The Enforcement Directorate (ED), India’s premier financial crime-fighting agency, recently carried out high-profile raids in Bhubaneswar, Odisha, targeting a prominent businessman, Shakti Ranjan Dash, and his companies. This operation is part of a larger investigation into a ₹1,396 crore bank fraud case, and the results were striking. The raids seized a fleet of 10 luxury vehicles and several high-value assets, including jewelry and cash, all tied to an alleged financial scam of monumental proportions. Let’s break down the story, explore its implications, and discuss how this case serves as an important lesson in corporate accountability.

ED Raids and Investigation

| Key Details | Summary |

|---|---|

| Target | Shakti Ranjan Dash, Odisha businessman |

| Companies Involved | Anmol Mines Pvt. Ltd. (AMPL), Anmol Resources Pvt. Ltd. (ARPL) |

| Total Amount Defrauded | ₹1,396 crore |

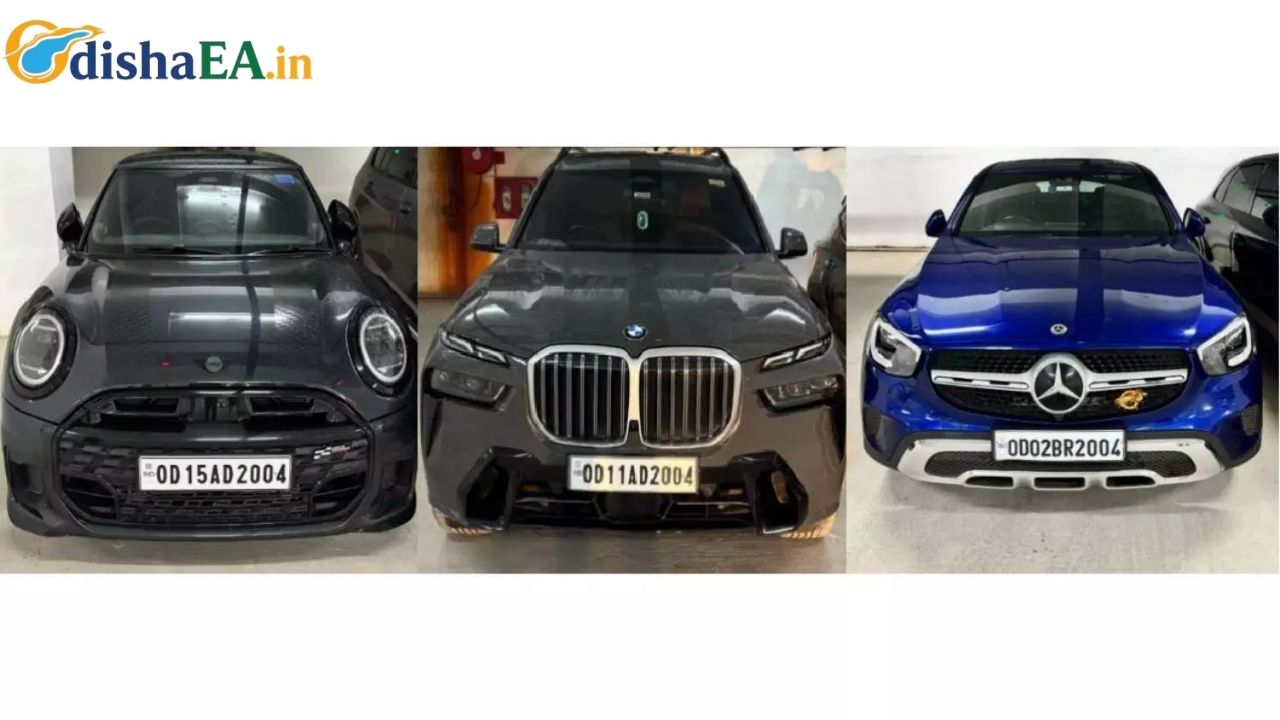

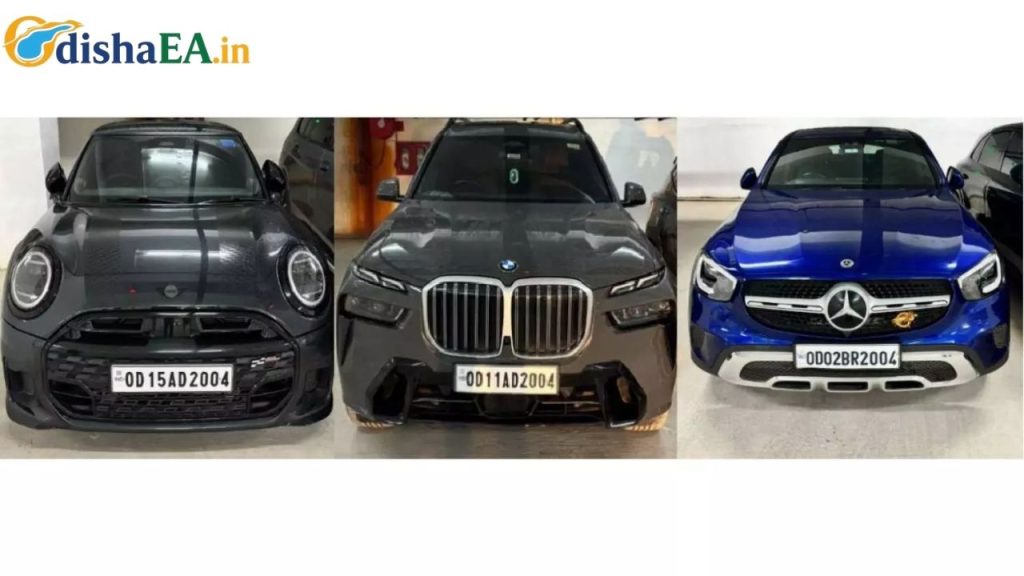

| Luxury Vehicles Seized | 10 luxury cars including a Porsche Cayenne, Mercedes-Benz, BMW X7, and Audi A3 |

| Other Assets Seized | ₹13 lakh in cash, ₹1.12 crore in jewelry |

| Incriminating Documents | Related to properties and financial transactions |

| Bank Lockers Frozen | Two bank lockers linked to Dash |

| Previous Asset Attachments | ₹310 crore, with ₹289 crore restituted to banks |

For more details, visit the India Today article.

