The Singapore government has announced a new support measure aimed at alleviating cost-of-living pressures for its older residents. As part of the Budget 2025 initiatives, a Singapore $1,080 payment for senior citizens will be disbursed in three stages throughout the year to eligible individuals. The measure is designed to provide targeted financial assistance to lower- and middle-income seniors amid persistent inflation.

Singapore $1,080 Payment for Senior Citizens in 2025

| Key Detail | Information |

| Total Payout | S$1,080 per eligible senior. Ministry of Finance |

| Eligibility (Age) | Singapore Citizens born on or before 31 Dec 1965 |

| Disbursement Dates | May 2025, August 2025, November 2025 |

| How to Receive | Automatic crediting via PayNow-NRIC |

Details of the Senior Support Package 2025

The payout, officially termed the “Senior Support Package (SSP) 2025,” will be distributed in three equal payments of $360 each. This staggered disbursement is intended to provide sustained support over the second half of the year, according to a press release from the Ministry of Finance (MOF).

The government has allocated an estimated S$1.2 billion for the programme, which is expected to benefit approximately 1.1 million senior citizens. “This package is a crucial part of our ongoing commitment to honour and support our pioneers and Merdeka Generation seniors,” said Finance Minister Lawrence Wong in a statement accompanying the budget announcement. “It provides immediate relief while we continue to invest in long-term healthcare and social support systems.”

Who Qualifies for the Singapore $1,080 Payment for Senior Citizens?

