LONDON – Drivers of electric cars are now several months into a new tax regime, following the removal of the Vehicle Excise Duty exemption for zero-emission vehicles that took effect in April. The changes, designed to ensure all motorists contribute to road funding, have reshaped the financial landscape of EV ownership and brought the car tax UK system for electric cars in line with petrol and diesel models.

Car Tax in the UK September 2025

| Key Change | Detail |

| New EV Tax Start Date | 1 April 2025 HM Treasury |

| Standard Annual Rate | EVs now pay the standard rate, currently £190 per year. |

| ‘Expensive Car’ Rule | Applies to new EVs with a list price over £40,000. HM Treasury |

Export to Sheets

Why Car Tax Rules Changed for Electric Vehicles

The central reason for the reforms is to address a growing imbalance in the UK’s motoring tax revenue. Historically, zero-emission vehicles were exempt from Vehicle Excise Duty (VED) to incentivise their adoption. However, as the number of electric vehicles (EVs) on UK roads has surged, the tax base from traditional VED and fuel duty on petrol and diesel cars has started to shrink.

In the 2022 Autumn Statement, Chancellor Jeremy Hunt announced the policy change, stating it was designed to “make our motoring tax system fairer.” The government has maintained that as the UK moves towards its 2035 goal of ending the sale of new petrol and diesel cars, it is necessary to ensure the tax system remains sustainable and that all road users contribute towards the upkeep of the road network.

According to a briefing from HM Treasury, the move is projected to bring the revenue generated from EVs more in line with that from internal combustion engine vehicles over the coming years.

What the VED Changes Mean for You

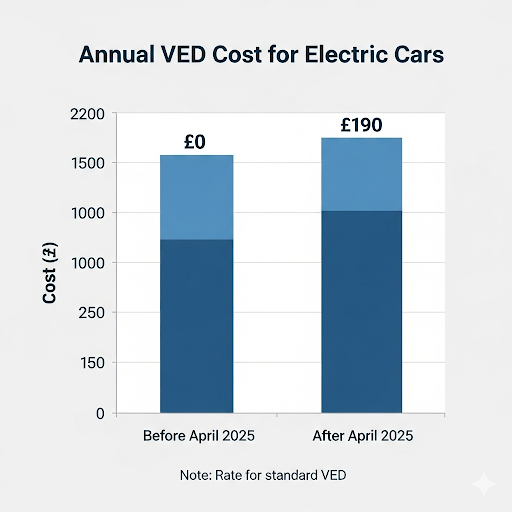

The impact of the new VED rules varies depending on when a vehicle was registered and its original list price. The VED changes have created distinct categories for both new and existing EV owners.

For New EVs Registered After 1 April 2025

Any new, zero-emission car registered for the first time on or after 1 April 2025 is now liable for VED. In their first year, they pay the lowest first-year rate, which is currently set at £10. From the second year of registration onwards, they must pay the standard annual rate, which is currently £190.

For EVs Registered Before April 2025

Owners of electric cars registered between 1 April 2017 and 31 March 2025 are also affected. Having previously paid £0 in VED, these vehicle owners are now also required to pay the standard annual rate of £190. This change has brought hundreds of thousands of existing EV drivers into the VED system for the first time.

The ‘Expensive Car Supplement’

A significant element of the new rules is the application of the ‘expensive car supplement’ to EVs. Any new electric car with a list price of £40,000 or more will be subject to an additional annual fee for five years. This supplement, currently £410, is paid on top of the standard VED rate from the second to the sixth year of the vehicle’s registration.

This has a notable impact on the premium EV market, substantially increasing the five-year running cost for many popular models.

Industry and Motoring Group Reactions

The introduction of the electric vehicle tax has drawn a mixed response from industry bodies and consumer groups.

The Society of Motor Manufacturers and Traders (SMMT) had previously expressed concern that removing tax incentives too early could dampen consumer demand for EVs. In a statement earlier this year, an SMMT spokesperson noted, “While we recognise the need for fair taxation, the abrupt removal of the VED incentive risks slowing down the crucial transition to zero-emission motoring.”

Motoring organisations have acknowledged the logic behind the change but have highlighted the financial pressure on drivers. A spokesperson for the RAC commented, “It’s probably fair that EV drivers start contributing to road maintenance, but this has created a new running cost that potential buyers must now factor in.” They added that the timing coincides with high living costs, potentially making the switch to electric less accessible for some households.

Looking Ahead: The Future of Motoring Taxation

These VED changes are widely seen as a first step in a broader overhaul of UK motoring taxation. With fuel duty revenue set to disappear as the country moves away from fossil fuels, experts and policymakers are exploring long-term alternatives.

Discussions around road pricing or pay-per-mile schemes continue to circulate within government and transport think tanks. While no firm policy has been announced, the end of the VED exemption for EVs signals a clear governmental direction towards a tax system based on road use rather than fuel type.

As Professor of Transport Policy at the University of Leeds, Dr. Eleanor Vance, stated, “The VED changes for EVs were inevitable. The real debate now is what comes next. The UK needs a modern, technology-neutral road pricing system to fund our infrastructure for the next generation, and that transition will present its own set of challenges.”

FAQ

1. How much is car tax for an electric car in the UK now?

For most EVs registered after 1 April 2017, the standard annual rate is now £190. New EVs registered after 1 April 2025 pay £10 for the first year, then £190 annually thereafter.

2. Do I have to pay the expensive car supplement on a used EV?

Yes, if the car’s original list price was over £40,000 and it is less than six years old, the supplement applies. The VED cost is transferred with the vehicle to the new owner.

3. Are hybrid cars affected by these changes?

The recent changes were specifically aimed at zero-emission vehicles. Hybrids have been subject to VED for many years, with rates based on their CO2 emissions. Their tax rates were not directly altered by this specific policy.

4. Where can I check my vehicle’s specific tax rate?

You can check the exact tax rate for any vehicle by using the vehicle’s registration number on the official gov.uk “Check if a vehicle is taxed” service.