The UK Department for Work and Pensions (DWP) has recently reiterated that the State Pension is primarily intended to cover one crucial expense for pensioners—the cost of heating the home. This clarification comes amid growing concerns about rising energy bills and the financial challenges faced by retirees in 2025.

Why Heating Costs Are a Priority

Keeping homes warm during cold months is essential for health and wellbeing, especially for older adults who are more vulnerable to cold-related illnesses. The State Pension provides foundational income primarily to help pensioners meet these basic living costs, with heating at the forefront. This focus aligns with government support programs like the Winter Fuel Payment, which specifically aims to ease the burden of energy bills during winter.

DWP Says This Payment Should Cover One Key Expense

| Topic | Details |

|---|---|

| State Pension Purpose | To cover basic living expenses, focusing especially on heating costs |

| Winter Fuel Payment 2025 Amount | £200 for households with someone aged 60-79; £300 if someone is aged 80 or over |

| Income Threshold for Payment | £35,000 annual income limit; if income is higher, payment is recovered through tax |

| Eligibility Qualifying Week 2025 | 15-21 September 2025 |

| Important Changes in 2025 | Payment restored universally for pensioners with income ≤£35,000, with opt-out option available |

| Additional Supports | Pension Credit, Cold Weather Payment, Warm Home Discount, Household Support Fund |

| Official Resource | DWP Winter Fuel Payment Guide – GOV.UK |

The State Pension is designed to provide essential financial support to retirees, primarily to cover necessary living costs such as home heating during the winter. The Winter Fuel Payment plays a crucial role in this by offering pensioners between £200 and £300 to help with energy bills, with eligibility now including an income cap of £35,000. Pensioners should ensure they understand their entitlements and make full use of available government schemes and advice services to stay warm and financially secure in the colder months.

Understanding the State Pension and Its Role in Covering Heating Costs

The average State Pension for new claimants as of April 2025 is about £230.25 per week following a 4.1% increase, thanks to the government’s triple lock guarantee that protects pensions from inflation and wage falls. While this payment offers stable income, it is designed to cover fundamental needs rather than luxuries.

Many pensioners face difficult choices between essential expenses, such as food, medication, and heating. The DWP emphasizes that the State Pension should ensure pensioners can afford to keep their homes warm during cold months because inadequate heating can cause serious health problems, particularly for older people.

The Winter Fuel Payment: What Pensioners Should Know for 2025/26

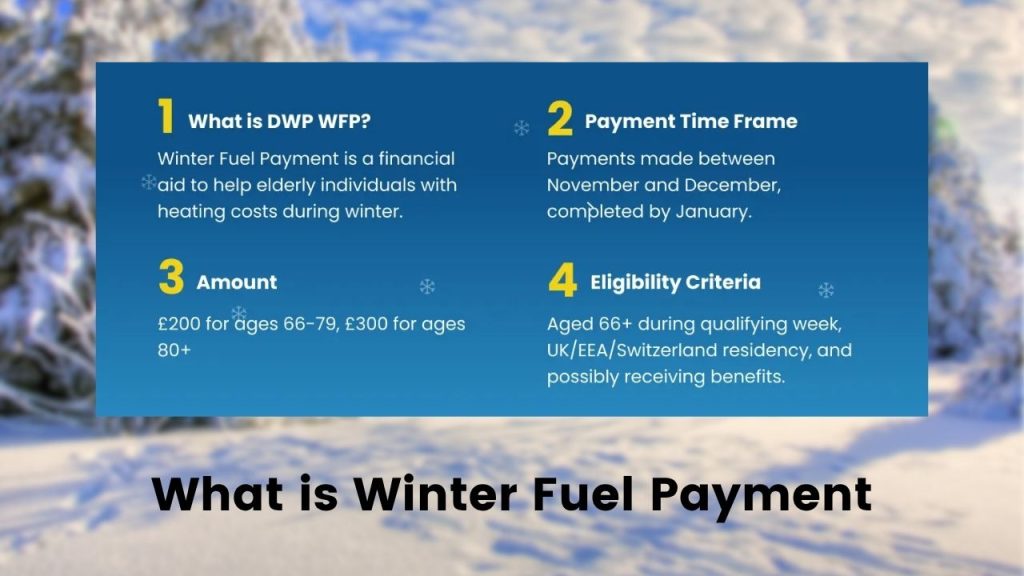

The Winter Fuel Payment (WFP) is a key government support designed to help older people with heating bills in winter.

What is the Winter Fuel Payment?

- An annual lump sum paid automatically to most eligible pensioners.

- Households with someone aged between the State Pension age and 79 receive £200.

- Households with someone aged 80 or over receive £300.

Eligibility and Income Limit

- Must be at or above State Pension age by the qualifying week of 15-21 September 2025.

- Must be a UK resident or meet residency criteria.

- Individuals with income exceeding £35,000 per year will receive the payment but it will later be recovered through the tax system.

- People above the income threshold can opt out of receiving the payment.

Changes in 2025

- In 2024, the government limited the payment primarily to those receiving Pension Credit or other means-tested benefits.

- Following public and political backlash, this was reversed in June 2025.

- The 2025 Winter Fuel Payment is restored to about 75% of pensioners with qualifying income and age, with the £35,000 income cap now in place.

Other Support for Heating Costs

Besides the Winter Fuel Payment, pensioners may access other schemes to help cover heating expenses and ease financial pressures:

- Pension Credit: A means-tested benefit that can increase entitlement and ensure eligibility for the full Winter Fuel Payment.

- Cold Weather Payment: Additional payments when temperatures fall below zero for sustained periods.

- Warm Home Discount: A one-off £150 discount on energy bills for eligible low-income households.

- Household Support Fund: Funds provided by local councils for targeted assistance.

Practical Advice for Pensioners on Managing Heating Costs

- Check Your Eligibility for Winter Fuel Payment and Pension Credit

Many pensioners qualify for Pension Credit but do not claim it. This benefit can unlock additional financial support. - Ensure State Pension Payments Go Into Your Own Bank Account

From July 17, 2025, payments must be made into a bank account in your name to prevent fraud. - Reduce Energy Use Without Sacrificing Warmth

Use energy-efficient heating systems, seal drafts, layer clothing, and consider smart thermostats to maintain comfort efficiently. - Seek Local Advice and Charity Support

Organizations like Age UK can provide guidance on claiming benefits and managing bills. - Stay Updated on Government Schemes

Support programs may change annually. Keeping informed helps ensure you receive all entitled benefits.

Extra £909 a Month for Disabled Brits — Full DWP Eligibility Criteria Revealed

DWP Bank Holiday Payment Shake-Up: Who’s Getting Paid Early in August 2025?

Universal Credit Crisis? These 4 DWP Advance Payments Could Save You

FAQs About DWP Says This Payment Should Cover One Key Expense

How much Winter Fuel Payment can I get in 2025?

You can receive £200 if you or your partner are aged between State Pension age and 79, and £300 if someone in your household is aged 80 or over.

What if my income is above £35,000?

You will receive the Winter Fuel Payment automatically but must repay it through your tax return or PAYE. You can also choose to opt out of receiving it.

Is the Winter Fuel Payment available in Scotland?

No, Scotland has a separate program called the Pension Age Winter Heating Payment, provided by Social Security Scotland.

Do I need to apply for the Winter Fuel Payment?

Most eligible pensioners receive it automatically. If not received, you can claim it via the government website or local advice services.

Are there other benefits to help with heating costs?

Yes, benefits like Pension Credit, Cold Weather Payment, and the Warm Home Discount offer additional support.