LONDON – As the UK moves further into 2025, many households continue to rely on government support to meet rising rental costs. Understanding the UK Housing Benefit in September 2025 is essential for eligible individuals, primarily those of State Pension age or in specific types of supported housing. This guide outlines the current benefit amounts, eligibility criteria, and the key factors influencing payments following the annual uprating in April.

UK Housing Benefit In September 2025

| Key Aspect | Detail |

| Benefit Status | A legacy benefit, largely replaced by Universal Credit. Department for Work and Pensions (DWP) |

| Primary Claimants | Those of State Pension age or in supported/temporary accommodation. gov.uk |

| Payment Determinants | Local Housing Allowance (LHA) rates, social rent rules, income, savings, and the benefit cap. |

| How to Apply | New claims are made through local councils, not the central government. |

Understanding Your Entitlement to UK Housing Benefit in September 2025

Housing Benefit is a government payment to help people on low incomes pay their rent. While most working-age people now receive rental support through Universal Credit, Housing Benefit remains a critical lifeline for two main groups. The Department for Work and Pensions (DWP) confirms that new applications are generally restricted to these specific cohorts.

Who Can Still Make a New Claim for Housing Benefit?

Individuals can typically make a new claim for Housing Benefit if they meet all the eligibility criteria and fall into one of the following categories:

- You and your partner have both reached State Pension age.

- You are living in temporary accommodation, such as a hostel on behalf of the council.

- You live in sheltered or supported housing, which includes extra support like care, supervision, or counselling.

“It is crucial for potential claimants to first check their eligibility, as applying for the wrong benefit can cause significant delays,” advises a senior policy officer at the housing charity Shelter. “For most people, the correct path for housing support is Universal Credit, but for pensioners and those in supported living, Housing Benefit is the designated system.”

The Continued Transition to Universal Credit

The government’s long-term policy is to move all legacy benefit claimants, including those on Housing Benefit, over to Universal Credit through a process known as ‘Managed Migration’. However, as of September 2025, this process is ongoing. Claimants will receive a formal notification from the DWP when they are required to move to Universal Credit. Until then, their existing Housing Benefit claim continues as normal.

How Housing Benefit Amounts Are Calculated

The amount of Housing Benefit an individual receives is not a fixed sum. It is calculated based on a combination of personal circumstances and local rental market conditions.

Local Housing Allowance (LHA) for Private Renters

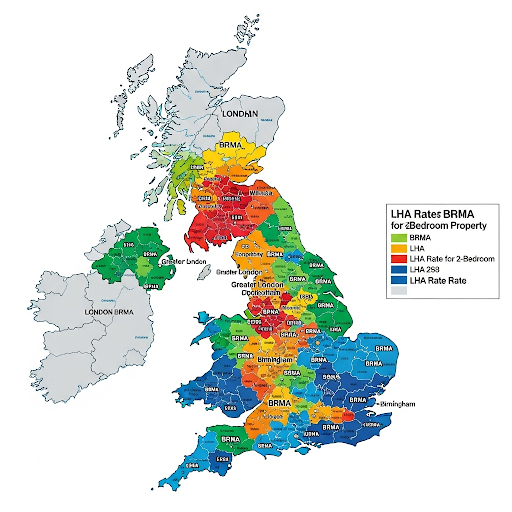

For those renting from a private landlord, the payment amount is heavily influenced by Local Housing Allowance (LHA) rates. These rates are set for each ‘Broad Rental Market Area’ across the UK and are determined by the number of bedrooms a household is deemed to need.

Following a period of being frozen, LHA rates were realigned in April 2024 to cover the 30th percentile of local market rents. The subsequent annual uprating in April 2025 adjusted these figures again based on rental data from the previous year. To check the specific LHA rates applicable in September 2025, claimants must consult their local council’s website or the official gov.uk LHA directory.

Rules for Social Housing Tenants

Tenants renting from a council or housing association are subject to different rules. Their eligible rent is based on the actual amount charged, but it can be reduced if they are considered to have more bedrooms than necessary. This policy, officially known as the ‘removal of the spare room subsidy’ and commonly referred to as the ‘bedroom tax’, reduces Housing Benefit by:

- 14% for one spare bedroom.

- 25% for two or more spare bedrooms.

