The phrase “401(k) millionaires are surging in 2025” is making waves this year, and it’s an exciting trend for anyone saving for retirement. More Americans than ever are reaching the milestone of having $1 million or more in their 401(k) retirement accounts. This shift is not just for the ultra-wealthy — it’s a testament to steady saving, smart investing, and the incredible power of time and consistency. But how exactly are people achieving this? And what can everyday savers learn from their success?

Whether planning for financial independence, a comfortable retirement, or simply peace of mind, understanding this trend and following proven strategies can set anyone on a path to retirement success.

401(k) Millionaires Are Surging in 2025

| Key Data Point | Details |

|---|---|

| Number of 401(k) millionaires | Over 537,000 individuals in 2024 — a 27% increase year-over-year |

| Average 401(k) balance | $131,700 – second highest on record |

| Recommended Savings Rate | Approximately 15% of salary (employee + employer contributions) |

| Employer Match Typical Structure | 100% match on first 3%, 50% on next 2% of salary |

| Age Group Leading Millionaire Count | Generation X (57%), followed by Baby Boomers (41%), Millennials (2%) |

| Average Age of 401(k) Millionaires | 59 years old with ~26 years of plan participation |

| Official Resource | Fidelity Investments 401(k) Insights |

The surge of 401(k) millionaires in 2025 proves that with consistent saving, smart investing, and patience, reaching a million-dollar retirement nest egg is possible for many Americans. This isn’t reserved for the wealthy elite—anyone can take the right steps to join this growing club.

Start early, contribute steadily, take full advantage of employer matches, and stay focused on long-term growth. These proven strategies will help turn retirement dreams into reality.

Why Are 401(k) Millionaires Surging in 2025?

Strong Market and Steady Contributions

Recent analyses show that 2024 and 2025 have seen record-setting growth in 401(k) savings, fueled by strong stock market performance and a disciplined commitment to saving. While markets experienced some volatility, savers maintained consistent contributions, benefiting from compounding returns over time.

The average 401(k) balance stands impressively at about $131,700 — the second highest ever recorded — showing that many savers are well on their way to hitting the seven-figure mark.

Younger Achievers on the Rise

While the majority of 401(k) millionaires are traditionally in their late 50s or older, there’s a noticeable increase in younger workers, including many millennials and Gen Xers, reaching this milestone earlier than expected. This shift underscores the importance of starting early and letting time work in one’s favor.

Consistency Is King

The most important lesson? Nearly all 401(k) millionaires share one thing in common: steadily saving over decades. The average 401(k) millionaire has been with their retirement plan for about 26 years, rarely stopping contributions, even during financial hardships or job changes. Time in the market has proven more valuable than trying to time the market.

