Lede: The Canadian federal government has outlined the payment schedule for its quarterly carbon tax rebate, officially known as the Climate Action Incentive Payment (CAIP), for 2025. This article details the Canada Carbon Tax Rebate next payment schedule, explains eligibility criteria for residents in applicable provinces, and provides information on the expected payment amounts designed to offset federal fuel charge costs.

2025 Carbon Rebate at a Glance

| Key Fact | Detail |

| 2025 Payment Dates | Payments are scheduled for April 15, July 15, October 15, 2025, and January 15, 2026. Government of Canada |

| Eligibility | Must be a resident of an eligible province, 19 years or older, and have filed your 2024 tax return. |

| Purpose | To return the proceeds from the federal carbon pollution pricing system to households. Department of Finance Canada |

| How to Receive | Payments are automatic for eligible individuals who file their taxes; no application is needed. |

Understanding the Climate Action Incentive Payment

The Climate Action Incentive Payment (CAIP) is a tax-free amount paid to help eligible individuals and families offset the cost of the federal pollution pricing. It consists of a basic amount and supplements for a spouse or common-law partner, eligible children, and for residents of small and rural communities.

According to the Government of Canada, the program is designed to return the majority of fuel charge proceeds directly to residents of the provinces where the federal system applies. This ensures that most households receive more back in rebates than they pay in direct federal carbon pricing costs. The policy aims to maintain affordability while creating a financial incentive to reduce greenhouse gas emissions.

Canada Carbon Tax Rebate Next Payment Schedule in 2025

The Canada Revenue Agency (CRA) administers the payments on behalf of the federal government. For 2025, eligible Canadians can expect to receive their direct deposits or cheques on the following dates:

- April 15, 2025

- July 15, 2025

- October 15, 2025

- January 15, 2026

If the 15th falls on a Saturday, Sunday, or a statutory holiday, the payment will be issued on the last business day before that date. To receive the payments, individuals must have filed their previous year’s income tax and benefit return.

Who Is Eligible for the Carbon Rebate 2025?

Eligibility for the Carbon Rebate 2025 is determined based on several factors, primarily residency and tax filing status.

Provincial Residency

The federal rebate is only available to residents of provinces that are part of the federal fuel charge system. As of the 2024-2025 benefit year, these provinces include:

- Alberta

- Manitoba

- New Brunswick

- Newfoundland and Labrador

- Nova Scotia

- Ontario

- Prince Edward Island

- Saskatchewan

British Columbia, Quebec, and the Northwest Territories have their own territorial or provincial carbon pricing systems and are therefore not part of the federal CAIP program.

Personal Requirements

To qualify, you must be a resident of an eligible province at the beginning of the payment month and be at least 19 years old. If you are under 19, you may still be eligible if you have (or had) a spouse or common-law partner, or are (or were) a parent and live (or lived) with your child.

Only one person per couple can claim the rebate for the family. The amount is calculated based on the individual, a supplement for a spouse or common-law partner, and an amount for each eligible child under 19.

How Much Will the 2025 Rebate Be?

The exact payment amounts for the 2025-2026 benefit year (starting in April 2025) will be officially confirmed by the Department of Finance Canada closer to the date, typically in early 2025. The amounts are adjusted annually based on the carbon price and vary by province to reflect the different levels of fuel charge proceeds collected.

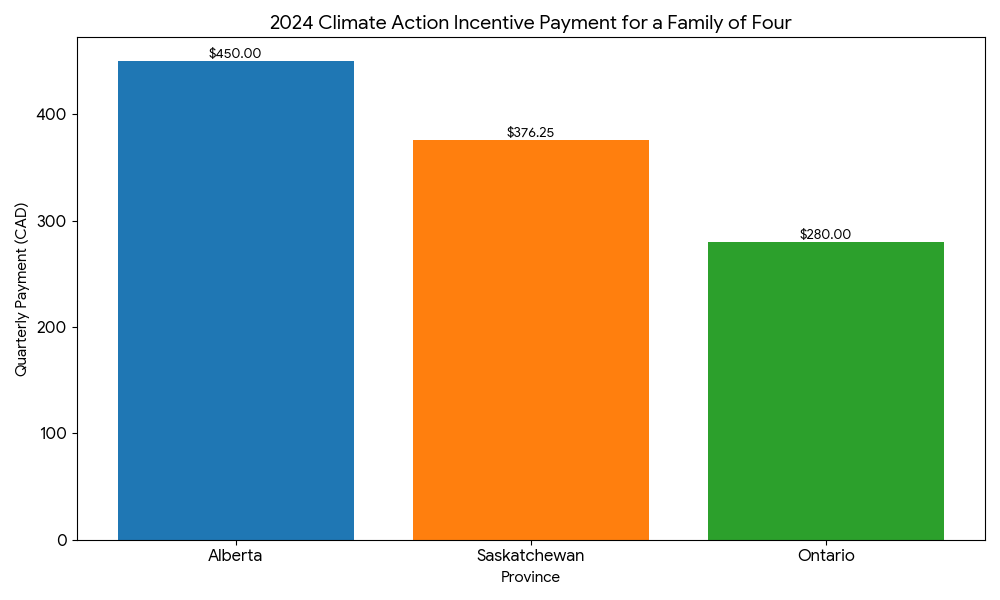

For context, the quarterly payment amounts for a family of four in the 2024-2025 benefit year ranged from $190 in New Brunswick to $450 in Alberta.

The Rural Supplement

In addition to the base amount, a supplement of 20% is available for residents of small and rural communities. The CRA defines these as areas outside a Census Metropolitan Area (CMA). Individuals must self-identify their eligibility for the rural supplement on their annual tax return to receive it.

How to Ensure You Receive Your Payment

No application is necessary to receive the CAIP. The CRA automatically determines eligibility each year based on the income tax and benefit returns filed. The most important step for residents is to file their tax return on time each year, even if they have no income to report.

Payments are issued via the same method as tax refunds. Individuals who have signed up for direct deposit with the CRA will receive the CRA Payment Dates rebate directly in their bank account. Otherwise, a cheque will be sent by mail.

The carbon pricing system and its associated rebate remain a subject of significant political debate in Canada. The federal government maintains the program is an essential tool in its climate plan, while opposition parties argue it places an undue financial burden on Canadians.

As the policy continues, the quarterly rebate payments are set to remain a fixture for households in most provinces. Residents are encouraged to check the official Government of Canada website for the most current information on payment amounts and program details for the upcoming year.

USA Retirement Age Increase in 2025 – Check New Retirement Age & Revised Eligibility

NZ Pension Dates 2025: Latest Updates on Payment Schedule & Eligibility!

NZ Pension Increase for 2025? Find Out New Rates & Payment Dates!

FAQs

1. Why haven’t I received my Canada Carbon Tax Rebate?

If you have not received your payment, it may be because you have not filed your most recent tax return, you are not eligible based on your province of residence, or your direct deposit information with the CRA is outdated. The CRA advises waiting 10 business days before contacting them about a missing payment.

2. Is the Climate Action Incentive Payment taxable?

No. The CAIP is a tax-free payment. It does not need to be reported as income on your tax return.

3. Do I have to apply for the carbon tax rebate?

No application is required. The CRA will automatically determine your eligibility and send the payment to you if you qualify and have filed your annual income tax return.

4. Which provinces do not receive the federal CAIP?

British Columbia and Quebec have their own provincial carbon pricing systems that meet federal requirements. The Northwest Territories also has its own system. Residents of these jurisdictions do not receive the federal payment.