Achieving a ₱18,500 monthly GSIS pension in 2025 is not a new universal benefit but a calculated outcome available to a specific group of government retirees. Qualification for this amount depends directly on a member’s final salary and total years of service, according to the governing formula of the Government Service Insurance System (GSIS).

₱18,500 Monthly GSIS Pension in 2025

Monthly GSIS Pension in 2025

| Key Factor | Detail |

| Minimum Retirement Age | 60 years old (for optional retirement). GSIS Official Website |

| Minimum Service Length | 15 years of paid premiums |

| Pension Calculation Basis | Average Monthly Compensation (AMC) from the last 3 years of service & total years of service |

| Primary Pension Drivers | High career salaries and service duration significantly exceeding the minimum are required for higher payouts |

Understanding the Path to a Higher Pension

Recent online discussions have highlighted the figure of a ₱18,500 monthly GSIS pension, causing some confusion among government employees and future retirees. It is critical to understand that this amount is not a newly mandated flat rate or an automatic increase for all pensioners. Instead, it represents a potential payout for individuals who meet specific criteria under the existing legal framework.

The Philippine retirement system for government workers, managed by GSIS, is designed to provide a pension that reflects a member’s contributions over their career. “The pension is not a one-size-fits-all benefit,” explained a GSIS representative in a recent public service announcement. “It is a direct computation based on the member’s loyalty and salary progression within the government service.”

Who Qualifies? A Breakdown of GSIS Pension Eligibility 2025

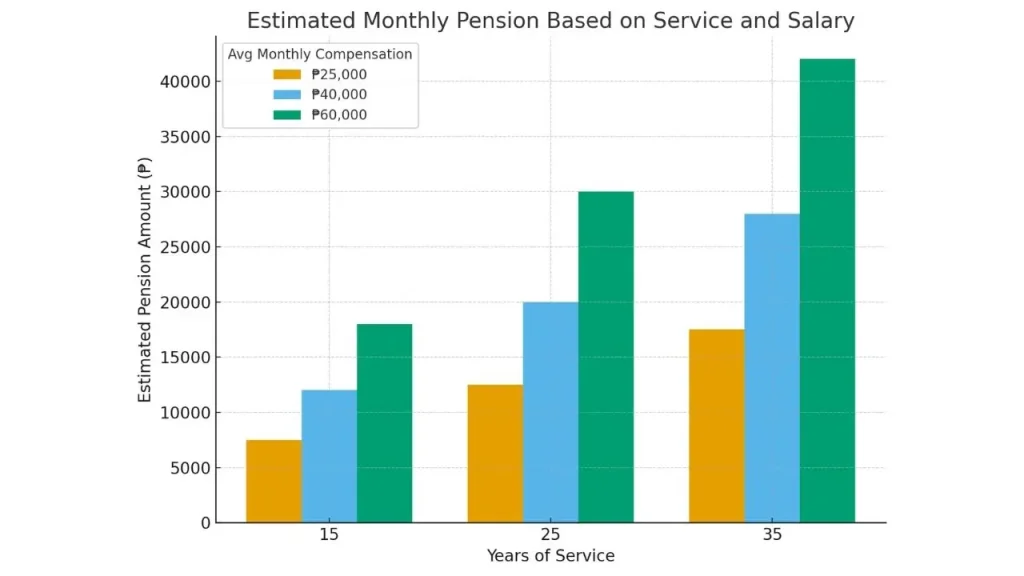

Attaining a monthly pension of ₱18,500 or more is contingent on two main variables: the member’s Average Monthly Compensation (AMC) and their total Period with Paid Premiums (PPP), or years of service.

The Core Requirements: Age and Service

To qualify for any retirement pension, a GSIS member must meet basic thresholds. According to GSIS rules, members must be at least 60 years of age to optionally retire and must have rendered a minimum of 15 years of service. They must not be receiving a permanent total disability benefit from GSIS.

However, simply meeting these minimums will not result in a high pension payout. The 15-year service period is the floor, not the target, for substantial government pensioner benefits.

The Decisive Factors: Salary and Service Length

The amount of a member’s pension is directly proportional to their salary and the length of their service.

- Average Monthly Compensation (AMC): This is the average of a member’s salary over the last 36 months of service before retirement. A higher AMC is the most significant factor in computing a larger pension. To reach a figure like ₱18,500, a retiree would typically need to have held a mid-to-high-level position with a corresponding salary in their final years of service.

- Years of Service: The GSIS formula provides a higher replacement rate for members with longer service records. A government employee who has served for 35 or 40 years will receive a substantially higher monthly pension than one who retires after the minimum 15 years, even if they have the same AMC.

For example, a member with a relatively high AMC who retires after only 15 years will receive a much smaller pension than a colleague with the same AMC who served for 30 years. It is the combination of both long service and a high salary that pushes the pension into the upper brackets.

The GSIS Commitment to its Members

The GSIS continues to manage the fund to ensure its long-term viability for current and future pensioners. In a statement released earlier this year, GSIS President and General Manager Wick Veloso assured members of the fund’s stability. “We are dedicated to safeguarding the financial security of our government workers upon their retirement. We do this by ensuring the fund is robust and that benefits are administered fairly and accurately based on a member’s dedicated service,” Veloso stated, according to the Philippine News Agency.

The focus remains on the established formula, which rewards long-term service and higher contributions reflective of a member’s career progression. This structure is central to the Philippine retirement system for public servants.

As the cost of living continues to be a concern, government employees are encouraged to understand their potential retirement benefits fully. The GSIS provides online tools and consultations for members to estimate their future pensions, helping them plan effectively for their retirement years. The final pension amount is a result of a career-long partnership between the employee and the system.

33% SSS Pension Increase in 2025: Benefits, Amounts & Payment Calendar

Filipino Seniors to Receive ₱11,000 From SSS in 2025; Will you get it? Check Eligibility

FAQs

1. What is the guaranteed minimum GSIS pension?

As of the latest official announcements, the minimum monthly pension for GSIS members is ₱5,000, provided the retiree has completed at least 15 years of service.

2. Can I compute my estimated pension myself?

Yes, the GSIS website has a pension calculator that members can use to get an estimate. However, the final, official computation will be done by GSIS upon the processing of your retirement application, based on your complete service record.

3. What happens if I have less than 15 years of service when I reach retirement age?

If a member reaches the age of 60 but has rendered less than 15 years of service, they are not eligible for a monthly pension. Instead, they are entitled to a “Separation Benefit,” which is a cash payment equivalent to their total contributions with interest.

4. Does the ₱18,500 monthly GSIS pension figure include other benefits?

The computed Basic Monthly Pension (BMP) is the primary benefit. Pensioners are also entitled to a cash gift every December and may be eligible for other benefits depending on their specific circumstances and prevailing policies.