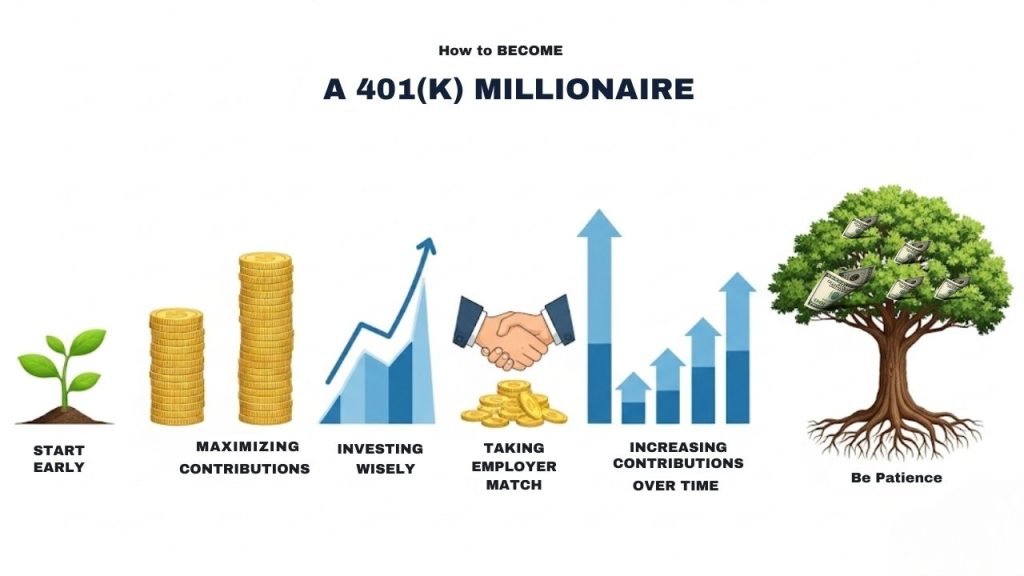

How to Become a 401(k) Millionaire: A Clear, Practical Guide

Step 1: Start Saving Early (It’s the Best Gift to Your Future Self)

- Saving early takes advantage of compound interest — the process of earnings generating more earnings.

- Even modest monthly contributions starting in your 20s can grow significantly over 30-40 years.

- Example: Saving $200 monthly from age 25 to 65 will accumulate more than saving $400 monthly starting at 35, due to the longer growth period.

Step 2: Save a Healthy Portion of Your Salary

- Aim to save at least 15% of your income, including employer match.

- Some millionaires contribute upward of 17% or close to IRS maximum limits annually.

- Use automatic contribution increases to boost savings gradually.

Step 3: Don’t Miss Out on Employer Matching

- Many employers offer a match, often 100% on the first 3% and 50% on the next 2% of your salary.

- Always contribute enough to receive the full match — it’s essentially free money.

Step 4: Invest for Long-Term Growth

- Allocate a significant portion of your 401(k) to stocks or stock funds for higher growth potential.

- Diversify your investments across sectors, markets, and geographies.

- Regularly review and rebalance your portfolio to maintain your ideal risk level.

Step 5: Resist Early Withdrawals

- Avoid cashing out your 401(k) before retirement, as it leads to taxes, penalties, and lost growth.

- If you change jobs, roll over your old 401(k) into your new plan or an IRA to keep it growing.

Step 6: Utilize Plan Features

- Take advantage of Roth 401(k) options if available — paying taxes now to enjoy tax-free withdrawals later.

- Consider managed accounts or target-date funds for professional portfolio management.

- Enable auto-escalation to increase your contributions automatically.

Step 7: Keep Your Focus on Long-Term Goals

- Stay the course through market ups and downs.

- Remember that regular investing and patience are the keys to building wealth.

Real-World Insights

Take, for example, a Gen X saver who contributed steadily for 15 years to their company 401(k). Over a decade and a half, their balance grew from around $500,000 to nearly $590,000, thanks to consistent contributions and market growth. Continuing this path with disciplined saving and investing makes reaching $1 million a realistic goal.

Millennials, though currently representing a smaller percentage of 401(k) millionaires, are expected to catch up as they save more, earn raises, and capitalize on power of compounding.

Trump Opens Door to Crypto in 401(k)s — What It Means for Your Retirement

Social Security’s Future Uncertain – 5 Backup Income Sources Every Retiree Should Consider

US Retirement Plans Could Push Bitcoin Rally Toward $200K: Expert Insights and Practical Guide

FAQs About 401(k) Millionaires Are Surging in 2025

What is a 401(k) millionaire?

A 401(k) millionaire is someone whose retirement savings in a 401(k) account have reached $1 million or more.

Can middle-income earners become 401(k) millionaires?

Absolutely. The majority of 401(k) millionaires achieved this through steady saving and maximizing employer matches, not by earning top-tier salaries.

How much should I contribute?

Aiming for 15% of your salary, including employer match, is a widely recommended target for comfortable retirement savings.

What if I withdraw early?

Early withdrawals come with taxes and penalties. More importantly, they reduce potential long-term growth and can significantly delay retirement goals.