Greater Manchester Police are reviewing claims concerning the past property sale by Labour’s Deputy Leader, Angela Rayner. The review centres on whether she paid the correct amount of tax following the 2015 sale of her former council house. Tax experts have highlighted that the core of the Angela Rayner tax issue rests on which of her two previous properties was legally considered her primary home. Ms Rayner maintains she has done nothing wrong.

Angela Rayner Facing Surprise Stamp Duty Bill

| Key Issue | Detail |

| Core Allegation | Questions over whether Ms Rayner should have paid Capital Gains Tax on the 2015 sale of her former council house in Stockport. |

| Central Dispute | Determining her “main residence” for tax purposes between 2010 and 2015, as individuals can only have one. |

| Potential Tax Liability | Experts estimate a potential Capital Gains Tax liability of several thousand pounds if her sold property was not her main home. |

| Official Stance | Ms Rayner states she has received professional advice that no tax was owed and has offered to present this to authorities. BBC News |

The Heart of the Matter: Defining a ‘Main Residence’

The controversy stems from the sale of a property on Vicarage Road, Stockport, in March 2015 for £127,500. Ms Rayner had purchased it in 2007 under the ‘Right to Buy’ scheme. The key tax question is whether this house was her principal private residence during the period of ownership.

Under UK tax law, a person does not have to pay Capital Gains Tax (CGT)—a tax on the profit when selling an asset that has increased in value—on the sale of their designated main home. However, an individual can only have one main residence for tax purposes at any given time.

