LONDON – Reform UK has put forward a contentious proposal to radically alter the investment strategy of the Local Government Pension Scheme (LGPS), a move the party claims will secure the retirement funds for millions of public sector workers. The plan, however, is facing significant scrutiny from financial experts who question its feasibility and risk profile.

This Simple Plan Could Save Your Local Pension

| Aspect | Detail |

| The Proposal | Reform UK suggests consolidating LGPS funds and shifting investments from global equities to UK infrastructure and bonds. |

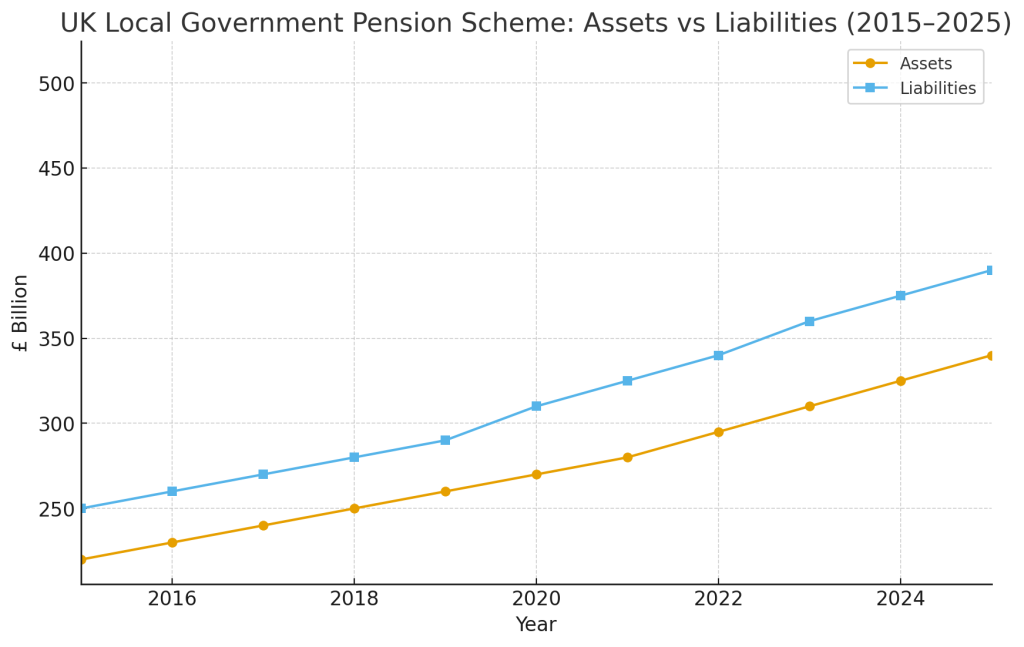

| The Problem | The LGPS holds £364 billion in assets but faces long-term pressure from increasing liabilities and market volatility. |

| Expert Reaction | Analysts express concern that the plan could concentrate risk and potentially lower long-term returns, jeopardising pension security. |

| Current System | The LGPS is a defined-benefit scheme for council and other public service workers in England and Wales, managed by 86 regional funds. Local Government Association |

The Core of the Reform UK Proposal

Reform UK’s plan centres on a fundamental shift in the investment strategy for the vast assets held by council pensions. The party proposes to compel the 86 separate regional funds that constitute the LGPS in England and Wales to significantly increase their investment in UK-based assets. This includes a heavy focus on government bonds and major national infrastructure projects.

Proponents, including Reform UK leader Richard Tice, argue that this approach would achieve two primary goals. “By investing in our own country, we not only bolster UK industry and infrastructure but also provide a more stable, predictable return for pension members, shielding them from global market shocks,” Tice stated in a recent press release. The party suggests this move would reduce reliance on financial advisers and overseas fund managers, thereby cutting administrative costs.

The Challenge Facing the Local Government Pension Scheme

The debate over pension reform is not new. The LGPS is one of the largest public pension schemes in Europe, providing retirement benefits for over 6 million members. While a 2022 report from The Pensions Regulator noted that many funds were in a relatively healthy position, long-term concerns persist over funding gaps and an ageing population increasing the number of retirees.

Local authority pension funds are legally required to balance their books over the long term, ensuring they can meet their obligations to pensioners for decades to come. To do this, they rely on a diversified portfolio of investments, which currently includes a significant allocation to global stocks, property, and other growth assets. This diversification is designed to mitigate risk and maximise returns.

Experts Raise Concerns Over Risk and Returns

While the idea of investing in Britain may have popular appeal, many pension analysts are sceptical of Reform UK’s proposal. They warn that forcing funds into a narrower range of UK-specific assets could run contrary to the fundamental investment principle of diversification.

“The primary duty of a pension fund is to secure the best possible risk-adjusted returns for its members, not to serve as a tool for industrial strategy,” said Dr. Eleanor Williams, a senior fellow at the independent Pensions Policy Institute. “Concentrating investments in one country’s economy, no matter which country, significantly increases risk. A downturn in the UK economy could have a devastating impact on pension funding levels.”

Furthermore, critics point out that UK government bonds, while traditionally safe, currently offer relatively low returns, which may not be sufficient to meet the scheme’s long-term liabilities without substantial increases in contributions from taxpayers and employees.

The Broader Push for Pension Reform

Reform UK’s plan enters a crowded field of ideas for the future of UK pensions. The current government has also encouraged pension funds to invest more in the UK economy through initiatives like the “Mansion House Compact,” albeit on a voluntary basis. This cross-party interest reflects a growing recognition that the immense capital held in pension schemes could be a powerful engine for national growth.

However, the central conflict remains between using pensions as a strategic national asset and the fiduciary duty of fund managers to prioritise the financial security of their members. The Local Government Association (LGA), which represents councils, has consistently advocated for the independence of the regional funds to make investment decisions based on their specific needs and risk appetites.

The debate is likely to intensify as political parties outline their economic visions. For the millions of people relying on the local government pension scheme, the outcome of this discussion will have profound consequences for their financial future, determining the security of the pensions they have worked their entire careers to build.

Confused by New Packaging Rules? Here’s What Small Businesses Need to Know About EPR

New Farm Sustainability Payment Rolls Out; Minister Muir Says It’s Just the Beginning

FAQs

1. What is the Local Government Pension Scheme (LGPS)?

The LGPS is a UK public sector pension scheme for employees working in local government and for other employers who have been admitted into the scheme. It is a defined-benefit scheme, meaning the pension you receive is based on your salary and length of service.

2. How are council pensions currently funded?

They are funded through a combination of contributions from employees and employers (such as local councils) and from returns on investments. Each regional fund manages its own investment portfolio.

3. Is my local government pension at risk?

The LGPS is a statutory scheme, meaning the benefits are guaranteed by law. While funding levels and investment strategies are subjects of constant debate, the benefits themselves are secure. The current discussion is about ensuring the scheme remains sustainable for taxpayers and members in the long term.