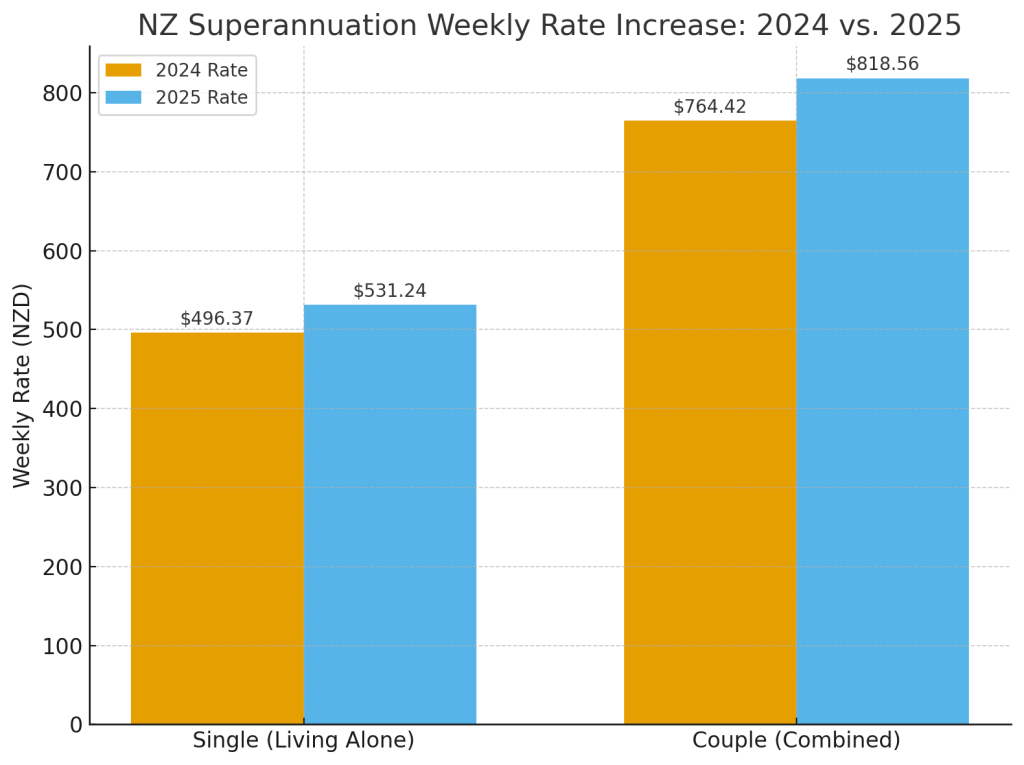

The annual New Zealand Superannuation Increase 2025 took effect on 1 April, providing a 3.8% boost to payments for hundreds of thousands of retirees. The adjustment, driven by inflation, aims to help seniors manage rising living costs. The increase lifts the after-tax weekly payment for a single person living alone to $543.82.

Key Changes at a Glance

| Key Fact | Detail/Statistic |

| Annual Increase | Payments increased by 3.8% from 1 April 2025. Ministry of Social Development |

| Single Rate (Living Alone) | New after-tax rate: $543.82 per week. |

| Couple’s Rate (Both Qualify) | New after-tax rate: $836.64 per week (combined). |

| Driving Factor | Adjustment tied to the annual Consumers Price Index (CPI). Stats NZ |

Details of the New NZ Super Rates

The government has finalised the updated payment rates following the annual review. This adjustment is a legal requirement to ensure that superannuation payments keep pace with both inflation and wage growth.

The Ministry of Social Development (MSD) confirmed the new rates are based on the 3.8% increase in the Consumers Price Index (CPI) for the year to December 2024.

For the most common situations, the after-tax fortnightly payments are:

- Single, Living Alone: The payment has risen to $1,087.64 per fortnight, up from $1,047.80.

- Single, Sharing: The payment is now $1,007.88 per fortnight, an increase from $971.00.