The recent ED raids in Bhubaneswar underscore the importance of vigilance in financial dealings and the ongoing battle against financial fraud in India. This case highlights how businesses and individuals can exploit the financial system for personal gain, but it also illustrates the effective role of authorities in investigating and recovering stolen assets. By learning from this case, we can all take steps to protect ourselves from falling victim to similar schemes.

The Context: Bank Fraud in India

In recent years, India has seen an increasing number of high-profile cases related to bank fraud, with perpetrators defrauding banks by falsifying financial documents and using shell companies to divert funds. The case involving Shakti Ranjan Dash and his companies is a prime example of how individuals manipulate the financial system to enrich themselves illegally.

In this case, the Indian Technomac Company Ltd. (ITCOL) allegedly took out loans from a consortium of banks, led by Bank of India, by submitting fake project reports and bogus sales to secure funds. The total amount defrauded by ITCOL between 2009 and 2013 was a staggering ₹1,396 crore. However, the funds were not used for their intended purpose. Instead, they were diverted through shell companies, including those owned by Dash, into personal accounts and assets.

What Happened During the ED Raids?

The Enforcement Directorate conducted a series of raids across multiple locations connected to Dash and his companies. The luxury vehicles seized included prestigious brands like Porsche, BMW, Mercedes-Benz, and Audi. The total value of the seized assets, including cars, motorcycles, cash, and jewelry, exceeded ₹7 crore.

In addition to the physical assets, the ED discovered incriminating financial documents related to immovable properties, and it froze two bank lockers that belong to Dash. The agency also uncovered evidence of money laundering, further intensifying the charges against the businessman. These findings illustrate the scale and sophistication of the financial misconduct that took place.

The Role of Shell Companies

A key aspect of this case revolves around the role of shell companies. These are companies that exist only on paper, often without any real business operations, and are used to launder money or evade taxes. Dash allegedly used shell companies to launder the proceeds of crime by funneling money through fake transactions. This made it difficult for banks to track the real origin of the funds, allowing the fraud to continue undetected for years.

Shell companies can be set up with little effort, making them an attractive tool for fraudsters. These companies often operate in jurisdictions where regulations are less stringent, giving them more freedom to conceal illegal activities.

The Financial Fallout: Impact on the Banks

The fraudulent activities have had significant financial consequences for the banks involved. The loss of ₹1,396 crore represents a substantial hit to the country’s banking sector. In response to the fraud, the Enforcement Directorate has been actively working to recover the stolen funds. They have already managed to attach assets worth ₹310 crore in connection with the case, and in April 2025, ₹289 crore was restituted to the victimized banks.

Lessons and Insights: How to Protect Yourself from Financial Fraud

While the specifics of this case may seem far removed from everyday life, the principles behind it apply to everyone, from individuals to large corporations. Here are a few takeaways from this massive fraud case:

1. Know Your Business Partners

One of the easiest ways for fraudsters to operate is by hiding behind shell companies. If you are dealing with a business partner, make sure you verify their credentials and ensure they are operating legally. This is especially important when large sums of money are involved. Perform thorough background checks to prevent becoming an unwitting accomplice in a fraud scheme.

2. Secure Your Financial Records

Financial fraud often begins with the manipulation of financial documents. Keep your business records secure, and make sure that they are transparent and accurate. This helps prevent fraud and protects you from legal consequences down the road.

3. Stay Vigilant Against Fake Loan Schemes

Be cautious when taking out loans, especially if you are approached with deals that seem too good to be true. Fraudsters often use fake loan offers to trick people into taking loans under false pretenses. Always verify the legitimacy of any loan provider and avoid engaging in any suspicious financial transactions.

4. Report Suspicious Activities

If you notice any financial irregularities, report them immediately. Being proactive can prevent larger-scale fraud and save others from falling victim to similar scams.

Puri Police Dismantle Inter-District Brown Sugar Ring, Arrest Three in Major Drug Bust

Vigilance Crackdown in Cuttack: Hospital Staff Accused of Amassing Disproportionate Assets

FAQs

1. What is the Enforcement Directorate (ED)?

The Enforcement Directorate (ED) is an Indian law enforcement agency tasked with investigating financial crimes, including money laundering and fraud. It operates under the Department of Revenue in the Ministry of Finance.

2. What are shell companies?

A shell company is a business entity that exists only on paper and does not have active operations. These companies are often used to hide ownership or launder money.

3. How can I protect myself from financial fraud?

To protect yourself from financial fraud, you should verify business partners, secure your financial documents, and report suspicious activities. It’s also important to be cautious when taking out loans and to verify any loan provider’s legitimacy.

4. What is money laundering?

Money laundering is the process of concealing the origins of illegally obtained money, typically by means of transfers involving foreign banks or legitimate businesses.

5. Why is the ED seizing luxury assets?

The ED seizes luxury assets in fraud cases to recover illicitly obtained wealth. These assets often represent the proceeds of crime, and their seizure helps to ensure that criminals do not profit from illegal activities.