Reports circulating online suggest an Extra Tax Refund in Canada is scheduled for 2025. However, the federal government has not announced any such new, one-time payment. Instead, Canadians can expect ongoing, and in some cases adjusted, payments from established federal programmes like the Canada Carbon Rebate and the GST/HST credit throughout the year.

Extra Tax Refund in Canada Coming in 2025

| Key Fact | Details |

| “Extra Refund” Status | No new, universal “extra tax refund” has been announced for 2025. Claims are unsubstantiated. Department of Finance Canada |

| Existing Rebates | Payments from existing programmes like the Canada Carbon Rebate and GST/HST credit will continue. |

| Payment Adjustments | Amounts for many benefits are indexed to inflation and may be adjusted for 2025. |

| How to Verify | The most reliable source for your personal benefit information is your CRA My Account portal. CRA My Account |

Debunking Claims of a New 2025 Refund

Claims of a new, special Extra Tax Refund in Canada for 2025 lack official confirmation and appear to stem from misunderstandings of existing federal support programmes. The Canada Revenue Agency (CRA) and the Department of Finance Canada, the bodies responsible for the country’s tax system and benefits, have not announced a novel, broad-based refund outside of the standard tax system.

Financial experts caution Canadians to seek information from official government sources. “During times of economic uncertainty, rumours about government handouts can spread quickly,” said Dr. Evelyn Reid, a professor of public policy at the University of Toronto. “It is crucial for individuals to verify information directly on the CRA’s website or through their secure online account to avoid misinformation and potential scams.”

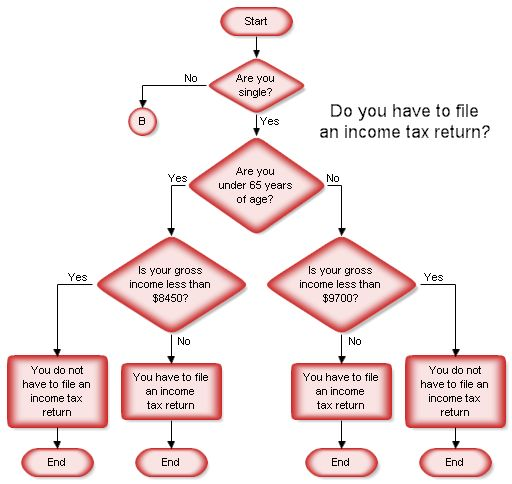

A tax refund is typically money returned to an individual who has overpaid their income tax throughout the year. The payments discussed in these online rumours more closely resemble federal benefits or rebates, which are direct payments made to eligible Canadians regardless of their tax overpayment status.

What Federal Payments and Rebates Can Canadians Expect in 2025?

While a new, singular refund is not on the horizon, several established federal payments will continue to be issued to eligible Canadians in 2025. The amounts for these benefits are often adjusted annually to account for inflation.

The Canada Carbon Rebate (CCR)

Formerly known as the Climate Action Incentive Payment, the Canada Carbon Rebate is a tax-free amount paid to help eligible individuals and families offset the cost of the federal carbon pollution pricing system.

- Payment Structure: It is paid quarterly in April, July, October, and January.

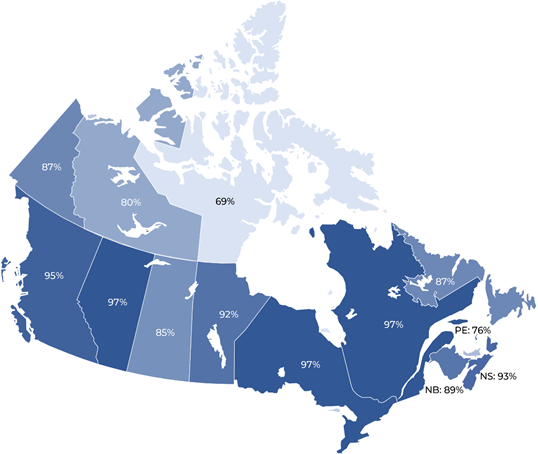

- 2025 Amounts: The specific rebate amounts for 2025 have not yet been announced. The government typically confirms these figures early in the year. Amounts vary by province and are based on family size.

The GST/HST Credit for 2025

The Goods and Services Tax/Harmonized Sales Tax (GST/HST) credit is a tax-free quarterly payment. It aims to help individuals and families with low and modest incomes offset the taxes they pay on purchased goods.

- Eligibility: Eligibility and payment amounts for the July 2025 to June 2026 period will be determined based on your 2024 income tax return.

- Payment Dates: Like the CCR, payments are typically issued in July, October, January, and April. The exact GST/HST Credit 2025 dates will be available on the CRA website.

Other Canada Revenue Agency Payments

Other key federal benefits, such as the Canada Child Benefit (CCB) and the Canada Workers Benefit (CWB), also continue. These are subject to their own eligibility rules and payment schedules, with amounts regularly indexed to the cost of living.

How to Check Your Eligibility and Avoid Scams

The most secure and accurate way for Canadians to verify their eligibility for federal benefits, check payment amounts, and confirm dates is through the official CRA My Account portal.

The CRA consistently warns the public about scams. The agency will never use text messages or email to ask for personal information or link to a page requesting such details to issue a payment. “Be vigilant,” a recent CRA advisory states. “If an offer seems too good to be true, it likely is. Never click on suspicious links or provide personal data in response to an unsolicited message.”

As Canada approaches the 2025 fiscal year, any new, significant financial support programmes would be formally announced by the Minister of Finance as part of the federal budget or a scheduled economic update. Until then, Canadians should rely on information about the established system of credits and rebates already in place.

Canada Parents Alert: Up to $666 per Child Arriving August 20!

New Benefit Cheques Are Coming in August & September Across Canada — Are You Getting One?

New Cheques Are Coming in August and September Across Canada — Are You on the List?

FAQs

1. Is the extra tax refund in Canada for 2025 real?

No. There has been no official announcement from the Government of Canada or the CRA about a new, one-time “extra tax refund” for 2025. Existing rebate and benefit programmes will continue as scheduled.

2. How much will the Canada Carbon Rebate be in 2025?

The federal government has not yet announced the Canada Carbon Rebate amounts for 2025. This information is typically released in the early months of the new year and will be available on the CRA’s website.

3. When are the GST/HST Credit 2025 payment dates?

The GST/HST credit is paid four times a year. The 2025 payment dates are expected to be on or around the fifth day of January, April, July, and October. Please check the official CRA website for the confirmed schedule.

4. How can I protect myself from tax refund scams?

Never provide personal or financial information through unverified links in texts or emails. The CRA communicates via official mail and its secure “My Account” portal. Be skeptical of any communication that demands urgent action or promises unexpected money.