The National Benefit Cap

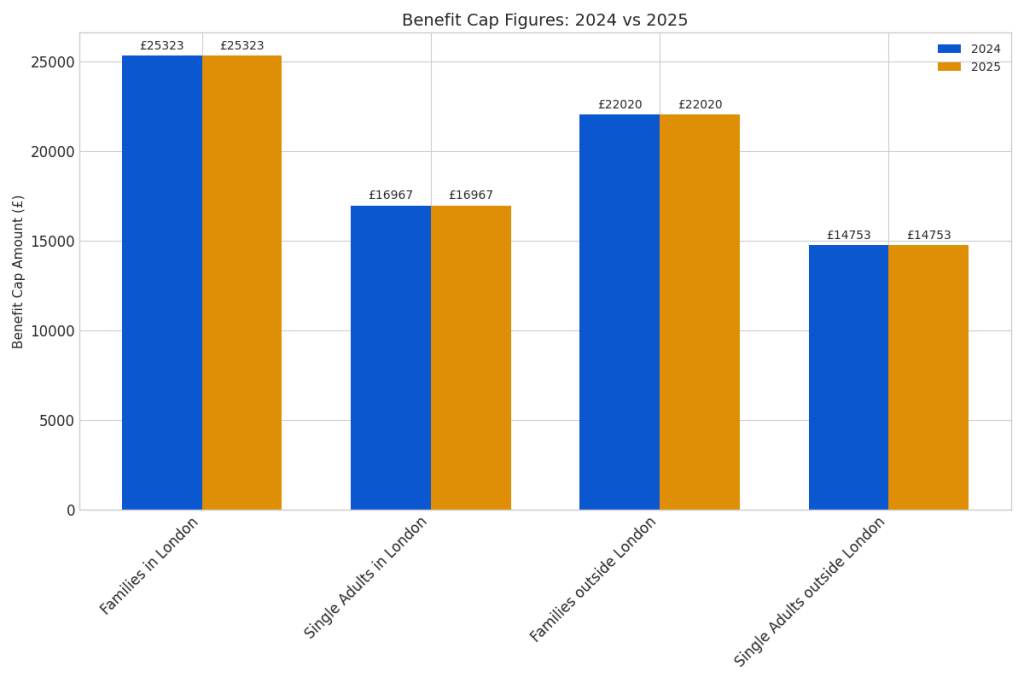

The benefit cap places a limit on the total amount of benefits a household can receive. This cap was adjusted in April 2025 in line with inflation figures from late 2024. As of September 2025, the expected annual caps are:

- Greater London: £25,323 for couples and lone parents; £16,967 for single adults.

- Rest of Great Britain: £22,020 for couples and lone parents; £14,753 for single adults.

Some claimants, such as those receiving Disability Living Allowance or Personal Independence Payment, are exempt from the cap.

Eligibility Criteria and How to Apply

To qualify for Housing Benefit, claimants must generally have a low income and savings below £16,000. However, different rules apply to those who receive the Guarantee Credit part of Pension Credit, where the savings limit can be higher.

Applications are not processed by the DWP but by local authorities. Prospective claimants should use the government’s official council finder tool to locate their local authority and begin the application process online or by phone.

The complexity of the system means that circumstances can change entitlements. “We urge anyone whose income, savings, or household composition changes to report it to their council immediately to ensure they are receiving the correct amount and avoid any potential overpayments,” a spokesperson for Citizens Advice stated in a recent press release.

As the government continues its gradual shift towards Universal Credit, those remaining on Housing Benefit should stay informed about annual rate changes and any communication from the DWP regarding migration. Checking with local advisory services can provide clarity and ensure all available housing support is being claimed correctly.

FAQ

1. What is the main difference between Housing Benefit and the housing element of Universal Credit?

Housing Benefit is a standalone legacy benefit administered by local councils, primarily for those of State Pension age or in supported housing. The housing element of Universal Credit is an integral part of a single monthly payment from the DWP for most other low-income claimants.

2. How often are Local Housing Allowance (LHA) rates reviewed?

LHA rates are reviewed annually. The rates effective from April of each year are typically announced by the government early in the year, based on rental market data from the previous autumn.

3. Can I claim Housing Benefit if I have savings over £16,000?

Generally, savings over £16,000 will disqualify you from receiving Housing Benefit. However, an important exception exists for individuals who receive the Guarantee Credit part of Pension Credit.