With the United Kingdom facing significant economic constraints, attention is turning towards the government’s costly system of pension tax relief as a potential source of revenue. Shadow Chancellor Rachel Reeves is under increasing pressure to clarify the Labour Party’s intentions for the policy, as experts warn that the next government will inherit a deeply challenged set of UK public finances.

The Core Challenge

The central problem for the next government is a widening gap between spending demands and tax revenues. Stagnant economic growth, coupled with high inflation and interest rates, has placed enormous strain on public services like the National Health Service (NHS). The Office for Budget Responsibility (OBR), the UK’s independent fiscal watchdog, has forecast that the winning party in the next general election will have to either implement tax rises or spending cuts to stabilise the national debt.

Faced with this reality, Labour has sought to reassure voters by ruling out increases in the main taxes—income tax, National Insurance, and VAT. In a recent speech, Ms Reeves reiterated her commitment to “iron-clad fiscal rules,” stating that she would not “play fast and loose with the public finances.” However, these self-imposed constraints have narrowed her options, forcing a search for funds in other, more politically sensitive areas of the tax system.

What is Pension Tax Relief and Why is it in Focus?

Pension tax relief is a long-standing government incentive designed to encourage people to save for retirement. It works by refunding the income tax an individual has already paid on the money they contribute to their private pension. For a basic-rate taxpayer, a contribution of £80 into their pension is topped up to £100 by the government.

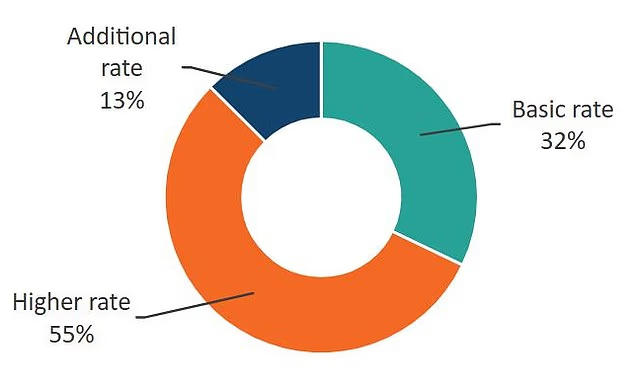

While the policy is popular, its cost is substantial. According to the latest figures from HM Revenue and Customs (HMRC), the total cost of pension tax relief and employer contributions was approximately £48.2 billion in the 2022-23 tax year. The system has also drawn criticism for disproportionately benefiting higher earners. The Institute for Fiscal Studies (IFS), a leading independent research institute, noted in a 2023 report that around half of all income tax relief on pensions goes to the top 10% of earners.

“The current system is very expensive and poorly targeted if the goal is to encourage those who are at risk of undersaving,” said Paul Johnson, Director of the IFS, in a recent analysis of fiscal policy options. “Any Chancellor looking to raise significant sums without breaking headline tax promises would inevitably have to look at tax reliefs.”

£18 Billion Pension Panic! Why UK Savers Are Rushing to Withdraw Before the Tax Hammer Falls

This Simple Plan Could Save Your Local Pension; But Does Reform UK Have It Right?

DWP Issues Urgent Warning: The One Week in September That Could Cost Pensioners £300

Potential Reforms and Political Risks

Should Labour decide to reform the system, several options are being discussed by policy experts.

Possible Changes to Pension Tax Relief

- A Flat Rate of Relief: The most commonly cited reform involves replacing the current tiered system with a single flat rate for all savers, likely set between 20% and 30%. This would reduce the benefit for top earners while potentially increasing it for some basic-rate taxpayers.

- Reducing Allowances: Another option is to further reduce the annual allowance (the maximum you can save tax-free in a pension each year, currently £60,000) or to reintroduce the lifetime allowance, which was a cap on the total value of a person’s pension pot before extra tax charges apply.

- Taxing Employer Contributions: A more radical change would be to alter the tax treatment of contributions made by employers, which are currently exempt from National Insurance.

However, any move to scale back pension tax relief carries significant political risk. The Conservative Party would likely frame such a policy as a “tax raid on savings,” designed to penalise prudent middle-class workers. Pension industry bodies have also warned of unintended consequences.

“Stability and predictability are essential for building long-term savings habits,” a spokesperson for the Pensions and Lifetime Savings Association (PLSA) stated. “Frequent changes to the tax relief system can undermine public confidence and may lead to people saving less, not more.”

The next government will inherit a difficult economic landscape. While Rachel Reeves has so far been cautious, avoiding firm commitments on pension taxation, the sheer scale of the UK’s financial challenges suggests that all options will have to be considered. The final decision will likely depend on the precise state of the UK public finances revealed after the election, leaving millions of pension savers in a state of uncertainty.