A new proposal urging the government and HM Revenue and Customs (HMRC) to simplify and raise the UK’s Inheritance Tax threshold to £1 million per person is gaining attention. Proponents argue the move would protect more families from being caught by a tax originally intended for the very wealthy, as rising property prices and frozen allowances draw an increasing number of estates into the net.

HMRC Told to Raise Inheritance Tax

| Aspect | Current System (Per Person) | Proposed Change (Per Person) | Potential Impact |

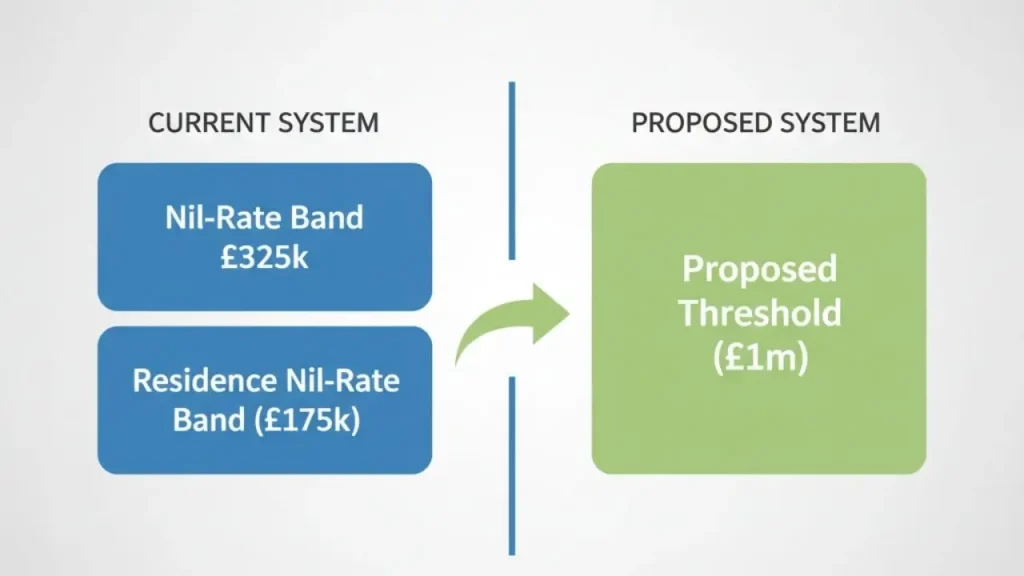

| Standard Allowance | £325,000 (Nil-Rate Band) | A single, flat £1 million threshold | Simplifies a complex two-part system. |

| Property Allowance | Additional £175,000 (if passing a home to direct descendants) | The property-specific allowance would be absorbed. | Removes complex rules about who can inherit a property tax-free. |

| Total for a Couple | Up to £1 million (by combining allowances) | Up to £2 million (by combining allowances) | Significantly increases the value of estates that can be passed on tax-free. |

The Drive to Simplify Inheritance Tax

Pressure is building on the UK government to reform what many critics describe as an overly complex and unpopular tax. A report from the think tank, the Institute for Economic Affairs, is the latest to call for a dramatic simplification, proposing a single Inheritance Tax threshold of £1 million.

Under this proposal, any estate valued below £1 million would be exempt from Inheritance Tax (IHT), regardless of its composition. This would replace the current, more complicated structure.

“The current system is a confusing patchwork of allowances,” stated Dr. Alistair Thompson, a tax policy analyst. “A single, higher threshold would provide clarity for families and eliminate the need for costly estate planning for a significant majority of the population.”

The primary driver behind these calls is a phenomenon known as “fiscal drag.” This occurs when tax thresholds are not increased in line with inflation and asset growth. As house prices and other asset values have risen significantly over the past decade, the frozen IHT allowances have resulted in more estates becoming liable for the tax.

