President Ferdinand Marcos Jr. has announced a series of SSS pension reforms aimed at strengthening the long-term stability of the state-run fund. The announcement coincided with the establishment of a “National Pensioners’ Week” to formally honour the nation’s millions of retirees. The reforms focus on investment strategies rather than an immediate increase in monthly benefits.

PBBM Unveils Bold SSS Pension Reforms

| Key Initiative | Details |

| New Investment Fund | Launch of the Workers’ Investment and Savings Program (WISP) Plus, a voluntary retirement savings plan. Social Security System |

| Consolidated Loan Program | A new low-interest loan consolidation programme to assist members with existing debts. |

| National Pensioners’ Week | Proclamation No. 646 declares 25-30 September each year as “National Pensioners’ Week”. Official Gazette of the Philippines |

Unpacking the SSS Pension Reforms

President Marcos Jr., speaking at the 67th anniversary of the Social Security System (SSS), detailed new programmes designed to improve the financial health of the pension fund and provide more options for its members. A central element of the reforms is a focus on enhancing the fund’s investment returns to ensure its viability for future generations of Filipino workers.

“We are not merely securing the present; we are building a more secure future for all,” President Marcos Jr. stated in his address, according to a transcript released by the Presidential Communications Office (PCO). “These reforms are crucial for the long-term health of the SSS fund.”

The Workers’ Investment and Savings Program (WISP) Plus

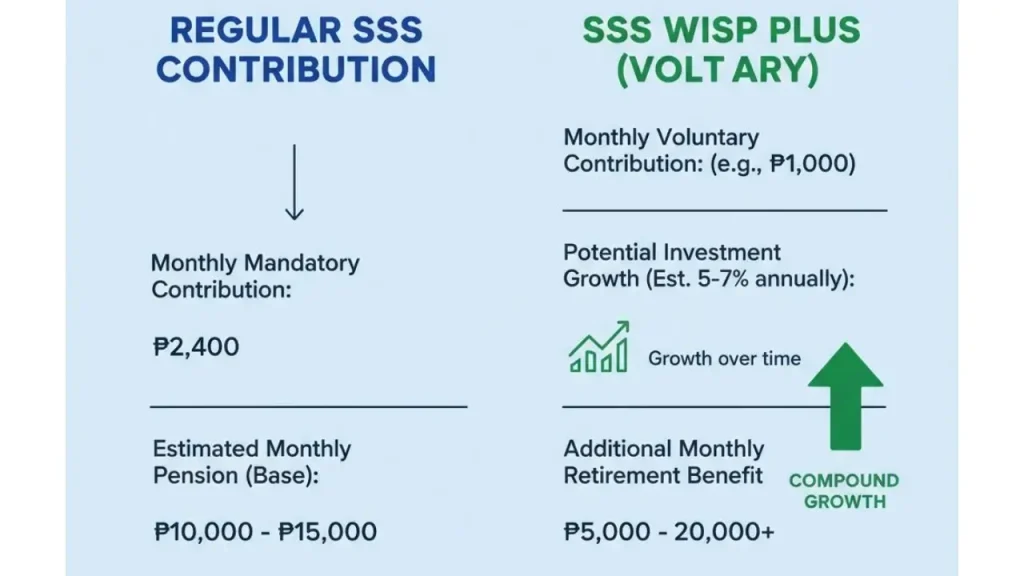

A key component of the new strategy is the full implementation of the Workers’ Investment and Savings Program (WISP) Plus. This initiative functions as a voluntary provident fund, allowing SSS members to contribute additional money towards their retirement, separate from their mandatory contributions.

According to SSS President and CEO Rolando Ledesma Macasaet, the programme provides a new avenue for members to increase their retirement savings through professionally managed investments. It is designed to supplement the standard SSS pension, which has faced questions about its adequacy in covering the rising cost of living.

Consolidation for Financial Relief

The President also highlighted a new loan programme, the Consolidation of Past Due Short-Term Member Loans with Condonation of Penalty. This allows members with unpaid short-term loans to consolidate their debt and pay it back over a longer period with the waiver of all penalties.

Officials hope this programme will bring delinquent accounts back into good standing, thereby improving the SSS’s collection efficiency and providing financial relief to thousands of Filipinos.

A New Week of Honour: National Pensioners’ Week

In a move to recognise the contributions of the country’s retirees, President Marcos Jr. signed Proclamation No. 646, officially designating the last week of September as National Pensioners’ Week. The inaugural celebration is scheduled for 25-30 September.

The proclamation directs the SSS to lead the planning and execution of events and programmes to honour pensioners from both the public and private sectors.

“This is our way of giving back to our pensioners who have spent their productive years contributing to our society and economy,” the President said.

Context and Reaction to the Announcements

These SSS pension reforms arrive amid ongoing discussions about the sustainability of the fund. The SSS reported a fund life of until 2054, but concerns remain about external economic pressures and the need for a potential pension increase to keep pace with inflation.

Ensuring Fund Viability

Economic analysts have pointed out that focusing on investment-driven programmes like WISP Plus, rather than an across-the-board benefit hike, is a fiscally cautious approach. According to a report from the Philippine Institute for Development Studies (PIDS), any increase in pension payouts must be supported by a corresponding increase in contributions or significant investment returns to avoid depleting the fund prematurely.

The current reforms under the PBBM SSS agenda appear to align with this principle, prioritising the fund’s long-term stability.

Voices from Pensioner Groups

Initial reactions from pensioner advocacy groups have been cautiously optimistic. The Coalition of Services for the Elderly (COSE) welcomed the establishment of National Pensioners’ Week as a positive step in recognising seniors’ welfare.

However, some groups continue to advocate for a direct pension increase. In a statement, a representative for one labour coalition noted, “While savings programmes are welcome, we must also address the immediate financial needs of current pensioners who are struggling with today’s prices.”

The government has stated that it is continuously studying the possibility of future pension increases but must balance this with the paramount need to protect the fund’s integrity for the 42 million members who have yet to retire.

₱19,863 SSS Disability Benefit Payout Approved in September 2025: Who will get it? Check Eligibility

Filipino Seniors to Receive ₱11,000 From SSS in 2025; Will you get it? Check Eligibility

SSS Pensioners to Get ₱1,000 Hike from Sept 2025: Status & Payout Guide

FAQs

1. Do the new SSS pension reforms include an immediate increase in monthly pensions?

No, the current announcements do not include an across-the-board increase in monthly pension benefits. The reforms are focused on new savings and investment programmes, like WISP Plus, and a loan consolidation scheme to improve the fund’s long-term health.

2. Who is eligible for the WISP Plus programme?

According to the SSS, all members, regardless of their income level, are eligible to enrol in the WISP Plus programme. It is a voluntary scheme designed to supplement the mandatory retirement fund.

3. What is the purpose of National Pensioners’ Week?

National Pensioners’ Week, established by Proclamation No. 646, is intended to honour and recognise the contributions of millions of Filipino retirees from both the government and private sectors. It is scheduled annually for 25-30 September.