The Department for Work and Pensions (DWP) is highlighting an existing financial support measure for those facing urgent expenses, effectively a Universal Credit emergency payment available as an interest-free loan. This Budgeting Advance is designed to help eligible claimants cover significant, one-off costs without resorting to high-cost credit, providing a crucial lifeline for households under financial pressure.

Universal Credit Lifeline

| Key Fact | Detail |

| What It Is | An interest-free loan, known as a Budgeting Advance, repaid via deductions from future Universal Credit payments. GOV.UK |

| Purpose | To help with emergency household costs (e.g., replacing a broken cooker) or one-off expenses (e.g., funeral costs). |

| Eligibility | Must have been on Universal Credit for at least 6 months (unless for a new job) and have earned less than £2,600 in the past 6 months. |

| Loan Amount | Minimum of £100. Up to £348 (single), £464 (couple), or £812 (with children). |

Understanding the DWP Support Mechanism

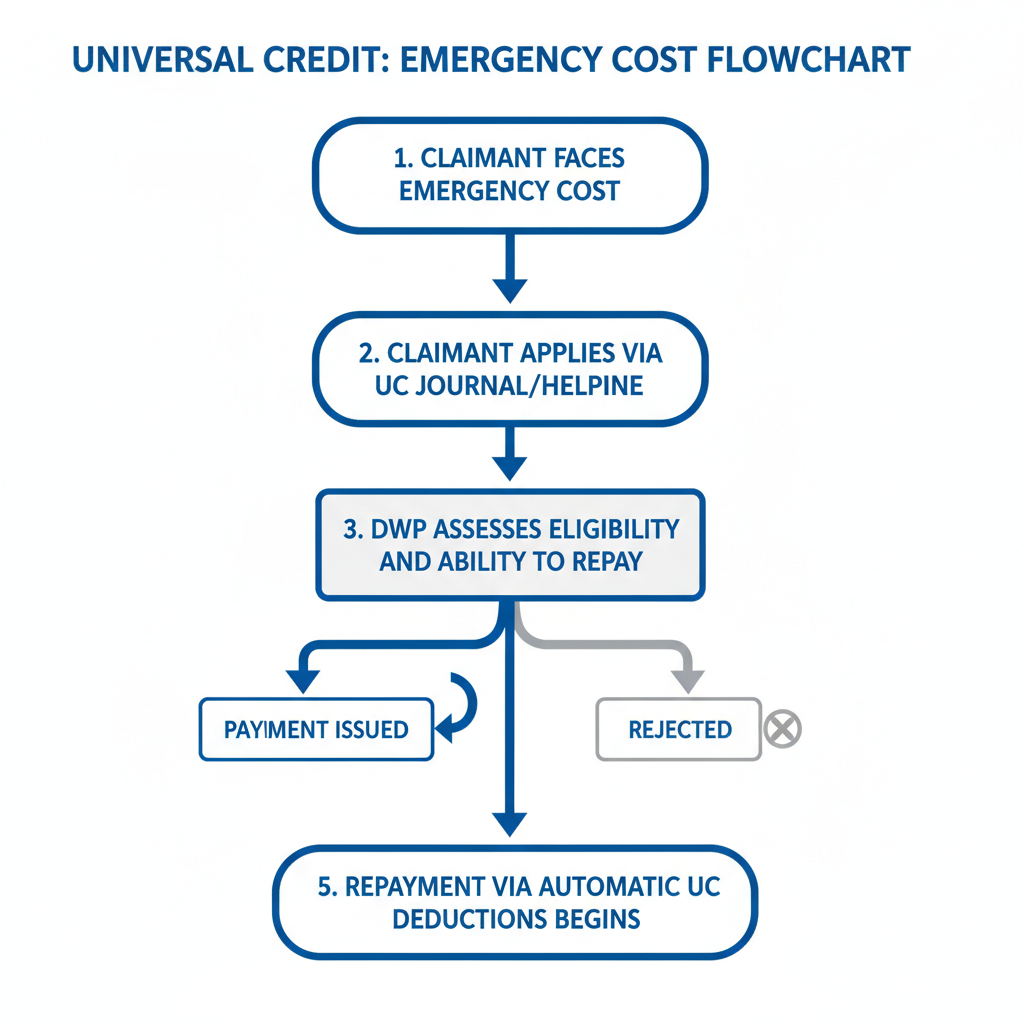

The financial provision, officially termed a ‘Budgeting Advance’, is not a new grant but an established component of the DWP support system. It functions as an advance on future Universal Credit payments. The government has reiterated its availability as a key tool to “protect” vulnerable claimants from financial shocks.

