LONDON – Financial authorities and police are issuing urgent warnings to people over 56 across England to remain vigilant following a significant increase in sophisticated scams designed to empty their life savings. Criminals are increasingly using complex psychological tactics, leaving many with their bank accounts drained in minutes, prompting a nationwide call for greater awareness and caution.

The Threat to Over-56s

| Key Fact | Detail / Statistic |

| Primary Target | Individuals aged 56 and over now account for 65% of all Authorised Push Payment (APP) fraud losses. UK Finance Annual Fraud Report |

| Common Tactic | Impersonation fraud, where criminals pose as bank staff, police, or government officials, is the leading method used. National Crime Agency (NCA) |

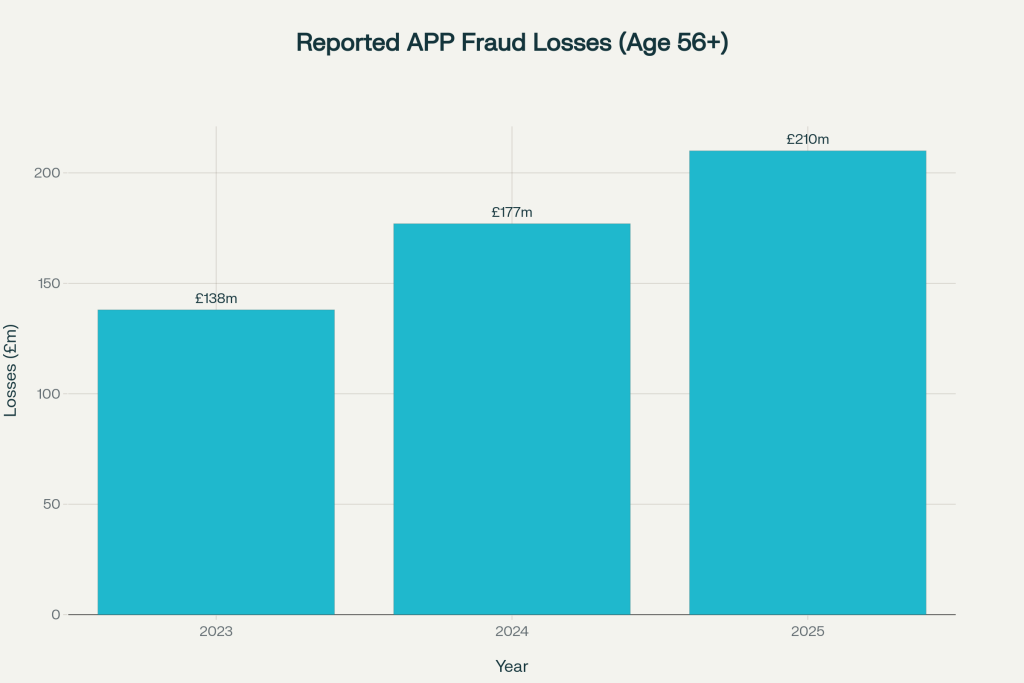

| Financial Impact | Reported losses in this demographic exceeded £177 million in the last financial year, a 28% increase from the previous year. |

| Key Advice | Never move money or provide personal details when contacted unexpectedly. Always verify requests via a trusted, separate channel. |

Export to Sheets

The Scale of the Threat: How Bank Accounts are Drained

Financial crime experts report a sharp rise in scams specifically targeting the assets of older adults. The latest figures from UK Finance, the collective body for the banking and finance industry, reveal a troubling trend where experienced criminals are successfully manipulating individuals into voluntarily transferring large sums of money.

These are not simple phishing emails but multi-stage social engineering attacks. “Criminals are more patient and persuasive than ever before,” said Sarah-Jane Smith, Director of Fraud Prevention at UK Finance, in a statement. “They build trust over several calls or messages before creating a false sense of urgency, pressuring their targets into making decisions they would never normally consider.”

The Rise of Authorised Push Payment (APP) Fraud

The most prevalent type of attack is Authorised Push Payment (APP) fraud. This occurs when a victim is deceived into sending money directly from their account to one controlled by a fraudster. Because the payment is technically authorised by the account holder, retrieving the stolen funds can be extremely challenging.

This type of over-56s scams often begins with an unexpected phone call, text message, or email. Criminals may claim there has been fraudulent activity on the victim’s account and that their money must be moved to a new “safe account” for protection—an account which, in reality, belongs to the criminal.

Impersonation Fraud Tactics

Impersonation fraud is the core psychological tool used in these scams. Fraudsters often use technology to “spoof” the phone number of a legitimate organisation, making it appear on the recipient’s handset as though the call is from their bank or the police.

“These criminals do their homework,” explained Detective Inspector John Davis from the National Economic Crime Centre (NECC). “They may have already obtained personal information from data breaches, which they use to sound credible. They will address you by your full name and may know your address or the last few digits of your account number.”

The NECC advises the public that a bank or a police officer will never ask you to transfer money for security reasons, request your full PIN or password, or send a courier to collect your bank card.

Why Are Over-56s a Primary Target?

This demographic is often targeted for a combination of reasons. Individuals in this age group are more likely to have accumulated significant savings, pensions, or investments, making them a more lucrative target for criminals.

Furthermore, while many are digitally savvy, some may be less familiar with the latest security protocols for online and telephone banking, according to a report by the consumer rights group Which?. This can create a vulnerability that criminals are quick to exploit. The generational tendency to be more polite and trusting of authority figures, such as those impersonating police or bank officials, is also a factor that criminals leverage.

Official Response and Fraud Prevention Advice

In response to the escalating threat, a coalition of banking bodies, police forces, and government agencies have amplified their public awareness campaigns. The central message revolves around the Take Five to Stop Fraud initiative.

The core advice is:

- Stop: Take a moment to stop and think before parting with your money or information.

- Challenge: It is okay to reject, refuse, or ignore any requests. Only criminals will try to rush or panic you.

- Protect: Contact your bank immediately if you think you have fallen for a scam and report it to Action Fraud.

“The single most important thing a person can do is pause,” DI Davis added. “If you receive an unexpected call, hang up. Find the official number for your bank from your statement or the back of your card, and call them directly from a different phone line or after waiting at least five minutes.”

Banks are continually upgrading their security systems, implementing new warnings for unusual payments, and working with telecommunication companies to block fraudulent numbers. However, officials stress that public awareness remains the most effective defence against fraud prevention.

The situation is being closely monitored by regulators, with ongoing discussions about reimbursement protocols for APP fraud victims. While many banks have signed up to a voluntary code to reimburse blameless victims, the process and outcomes can vary, leaving some individuals facing significant financial and emotional distress.

Another Devastating Leak: Kennedys Law Breach Joins Growing List of UK Victim Data Disasters

FAQs

1. What is the first thing I should do if I think I’ve been scammed?

Immediately contact your bank’s fraud department using the number on the back of your card. The sooner you report it, the better the chance of recovering funds. After contacting your bank, report the crime to Action Fraud online or by phone.

2. My bank called me and asked for personal details. How do I know it’s real?

A genuine bank or police service will never contact you out of the blue to ask for your PIN, full password, or to move money to another account. If you are unsure, hang up and call the organisation back on a publicly listed number from a different phone.

3. I transferred the money myself. Can I still get it back?

It can be difficult, but not impossible. Many UK banks are part of the Contingent Reimbursement Model (CRM) Code, which aims to reimburse victims of APP fraud who were not at fault. Report the incident to your bank immediately to start the investigation process.