LONDON — The UK government is working to correct a significant, long-term State Pension underpayment error that has left an estimated 237,000 pensioners, the majority of whom are women, out of pocket by a collective total of approximately £1.5 billion. The Department for Work and Pensions (DWP) is conducting a large-scale review to identify and repay those affected.

The State Pension Correction Programme

| Key Fact | Detail / Statistic |

| Total Underpayment | An estimated £1.46 billion in arrears. DWP Annual Report |

| People Affected | Estimated 237,000 pensioners, primarily women. |

| Primary Groups | Married women, widows, and those over 80 on the pre-2016 pension system. Work and Pensions Committee |

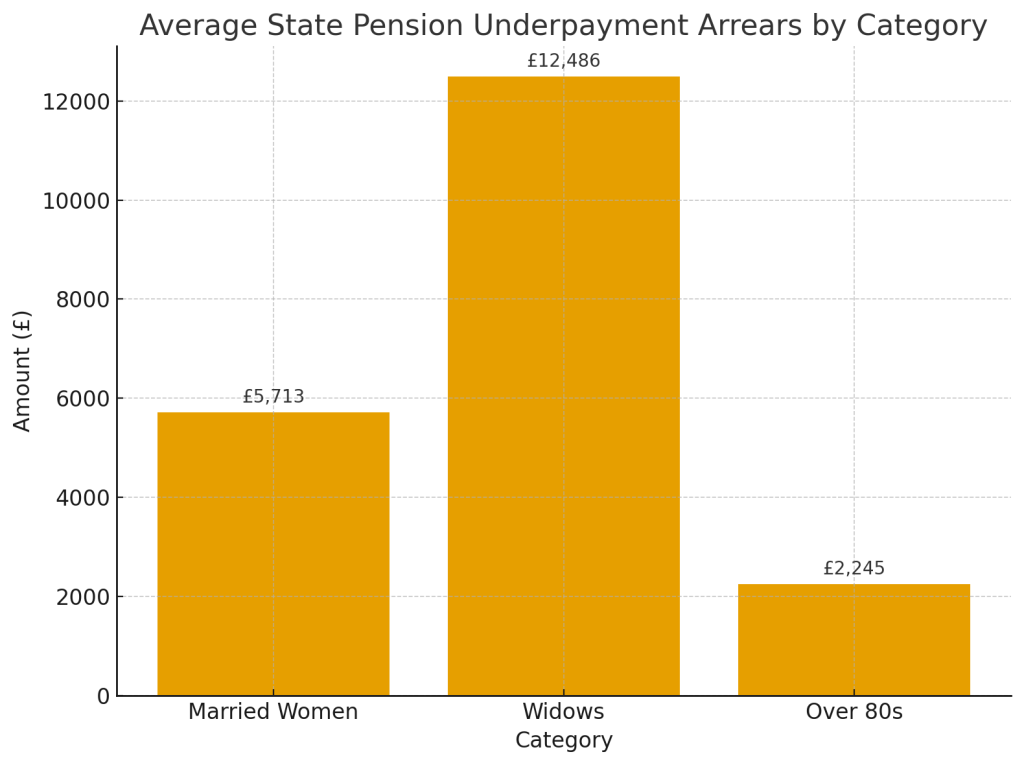

| Average Payout | Varies by category, from £2,245 to £12,486. |

The Scope of the State Pension Underpayment Error

The issue stems from historical failures to automatically increase State Pension payments for certain individuals under the old system, which existed before sweeping reforms in April 2016. The Department for Work and Pensions (DWP) has acknowledged the errors and initiated a formal correction programme, known as the Legal Entitlements and Administrative Practice (LEAP) exercise, to manage the complex process of identifying and compensating pensioners.

According to the DWP’s latest progress report, the programme had identified nearly £572 million in underpayments for over 97,000 individuals by the end of February 2024. The department is checking hundreds of thousands of cases to ensure all who were underpaid receive the money they are rightfully owed.

“Our priority is ensuring every pensioner receives the financial support to which they are entitled,” a DWP spokesperson said in a statement. “We have a dedicated team of over 1,000 people working on this correction exercise, and we are committed to getting it right.”

Who Is Most Likely to Be Affected?

The complex rules of the old ‘basic’ State Pension system are at the heart of the underpayments. The errors primarily impact three groups:

Married Women (Category BL)

Under the old system, married women who had a low State Pension entitlement based on their own National Insurance contributions could claim an uplift to 60% of their husband’s basic State Pension rate once he turned 65. This uplift was supposed to be applied automatically, but in many cases, it was not.

Widows and Divorcees

A woman’s State Pension should have been reassessed when her husband passed away, taking into account his contribution record. This could result in a significantly higher pension rate. Failures to correctly apply these inheritance rules have resulted in some of the largest individual underpayments, with the DWP reporting an average payout of £12,486 for this group.

Pensioners Over 80

A specific provision granted a State Pension uplift to individuals aged 80 and over, provided they were not already receiving a basic State Pension of a certain amount. This was another entitlement that was not always automatically applied, leading to underpayments for some of the oldest pensioners.

Why Did This Happen?

A 2021 report from the National Audit Office (NAO), the UK’s public spending watchdog, identified the root causes as a combination of complex pension rules and outdated, manual-input IT systems. The NAO concluded that the DWP’s processes were “not fit for purpose” and that opportunities to correct the errors sooner were missed.

Sir Steve Webb, a former Pensions Minister and now a partner at consultancy LCP, has been a vocal critic of the handling of the issue. “For decades, DWP’s IT systems and manual processes have failed to cope with the complex rules of the old State Pension system,” Webb told the BBC. “The scale of these errors is a tragedy, and it is vital that the government now moves as quickly as possible to find every person who has been underpaid.”

What Is Being Done and What Should Pensioners Do?

The DWP has stated it is proactively reviewing cases and will contact anyone who is owed money. Most affected pensioners do not need to take any action and will receive a letter from the government if they are due a payment.

However, the process is expected to continue until at least the end of 2025. The Work and Pensions Select Committee, a cross-party group of MPs that scrutinises the DWP, has urged the department to improve communication and speed up the correction programme.

For pensioners who have passed away, the DWP will make payments to their estate. Family members or executors who believe a deceased relative may have been underpaid are encouraged to contact the Pension Service to enquire.

New MOT Rules for September 2025: What Drivers Need to Know

New Farm Sustainability Payment Rolls Out; Minister Muir Says It’s Just the Beginning

FAQ

1. How do I know if I might have been underpaid?

You may be affected if you are a woman who reached State Pension age before 6 April 2016 and your basic State Pension was less than 60% of your husband’s rate. Widows whose pension did not increase after their husband died and anyone over 80 receiving less than the full basic pension could also be affected.

2. Do I need to make a claim?

For the majority of cases, the DWP will identify the underpayment and contact you automatically. However, for more complex cases, such as those involving divorce, you may need to contact the Pension Service directly.

3. What happens if the affected pensioner has died?

The arrears can be paid to the pensioner’s surviving spouse or to their estate. The next of kin or executor should contact the DWP to provide the necessary information.

4. How long will it take to receive a payment?

The DWP is processing cases in batches and has said the LEAP programme will run until the end of 2025. The timeline for individual payments can vary depending on the complexity of the case.