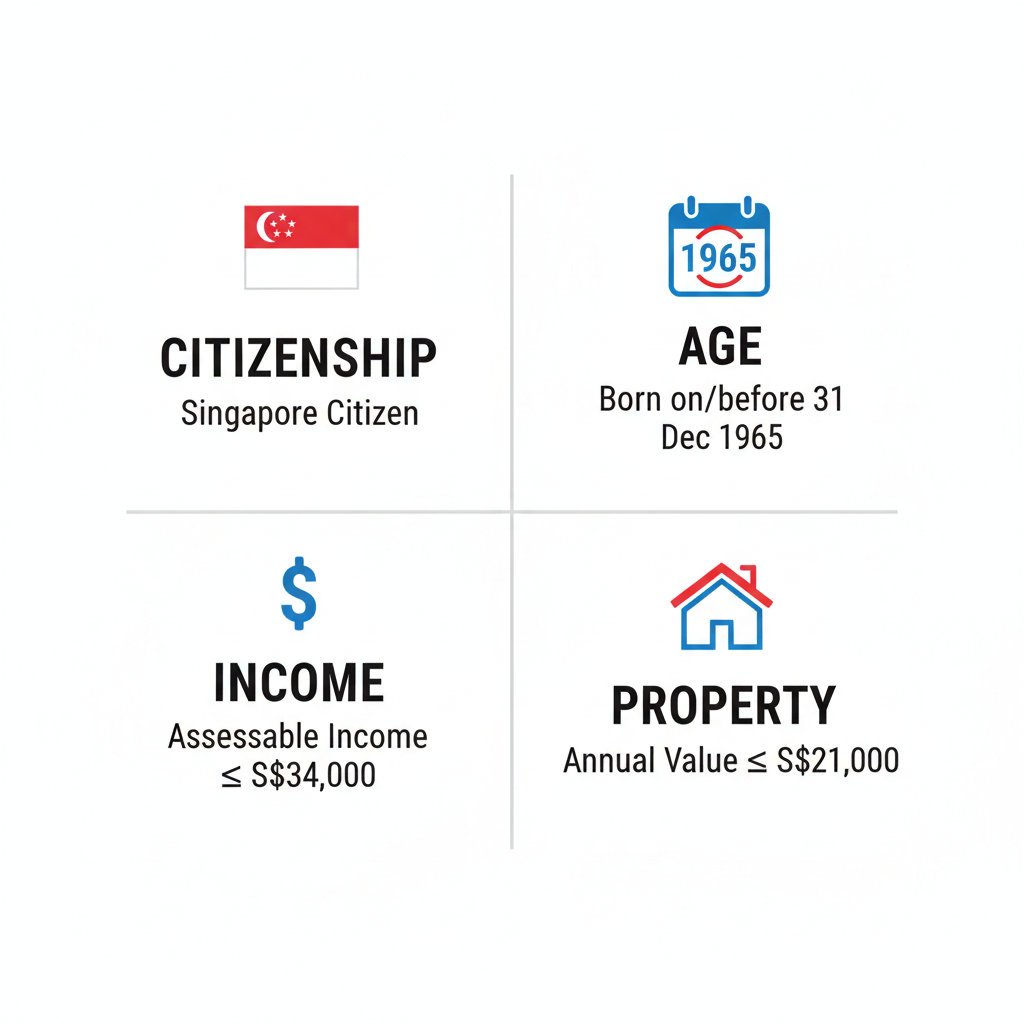

Eligibility for the SSP 2025 is automatic for those who meet a specific set of criteria based on age, citizenship, income, and property ownership. The government has stressed that no application is necessary, a move designed to streamline the process and prevent scams.

Citizenship and Age Requirements

To be eligible, an individual must be a Singapore Citizen as of 31 December 2024. The age criterion requires that the individual be born on or before 31 December 1965, meaning they will be 60 years of age or older in 2025.

Income and Property Value Thresholds

The payment is targeted at lower- and middle-income groups. The following financial criteria must be met:

- Assessable Income (AI): The individual’s Assessable Income for the Year of Assessment 2024 must not exceed S$34,000. This information is based on tax filings with the Inland Revenue Authority of Singapore (IRAS).

- Annual Value (AV) of Residence: The Annual Value of their primary residence must not exceed S$21,000. The AV is the estimated gross annual rent of the property if it were to be rented out, and this criterion excludes those living in higher-value private properties.

Payment Schedule and Disbursement

The MOF has confirmed the payment schedule to ensure timely assistance. The three tranches of S$360 will be paid out on the following dates:

- First Payment: 28 May 2025

- Second Payment: 15 August 2025

- Third Payment: 20 November 2025

The default and quickest method of payment will be via PayNow linked to an individual’s National Registration Identity Card (NRIC). The government encourages all eligible seniors to link their NRIC to PayNow with a participating bank by early May 2025 to ensure swift receipt of the funds.

For those without a PayNow-NRIC linkage, the payment will be credited directly to the bank account used for previous government payouts. Individuals who have not provided a bank account will be able to withdraw their payment in cash from government service centres using the GovCash service.

Economic Context and Expert Analysis

The announcement of this 2025 government payout comes as Singapore, like many nations, continues to grapple with elevated inflation and a higher cost of living. The SSP 2025 is part of a broader suite of measures in the budget, including enhancements to the permanent GST Voucher (GSTV) scheme and the Assurance Package.

Dr. Kelvin Tan, a senior lecturer in economics at the National University of Singapore, commented on the measure. “The targeted nature of the payment, using income and property value as proxies, ensures that the support is channelled to those who need it most,” Dr. Tan said. “While one-off payments provide welcome relief, the long-term challenge remains in ensuring our social safety nets are robust enough to handle the demographic shift of an ageing population.”

The government will begin sending letters to all eligible citizens from late April 2025, informing them of their eligibility and the payment details. Officials advise the public to be wary of phishing scams and to only refer to official government websites, such as the Gov.sg portal, for information regarding the payout.

Millions of UK Drivers Could Receive £950 Payouts as Car Finance Mis-selling

UK Income Support Rates 2025: Check September Rates, Date & Amount

FAQs

1. How do I check my eligibility for the senior payment?

Official eligibility status can be checked by logging into the government’s official support scheme portal using your Singpass from April 2025. You will also receive a letter by post.

2. Do I need to apply for the S$1,080 payment?

No, application is not required. The payment is automatic for all citizens who meet the age, income, and property value criteria.

3. What if I do not have a PayNow-NRIC linked bank account?

If you do not have a PayNow-NRIC linkage, the funds will be credited to the bank account you have on record from previous government payouts. If no bank account is available, you can withdraw the funds via GovCash.

4. Is this payment taxable? No, the S$1,080 Senior Support Package payment is not considered taxable income.