The Government has confirmed that New Zealand Superannuation and Veteran’s Pension payments will increase by 4.2% from 1 April 2025, in line with annual wage growth. The NZ Pension changes 2025 will provide a cost of living adjustment for nearly 900,000 eligible New Zealanders, according to an announcement from the Ministry of Social Development.

NZ Pension Changes in 2025

| Key Fact | Detail / Statistic |

| Rate Increase | 4.2%, Ministry of Social Development |

| Effective Date | 1 April 2025 |

| Affected Recipients | Approximately 885,000 New Zealanders |

| Primary Driver | Net Average Ordinary Time Weekly Earnings (NAOTWE) Growth, NZ Treasury |

Government Confirms Annual Pension Adjustment

The annual adjustment ensures that payments to retirees keep pace with changes in the cost of living and broader economic conditions. Carmel Sepuloni, the Minister for Social Development and Employment, stated that the increase is a crucial measure to support seniors.

“The Government is committed to ensuring our seniors have security and dignity in retirement,” Sepuloni said in a press statement released today. “This 4.2% adjustment reflects the growth in the average wage, ensuring that superannuitants maintain a direct link to the economic progress of the country.”

This pension increase NZ is calculated annually based on legislation that ties the rates to either the Consumer Price Index (CPI) or the net average wage, with the government applying whichever is higher. For the year ending December 2024, the CPI increased by 3.5%, while the Net Average Ordinary Time Weekly Earnings grew by 4.2%.

New Superannuation Payment Rates from 1 April 2025

The confirmed changes will result in higher fortnightly payments for all recipients. The Ministry of Social Development (MSD) has released the updated gross payment rates, which will appear in bank accounts from the first payment date after 1 April.

Here is a breakdown of the new before-tax fortnightly payments:

| Recipient Status | Old Fortnightly Rate (Before 1 April 2025) | New Fortnightly Rate (From 1 April 2025) | Fortnightly Increase |

| Single (Living Alone) | $1,118.42 | $1,165.40 | +$46.98 |

| Single (Sharing) | $1,029.08 | $1,072.30 | +$43.22 |

| Couple (Combined) | $1,720.64 | $1,792.90 | +$72.26 |

These figures are before tax and any other deductions. Individual payment amounts may vary based on tax codes and other personal circumstances.

The ‘Why’ Behind the Cost of Living Adjustment

The mechanism for setting pension rates is designed to be automatic, preventing payments from falling behind living costs. By law, the after-tax rate for a married couple must be maintained between 65% and 72.5% of the net average ordinary time weekly wage.

Dr. Susan St John, an associate professor of economics at the University of Auckland and a pensions expert, explained the importance of this link to wages.

“Tying superannuation to wage growth rather than just inflation is a fundamental pillar of our system,” Dr. St John said. “It ensures that retirees don’t just subsist but continue to participate in the nation’s prosperity. When workers’ wages go up, so does the pension.”

However, advocacy groups note that while the increase is welcome, many seniors still face significant financial pressures.

“This cost of living adjustment is essential, but it follows a period of high inflation that has particularly impacted those on fixed incomes,” said a spokesperson for Age Concern New Zealand. “Rising costs for food, energy, and healthcare mean many older Kiwis will still need to budget carefully.”

Looking Ahead: Long-Term Sustainability

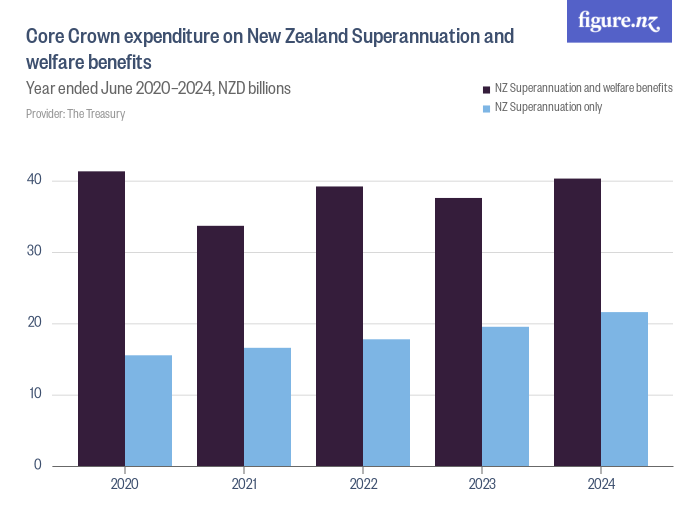

The annual adjustment often prompts wider discussions about the long-term affordability of New Zealand’s universal superannuation scheme. With an aging population, the cost of NZ Super is projected to rise significantly as a percentage of GDP over the coming decades.

The Treasury’s latest long-term fiscal statement highlights this challenge, noting that governments will need to consider policy options to manage future costs. However, the current government has reiterated its promise not to change the age of eligibility or the core principles of the pension system.

The next annual review will occur in early 2026, based on economic data from the 2025 calendar year.

Worked a Summer Job? You Could Be Owed £100s in Tax Refunds; Here’s How to Find Out

Angela Rayner Facing Surprise Stamp Duty Bill? Tax Experts Raise Alarming Questions

FAQs

1. Do I need to apply for this pension increase?

No. If you are already receiving NZ Superannuation or the Veteran’s Pension, the rate change will be applied automatically by Work and Income.

2. When will I see the new rate in my bank account?

The new rates are effective from 1 April 2025. Your first payment at the higher rate will be on your next scheduled payment date after this. For most people, this will be in the first or second week of April.

3. How is the pension increase calculated each year?

The increase is based on the higher of two figures: the percentage increase in the Consumer Price Index (inflation) or the percentage increase in the net average weekly wage. For 2025, the wage growth of 4.2% was higher than inflation.