- Couple (both qualify): The combined payment has increased to $1,673.28 per fortnight, from $1,612.00 previously.

- Couple (one partner qualifies): The rate varies based on the non-qualifying partner’s income.

These new NZ Super rates are intended to ensure that a married couple’s payment is at least 66% of the net average ordinary time weekly wage, a benchmark set in legislation.

Why the Pension Increase NZ Occurred

The annual adjustment is a non-discretionary process linked directly to economic indicators reported by Statistics New Zealand (Stats NZ).

“The government’s commitment is to ensure the financial security of our seniors,” said the Minister for Social Development, Hon. Sarah Thompson, in a statement from her office. “This automatic annual adjustment protects superannuitants from the erosion of their purchasing power due to inflation, ensuring their income keeps up with the cost of living.”

The 3.8% CPI figure reflects the broad increase in the price of goods and services across the economy over the 12-month period. Economists note that while this pension increase NZ provides relief, many seniors still face pressure from specific costs like housing and healthcare, which can sometimes outpace general inflation.

Dr. Ben Carter, a senior economist at the University of Auckland, commented, “The CPI-linked adjustment is a robust mechanism. However, the lived experience of inflation can differ for retirees, whose spending is often more heavily weighted towards essentials. This year’s increase is crucial, but the broader conversation about retirement affordability continues.”

Superannuation Eligibility Criteria

To receive New Zealand Superannuation, individuals must meet specific criteria. The core requirements remain unchanged for 2025.

Key Eligibility Requirements:

- Age: You must be 65 years or older.

- Residency: You must be a New Zealand citizen, permanent resident, or hold a residence class visa.

- Time in New Zealand: You must have lived in New Zealand for at least 10 years since the age of 20, with five of those years being since the age of 50.

Time spent living in certain other countries may count towards these residency requirements under specific social security agreements. Applicants are encouraged to check their individual circumstances with Work and Income, the service delivery arm of MSD.

Payment Dates and Application Process

NZ Super is paid fortnightly. The specific day a person receives their payment depends on their birth date. Work and Income provides a clear schedule on its website for recipients to track their payment dates.

For those turning 65, it is recommended to apply for NZ Super at least a few weeks before their birthday to ensure payments start on time. Applications can be completed online through the Work and Income website or by requesting paper forms.

The application process requires providing proof of identity, age, and residency. Once approved, payments are made directly into the recipient’s chosen bank account.

The Age Concern New Zealand organization welcomed the increase but reiterated the challenges many older New Zealanders face. “This adjustment is vital and expected,” a spokesperson said. “We continue to advocate for policies that address the high cost of housing and healthcare, which remain significant concerns for those on fixed incomes.”

Looking ahead, the next annual adjustment to NZ Super will occur on 1 April 2026, and will be based on economic data from the 2025 calendar year. The long-term affordability of the universal superannuation scheme remains a topic of ongoing public and political discussion.

Confused by New Packaging Rules? Here’s What Small Businesses Need to Know About EPR

New Farm Sustainability Payment Rolls Out; Minister Muir Says It’s Just the Beginning

FAQs

1. Is the New Zealand Superannuation payment taxed?

Yes, NZ Super is a taxable income. The rates mentioned in this article are after-tax amounts, calculated using the standard ‘M’ tax code. Your individual tax code may result in a different net payment.

2. Can I receive NZ Super if I still work?

Yes, you can receive NZ Super while you are still working. However, the income you earn from work may affect your tax obligations or your eligibility for other supplementary assistance.

3. Does having an overseas pension affect my NZ Super?

Yes. If you receive a pension from another country, it may affect the amount of NZ Super you are entitled to under the Direct Deduction Policy. You must declare any overseas pension to Work and Income.

4. How do I apply for New Zealand Superannuation?

You can apply online via the Work and Income website. It is best to apply 3-4 weeks before your 65th birthday to ensure your payments are processed in a timely manner.