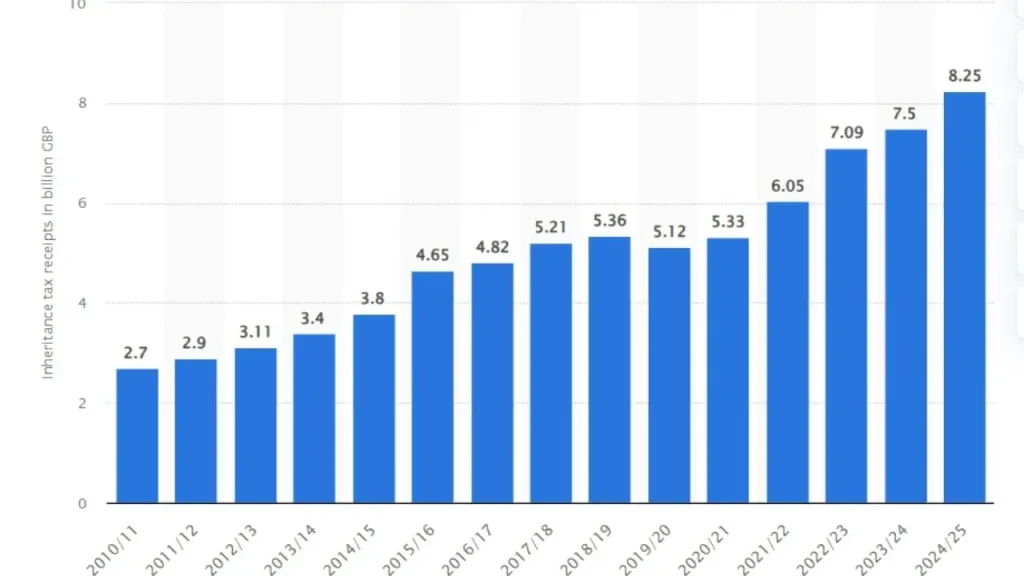

According to HMRC’s latest statistics, IHT receipts reached a record high of £7.5 billion in the 2023-24 tax year, a substantial increase from previous years. This has amplified arguments that the tax is no longer targeting only the wealthiest households as it was initially designed to do.

How the Current IHT System Works

To understand the impact of the proposed change, it is essential to review the current rules managed by HMRC.

The Nil-Rate and Residence Nil-Rate Bands

Every individual currently has a tax-free allowance, known as the nil-rate band (NRB), of £325,000. This amount has been frozen since 2009.

In addition, a Residence Nil-Rate Band (RNRB) of £175,000 is available. However, this extra allowance comes with strict conditions: it can only be used if a main residence is passed on to direct descendants, such as children or grandchildren.

For many, this creates a potential tax-free threshold of £500,000. Married couples and civil partners can share their allowances, allowing them to pass on up to £1 million without incurring IHT. The proposed change would effectively make this £1 million figure the standard allowance for a single individual, doubling the potential tax-free amount for a couple to £2 million.

What a £1 Million Threshold Could Mean for You

The primary beneficiaries of such a policy would be homeowners in regions with high property values, such as London and the South East, whose estates are often pushed over the current threshold purely by the value of their family home.

Impact on Estate Planning

Tax experts suggest a simplified system would fundamentally change estate planning. Currently, many people use complex trusts, gifts, and insurance policies to manage their potential IHT liability. A higher threshold would render these strategies unnecessary for millions of families.

“A £1 million threshold would remove a major source of anxiety for many individuals in their later years,” commented Sarah Jones, a financial planner at a leading wealth management firm. “It would allow people to pass on their assets with more certainty and less administrative burden.”

Economic and Political Debate

While the proposal is popular with many taxpayers, it is not without its critics. Opponents argue that raising the threshold would disproportionately benefit the wealthiest households and lead to a significant loss of tax revenue for the Treasury, which funds public services like the NHS and education.

Analysis from the Resolution Foundation, a think tank focused on living standards, has previously noted that IHT is a progressive tax, with only the largest 4% of estates paying it. Critics argue that cutting it would exacerbate wealth inequality by allowing large fortunes to be passed down untaxed.

The political reaction remains divided. While some factions within the Conservative party have long advocated for IHT reform or abolition, the Labour party has historically argued for maintaining or strengthening taxes on inherited wealth.

The government has not yet issued a formal response to the latest proposals. Any change to the Inheritance Tax threshold would require new legislation to be passed by Parliament, a process that would involve significant debate and scrutiny. For now, the existing rules remain firmly in place.

Households Could Be Due £2,000 From HMRC, But Must Claim Themselves

HMRC Issues Refunds to Thousands of Pensioners — How to Claim Yours Now

Exact Dates Revealed for August 2025 Benefits, Pensions, and Cost of Living Boosts

FAQs

1. What is the current Inheritance Tax threshold?

Currently, each individual has a £325,000 nil-rate band. An additional £175,000 residence nil-rate band may apply if a home is passed to direct descendants, for a potential total of £500,000. A married couple can combine their allowances to pass on up to £1 million.

2. What is the Inheritance Tax rate?

The standard Inheritance Tax rate is 40% on the value of an estate above the tax-free threshold.

3. Who pays Inheritance Tax now?

According to the latest government figures, less than 5% of estates in the UK are liable for Inheritance Tax. However, due to rising property values, this number has been gradually increasing.