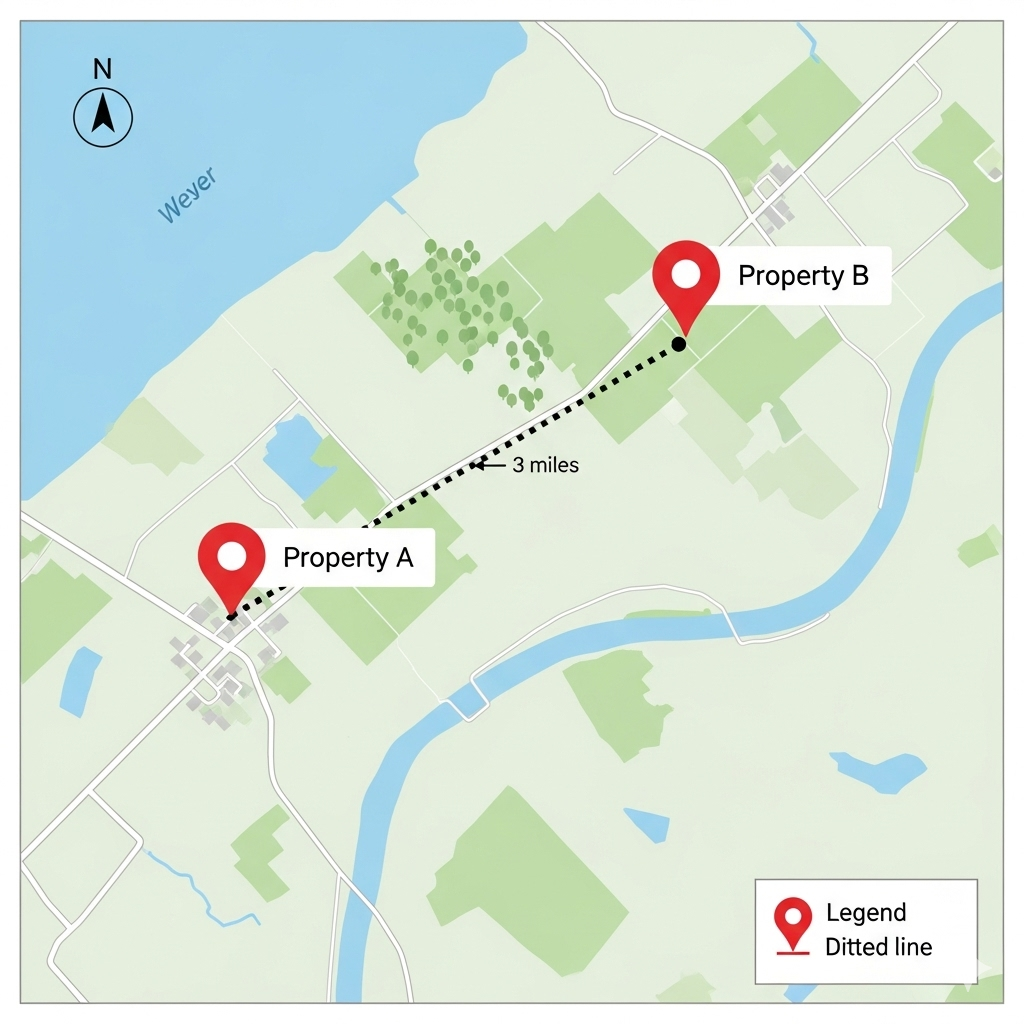

At the time, Ms Rayner was married to Mark Rayner, who owned a separate home on Lowndes Lane, just over a mile away. Scrutiny has focused on which of these two properties was her genuine primary home. Evidence being cited by critics includes her registration on the electoral roll at her husband’s address for a period.

What is the potential Angela Rayner tax liability?

If His Majesty’s Revenue and Customs (HMRC) were to determine the Vicarage Road house was not her main residence, a tax liability could arise. The property was sold for a profit of approximately £48,500.

Understanding Capital Gains Tax

Tax specialists, writing in national newspapers, have calculated the potential bill. After deducting the annual CGT allowance for the 2014-2015 tax year (£11,000), the taxable gain would be around £37,500. Depending on Ms Rayner’s income at the time, this would have been taxed at either 18% or 28%, suggesting a potential liability of between £6,750 and £10,500. There could also be questions relating to stamp duty on other property transactions.

Dan Neidle, a tax law expert and founder of the non-profit organisation Tax Policy Associates, has analysed the situation publicly, stating that while “the evidence is not clear-cut,” there are “serious questions for Ms Rayner to answer.”

Police Involvement and Political Reaction

Following a complaint made by James Daly, a Conservative Party Member of Parliament, Greater Manchester Police (GMP) initially stated they would not be investigating. However, in a revised statement, the force confirmed it would “review the circumstances” following receipt of new information.

A GMP spokesperson said, “We have received a complaint and are in the process of reviewing the information provided.” The force has emphasised that this is a review, not a formal investigation at this stage.

The Conservative Party has maintained pressure on the issue, with several cabinet ministers calling for greater transparency from the Labour deputy leader.

Rayner’s Defence and Labour’s Position

Ms Rayner has consistently and strongly denied any wrongdoing. She has stated she is “completely confident” she has followed the rules and has sought professional advice to confirm this.

In a statement, she said, “I’ve been very clear there’s no rules broken. They [the Conservatives] are smearing me.” She has also indicated a willingness to present her tax advice to HMRC or the police if they request it.

Labour leader Sir Keir Starmer has backed his deputy, telling reporters he has “full confidence” in Ms Rayner and that the public is more interested in other national issues. The party views the scrutiny as a politically motivated attack in the run-up to a general election.

The ongoing review by the police means the issue is likely to persist. While the tax implications depend on specific, personal details not yet public, the political questions surrounding transparency and accountability continue to be debated.

UK House Prices Plunge; Is Reeves’ New Property Tax Plan to Blame?

Lidl Just Changed the Rules; What the New £13.95 Payment Means for Every UK Shopper

FAQs

What tax is Angela Rayner accused of potentially not paying?

The main focus is on Capital Gains Tax (CGT), which is due on the profit from selling a property that is not your primary home.

Why is her “main residence” so important?

UK tax law provides relief from CGT on the sale of a person’s only or main residence. If Ms Rayner’s sold property was not legally her main home, she would not have been eligible for this relief.

Has Angela Rayner been charged with any offence?

No. Greater Manchester Police are currently reviewing the circumstances. This is not a formal investigation, and no charges have been brought.