A major pension fund has provoked outrage after revealing plans to increase investments in the arms industry, with unions and civil society groups urging workers to reject the proposal. The move has sparked a heated debate over financial ethics, security policy, and workers’ rights in managing retirement savings. The Pension Fund is at the centre of a growing clash between economic interests and social responsibility.

Fury as Pension Fund Pushes Arms Investments

| Key Fact | Detail |

|---|---|

| Pension Fund | Announced strategy to increase investments in defence and arms Reuters |

| Opposition | Unions and NGOs urge members to block plan, citing ethical risks |

| Industry Value | Global arms trade worth over $600 billion annually Stockholm International Peace Research Institute |

Pension Fund’s Defence Strategy

The fund, one of the largest in Europe, said it intends to channel more resources into defence companies producing weapons, technology, and infrastructure. Officials argued the sector offers “strong and resilient returns” at a time of global instability, pointing to rising military budgets across NATO countries.

A spokesperson for the fund stated the shift “reflects long-term strategic opportunities in defence,” citing geopolitical tensions and increased commitments to collective security.

Workers’ and Unions’ Backlash

Labour unions immediately condemned the plan, saying workers’ retirement savings should not be used to profit from warfare. Anna Müller, chair of a national metalworkers’ union, said: “Members want security in retirement, not complicity in global conflicts. We cannot support investments that fuel violence.”

Several unions have called for a formal ballot to allow workers to vote on whether the fund should proceed. Campaigners argue this is a matter of democratic accountability, as contributors are effectively the owners of the pension capital.

Ethical and Political Dimensions

Critics of the move stressed the moral implications. Human rights organisations warned that investing in weapons could tie pension funds to arms exports linked to civilian casualties. According to the Stockholm International Peace Research Institute (SIPRI), arms sales continue to rise despite global calls for disarmament, with the top 100 arms-producing companies earning $597 billion in 2022.

On the political front, lawmakers are divided. Some argue that supporting domestic arms industries strengthens national security and creates jobs. Others say it undermines commitments to peacebuilding and risks reputational damage for the fund.

Broader Economic Context

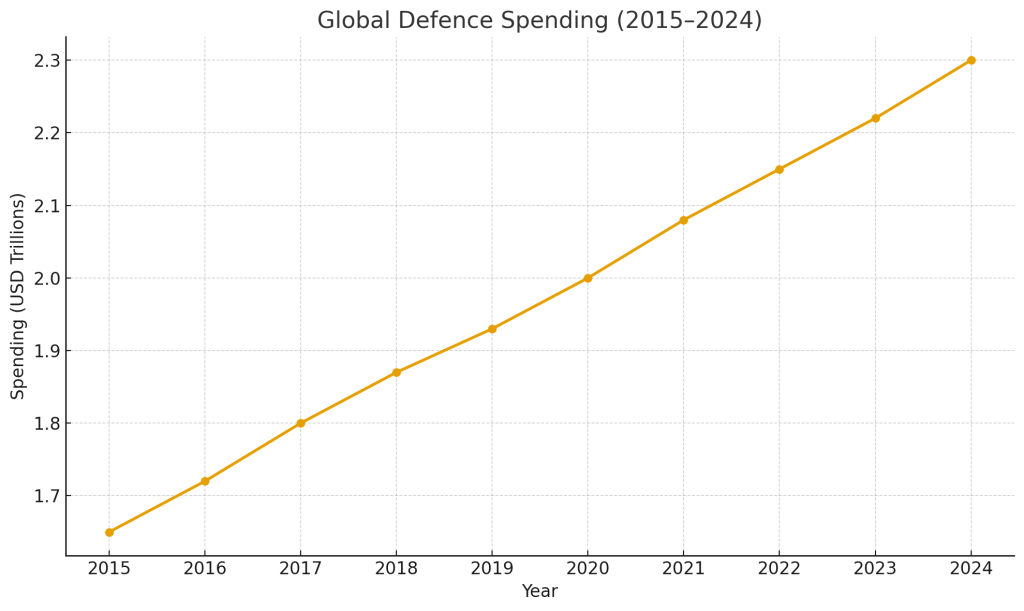

The debate comes as pension funds worldwide face pressure to deliver higher returns in uncertain markets. Defence spending has surged since Russia’s invasion of Ukraine in 2022, with NATO members pledging to spend at least 2% of GDP on military budgets. This has created a lucrative environment for defence contractors, many of which have seen share prices climb significantly.

Yet, socially responsible investment (SRI) principles remain influential. According to a 2023 report from the Global Sustainable Investment Alliance, nearly 36% of global assets are managed with environmental, social, and governance (ESG) criteria, which typically exclude weapons.

What Happens Next?

The pension fund has said it will move forward unless a majority of members formally object. Worker representatives are now campaigning for widespread participation in upcoming consultations. If members reject the plan, the fund may be forced to reconsider its portfolio strategy.

“This is not just about money,” said Dr. Elias Kahn, a political economist at the University of Amsterdam. “It’s about whether workers’ collective savings should be used to shape global security policy. The outcome will set an important precedent.”

UK Households to Receive Cost of Living Support: What to Expect in 2025 Winter

New Farm Sustainability Payment Rolls Out; Minister Muir Says It’s Just the Beginning

Final Note

The decision could redefine how pension funds balance financial performance with ethical standards. For now, the debate underscores a deeper question: should retirement savings serve security markets, or social responsibility?