The Department for Work and Pensions (DWP) is encouraging eligible individuals on Universal Credit and other benefits to take advantage of a government programme offering a bonus of up to £1,200. The Help to Save scheme is a government-backed savings account designed to provide a 50% bonus on savings over four years, aimed at helping low-income earners build a financial cushion.

The Help to Save Scheme

| Key Feature | Details |

| Maximum Bonus | £1,200. GOV.UK |

| Savings Mechanism | Save between £1 and £50 each calendar month. |

| Bonus Structure | Receive a 50% bonus on the highest balance achieved after two years, and again after four years. |

| Eligibility | Must be receiving Universal Credit (with minimum earnings) or Working Tax Credit. Citizens Advice |

What is the Help to Save Scheme?

The Help to Save scheme is a savings account specifically for low-income individuals in the United Kingdom. It allows eligible participants to save up to £50 per month. The government then adds a tax-free bonus of 50 pence for every £1 saved over a period of up to four years.

This programme is designed as a form of DWP support to foster saving habits among those who may find it difficult to accumulate savings. According to official government guidance, the funds saved can be withdrawn at any time, though this may affect the final bonus amount. Importantly, savings held within the Help to Save account do not impact a claimant’s eligibility for their existing benefits.

“The scheme is designed to be flexible and to provide a real incentive for people to start saving, no matter how small the amount,” a statement from a government spokesperson previously explained regarding financial incentives for savers.

Who is Eligible for the £1,200 Bonus?

Eligibility for the Help to Save scheme is targeted and linked to specific benefits. To open an account, an individual must be a UK resident and meet one of the following criteria:

- Receive Working Tax Credit.

- Be entitled to Working Tax Credit and receive Child Tax Credit.

- Receive Universal Credit and have had take-home pay of at least £793.93 in their last monthly assessment period. This figure is for the 2024/2025 financial year and is equivalent to the national minimum wage for 16 hours per week.

Couples can open individual accounts, potentially allowing a household to earn up to £2,400 in bonuses. Eligibility can be checked directly through the official GOV.UK website.

How the Bonus Payments Work

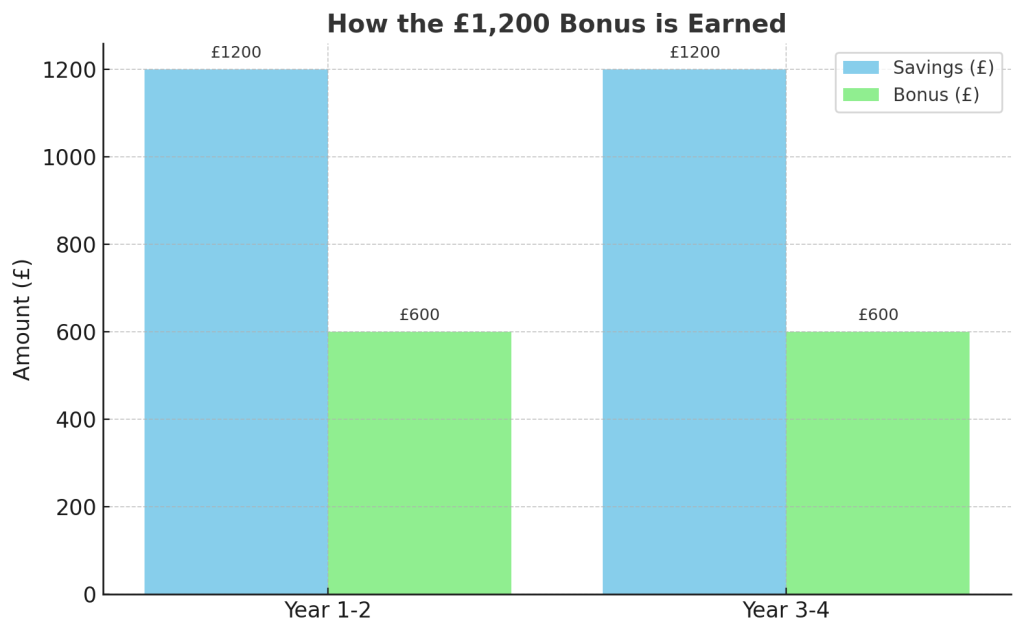

The Universal Credit bonus is paid out in two instalments. The first bonus is paid after the account has been open for two years. It is calculated as 50% of the highest balance saved during that period.

A second and final bonus is paid after four years. This bonus is 50% of any additional savings deposited in the final two years, on top of the highest balance achieved in the first two years. If someone saves the maximum of £50 every month for four years, they will have deposited £2,400 and earned total tax-free bonuses of £1,200.

How to Apply for the Scheme

The application process is managed online through the GOV.UK portal. Applicants can use their Government Gateway account to sign in and check their eligibility. The process typically takes only a few minutes.

Prospective savers will need their National Insurance number to apply. The account is managed by National Savings and Investments (NS&I), the UK’s state-owned savings bank, ensuring the security of the funds.

Consumer finance experts have widely praised the scheme. In a guide, Citizens Advice describes it as a “top savings account” for those who qualify, highlighting the significant government contribution that is unavailable through standard savings accounts.

The primary goal remains to help individuals and families build an emergency fund. Having accessible savings can prevent the need for high-cost credit or loans when unexpected expenses arise, a key policy objective in promoting financial resilience.

Five Groups Who Won’t Receive DWP Winter Fuel Payment in 2025: Full List and Guide

Millions to Lose Out on Triple Lock Pension Boost: Fury Grows Over DWP’s Silent Move

DWP Issues Urgent Warning: The One Week in September That Could Cost Pensioners £300

FAQs

1. Is the Help to Save bonus a loan?

No, the money paid out is a tax-free government bonus and does not need to be repaid.

2. What happens if I need to withdraw my savings?

You can withdraw money at any time from your Help to Save account without penalty. However, withdrawing funds may reduce the final bonus amount you receive, as the bonus is calculated on the highest balance achieved.

3. Will saving in this scheme affect my benefit payments?

No. According to the DWP, money saved in the Help to Save account will not affect any of your other benefit payments, including Universal Credit and Housing Benefit.

4. What if I stop being eligible for Universal Credit or Working Tax Credit after I open the account?

You can keep your account open and continue saving for the full four-year period, even if your circumstances change and you no longer receive the qualifying benefits.