WELLINGTON – New Zealand superannuitants are set to receive an increase in their fortnightly payments from 1 April 2025, as the government adjusts rates to match rises in the cost of living and average wages. This annual NZ Pension Boost 2025 is a crucial financial update for hundreds of thousands of retirees, designed to maintain their purchasing power amidst ongoing economic pressures.

NZ Pension Boost in 2025

| Key Fact | Detail |

| Adjustment Date | Payment rates for NZ Superannuation and the Veteran’s Pension increase on 1 April 2025. Ministry of Social Development |

| Primary Drivers | The increase is tied to the annual Consumer Price Index (CPI) and growth in the net average wage. |

| Eligibility Core | Applicants must generally be aged 65 or over and meet specific residency criteria. |

What is the NZ Pension Boost 2025 and How is it Calculated?

The annual adjustment to New Zealand Superannuation is not a discretionary policy decision but an automatic process mandated by law. The goal is to ensure that the real value of the pension is not eroded by inflation over time.

According to the Ministry of Social Development (MSD), which oversees Work and Income, the rates are adjusted each year based on two main factors:

- Consumer Price Index (CPI): The adjustment reflects the percentage increase in the CPI over the 12 months to the previous December. This directly links the pension to the rising cost of goods and services.

- Net Average Wage: The legislation requires that the after-tax rate for a qualifying couple must be at least 66% of the net average ordinary time weekly wage.

The final increase will be based on whichever of these two metrics provides a larger boost for superannuitants. Given recent inflationary trends, the CPI is expected to be a significant driver for the 2025 adjustment.

“This mechanism acts as a critical safeguard for retirees,” stated Dr. Michael Stevens, a senior economist at the University of Auckland. “It ensures that seniors, who are often on fixed incomes, can better cope with rising expenses for essentials like food, housing, and healthcare.”

Updated Superannuation Rates Expected for 2025

While the official confirmed rates will be announced by the government closer to the 1 April effective date, the adjustment is expected to provide a noticeable increase from the current payment levels. The final figures are dependent on wage and inflation data from Stats NZ Tatauranga Aotearoa for the year ending December 2024.

For context, the gross fortnightly rates effective from 1 April 2024 were:

- Single (Living Alone): $1,118.42

- Single (Sharing): $1,029.02

- Couple (Each): $850.56

The exact percentage increase will be calculated once the official data is finalised. Retirees do not need to take any action; the new rate will be applied automatically to their payments from 1 April 2025.

Who is Eligible for NZ Superannuation?

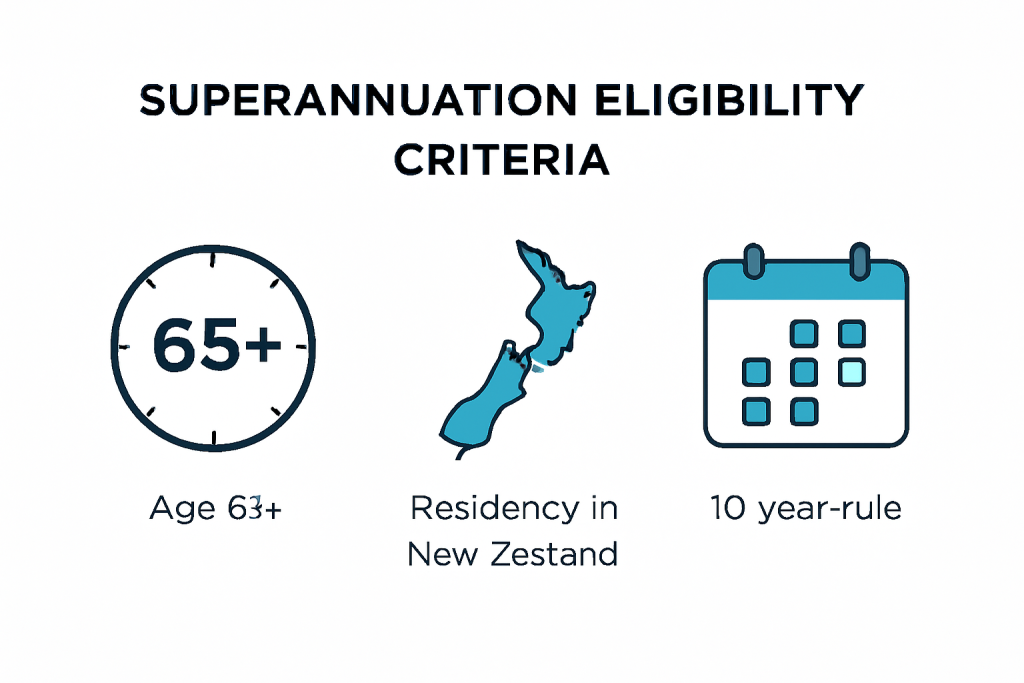

Eligibility for NZ Super is based on age and residency, not on an individual’s work history or assets. The criteria are straightforward but strict.

Age and Residency Requirements

To qualify for superannuation eligibility, a person must be 65 years of age or older. They must also meet the residency rules, which, according to Work and Income, require an individual to:

- Be a New Zealand citizen, permanent resident, or hold a residence class visa.

- Have lived in New Zealand for at least 10 years since turning 20.

- Have lived in New Zealand, the Cook Islands, Niue, or Tokelau for at least 5 of those years since turning 50.

Time spent living overseas in certain countries with which New Zealand has a social security agreement may also count towards these requirements.

Impact of Overseas Pensions

It is important to note that individuals who are eligible for a state-funded pension from another country may have that amount deducted directly from their NZ Super payments. This “direct deduction” policy is a common point of confusion, and applicants are advised to declare any overseas pension entitlements to Work and Income.

2025 Pension Payment Dates

NZ Superannuation is paid fortnightly on a Tuesday. New recipients are assigned a payment week based on their birthday, and this schedule continues throughout their retirement. The April 1st increase will be reflected in the first full fortnightly payment cycle following that date. The schedule for pension payment dates will not change; only the amount paid will be updated.

The Broader Economic Context

The 2025 adjustment comes as households across New Zealand continue to face elevated living costs. The annual increase is a vital component of the nation’s social safety net, though it also contributes to ongoing government expenditure. The long-term sustainability of the universal pension system remains a topic of discussion among policymakers, particularly regarding the qualifying age.

Te Ara Ahunga Ora Retirement Commission regularly highlights the importance of the scheme. In a recent report, it emphasised that “NZ Super is the backbone of retirement income for most New Zealanders, and ensuring its value keeps pace with economic reality is fundamental to preventing elder poverty.”

As the 1 April 2025 date approaches, superannuitants and financial advocates will be watching for the official rate announcement from the government. The figures will provide a clearer picture of the financial landscape for New Zealand’s retirees in the year ahead.

How to Target a £44,711 Retirement Income With Dividend Shares — Simple Strategy Revealed

FAQs

1. When will the official 2025 NZ Super rates be announced?

The government typically announces the new rates in March, after the official CPI and wage data for the previous year are finalised.

2. Do I need to apply for the annual increase?

No. The adjustment is automatic for everyone currently receiving NZ Superannuation or the Veteran’s Pension. The new rate will be applied to your regular payments.

3. Can I work and still receive NZ Super?

Yes. Income from paid work does not affect your NZ Super payments. However, this income is taxable, which may affect your overall tax rate.

4. Is NZ Superannuation taxed?

Yes, NZ Super is a taxable income. The amount of tax you pay depends on the tax code you provide to Work and Income, which is determined by any other income you may receive (e.g., from work, investments, or an overseas pension).