.2 billion in federal funding for SNAP benefits. The state administers the program and shares in the administrative costs, which currently stands at 50% covered by the state.

What Has Changed in the Federal Legislation?

Recently, the federal government passed legislation called the “One Big Beautiful Bill,” which changes some of the funding rules for SNAP. These changes have the potential to alter the way Kentucky funds and administers SNAP benefits starting as early as 2026 and 2028.

- Effective October 2026, Kentucky’s share of administrative costs for SNAP will increase from 50% to 75%. This means the state will need to allocate significantly more money to run the program — roughly an additional $115 million over two fiscal years.

- Beginning in fiscal year 2028, states including Kentucky may be required to pay a portion of the SNAP benefits themselves if their error rates (the rate at which benefits are incorrectly provided) exceed thresholds set by the federal government.

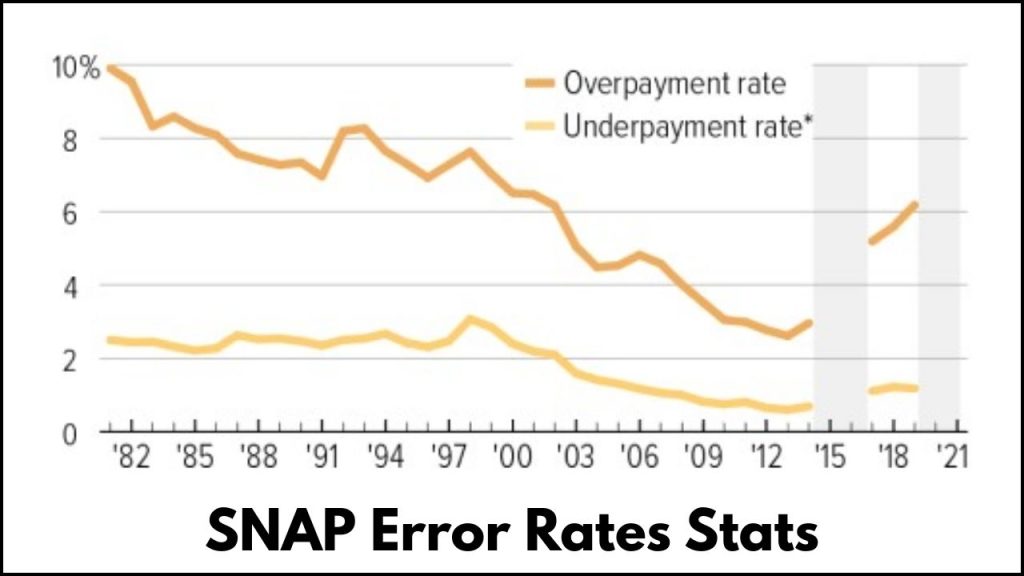

Understanding SNAP Error Rates and Their Impact on Kentucky

The “error rate” is a key factor in determining if Kentucky will need to pay a share of SNAP benefits starting in 2028. This rate measures how often payments made under SNAP are either too high or too low. Causes can include mistakes by state workers but also inaccurate information from SNAP recipients.

- According to recent reports, Kentucky’s 2024 SNAP payment error rate was 9.1%, which is slightly below the national average of 10.9%.

- If a state’s error rate remains below 6%, the federal government will continue to cover 100% of SNAP benefits with no cost-sharing by the state.

- Should the error rate exceed 6%, Kentucky may have to pay between 5% and 15% of SNAP benefits costs based on how high the error rate is. This could mean Kentucky paying from $57 million up to $286 million annually, which would place a substantial burden on the state’s budget.

- For 2025, Kentucky’s current estimated error rate is 3.7%, which is under the 6% threshold, making it possible for the state to avoid paying benefit costs for 2028, but this depends on the error rates held through 2026.

What Does This Mean for Kentuckians Receiving SNAP Benefits?

The changes will not immediately affect the benefits Kentuckians receive. As of now and continuing through 2027, the federal government will fully cover SNAP benefits. However, there are some important takeaways:

- Kentucky will need to prepare for increased financial responsibility by 2026 and beyond, especially for program administration.

- If error rates remain low, residents will continue to receive benefits without the state having to contribute to the cost of the benefits themselves.

- If error rates rise, the state could be forced to either find additional funds—potentially impacting the scope of the program—or face difficult trade-offs in public spending.

Practical Advice for SNAP Recipients and Advocates

Here are some clear actions and advice for those involved with or interested in SNAP in Kentucky:

- Stay informed: Follow updates from the Kentucky Department for Community Based Services (DCBS), which administers SNAP in the state, and national sources like the USDA.

- Report changes promptly: SNAP recipients should promptly report any changes in income or household status to reduce error rates.

- Advocate for accuracy: Support efforts to improve SNAP administrative processes and accuracy, including investments in better technology and staff training.

- Engage with policymakers: Residents should communicate with lawmakers about the importance of maintaining strong SNAP funding and supporting administrative improvements.

Detailed Guide to Understanding and Navigating SNAP Changes in Kentucky

1. What Is SNAP?

SNAP provides financial assistance for food purchases to eligible low-income households. It’s designed to ease hunger and improve nutrition.

- Benefits are provided monthly via an EBT card.

- Eligible expenses include most grocery foods.

- To qualify, applicants must meet income and resource limits.

2. How Are SNAP Benefits Funded?

- The federal government has historically paid 100% of the benefits.

- States pay for program administration, which involves managing applications, verifying eligibility, and issuing benefits.

3. What is the SNAP Payment Error Rate?

- The payment error rate tracks incorrect payments due to processing mistakes or inaccurate reporting.

- States must monitor and try to minimize errors.

- A high error rate leads to financial penalties where states must pay a share of the benefits.

4. Upcoming Federal Changes Affecting Kentucky

- Increased state share for administrative costs starting in October 2026 (from 50% to 75%).

- Potential state cost sharing for benefits from fiscal year 2028, depending on error rates.

5. Tips for Reducing SNAP Error Rates

- Fast and accurate reporting of income changes.

- Clear communication with SNAP case managers.

- Training and monitoring for administrative staff.

- Upgrading technology systems to track and verify data more efficiently.

6. What Can Kentuckians Expect?

- No immediate change in SNAP food benefits eligibility or amounts.

- Possible budgetary impacts on state programs if SNAP costs increase.

- Importance of community education and support to sustain healthy participation.

SNAP Payout Schedule Revealed—Are You Eligible for Cash Between August 18 & 24, 2025?

Colorado SNAP Shake-Up: Soda and Sugary Drinks Now Exempted by USDA Starting 2026

SNAP Shoppers Rejoice: Hy-Vee Now Offers Online Grocery Delivery With EBT Payments

FAQs About Feds Confirm Full SNAP Benefits Coverage For Kentucky Until 2028

Q1: Will my SNAP benefits be cut because of these changes?

No, as of now, federal funding will cover SNAP benefits through 2027. Any changes after 2028 depend on the state’s ability to keep error rates low.

Q2: What is an error rate and why does it matter?

The error rate is the percentage of benefits that are paid incorrectly. The federal government uses it to determine if states should pay part of the benefit costs.

Q3: How can I help keep error rates low?

Make sure to report any changes in income or household size promptly and follow all SNAP rules closely.

Q4: What happens if Kentucky’s error rate goes above 6%?

Kentucky may need to pay between 5% and 15% of SNAP benefit costs, potentially hundreds of millions annually.

Q5: Where can I get more information about SNAP in Kentucky?

Visit the official Kentucky Department for Community Based Services (DCBS) website.