Officials state the advance is intended to cover essential, unforeseen expenses. These can include costs related to starting a new job, funeral expenses, or the urgent need to repair or replace essential household items like a refrigerator or boiler. The DWP stresses that this support is designed to prevent individuals from turning to high-interest payday loans or other forms of unsustainable debt.

“We are committed to ensuring that people can get the support they need when they need it most,” a DWP spokesperson stated in a recent press release. “The Budgeting Advance provides a vital safety net, allowing people to manage unexpected costs without incurring interest.”

Eligibility and Repayment Conditions

To qualify for a Universal Credit emergency payment, claimants must meet specific criteria. An individual must have been receiving Universal Credit, employment and support allowance, income support, jobseeker’s allowance, or pension credit for six months or longer, unless the money is required to help them start a new job or keep an existing one.

Crucially, applicants must also have earned less than £2,600 (£3,600 for couples) in the six-month period prior to their application. The DWP assesses each application based on the claimant’s ability to repay the loan.

The advance is repaid through automatic deductions from monthly Universal Credit payments over a period of up to 12 months. The size of these deductions is calculated based on the total amount borrowed and the claimant’s overall benefit award, ensuring repayments are manageable.

Context: A Lifeline Amid Rising Cost of Living

The renewed focus on this emergency fund comes as UK households continue to navigate significant cost of living pressures. Inflation, while having eased from its peak, remains a concern for low-income families, with the cost of food and essential services still high, according to the latest figures from the Office for National Statistics (ONS).

Charities and financial advisory services have reported a sustained increase in requests for help from benefit claimants struggling to cover basic expenses. For many, an unexpected bill for a broken appliance or a sudden travel requirement can precipitate a financial crisis.

Dr. Mark Johnson, an economist at the Centre for Social Policy, commented, “While the availability of interest-free credit is positive, the fact that it is a loan is critical. For households already on a financial knife-edge, any reduction in their future monthly income, even a small one, can have a significant impact. It’s a temporary fix, not a solution to underlying income inadequacy.”

Perspectives from Advocacy Groups

While the DWP presents the advance as a protective measure, some advocacy organisations have raised concerns about the reliance on loans rather than grants for those in desperate need. Organisations such as Citizens Advice have long highlighted the issue of benefit deductions pushing people further into hardship.

In a report published earlier this year, the Joseph Rowntree Foundation (JRF) argued that the social security system should provide a stronger safety net that does not require individuals to take on debt to meet essential needs.

“A loan is still a debt,” said a JRF policy advisor. “When a family’s cooker breaks, they need a grant to replace it, not a loan that will mean they have to cut back on food or heating for the next twelve months to pay it back. The government should be looking at the adequacy of benefit levels as the root cause of these financial emergencies.”

The DWP maintains that its approach balances providing immediate help with ensuring the long-term sustainability of the welfare system. Claimants who are not eligible for a Budgeting Advance may be able to apply for a Hardship Payment if their benefits have been sanctioned, although this also typically requires repayment.

PIP Review Status for Carers and Veterans Updated by DWP

State Pensioners Issued Warning Over £10,000 Savings Rule by DWP

MPs Warn DWP That Universal Credit Sanctions Weaken Jobcentre Support

FAQs

1. Is the Universal Credit emergency payment a grant or a loan?

It is a loan, not a grant. The full amount of the Budgeting Advance must be paid back through deductions from your future Universal Credit payments.

2. How quickly is the money paid if my application is successful?

While there is no guaranteed timescale, the DWP aims to process applications and make payments as quickly as possible, especially in emergency situations. The decision is typically made on the same day you apply.

3. What can I do if I am not eligible for a Budgeting Advance?

If you are not eligible, you can contact your local council to see if they offer a Local Welfare Assistance scheme. You can also seek guidance from independent advisory organisations like Citizens Advice or Step Change Debt Charity.

4. Does the Budgeting Advance affect my credit score? No, applying for and receiving a Budgeting Advance does not affect your credit score. It is a government loan scheme managed entirely within the social security system.