The Singapore government has announced a new Cost-of-Living Support Package for 2025, which includes a cash payout of up to S$1,300 for eligible citizens. The measures, unveiled by the Ministry of Finance (MOF), are designed to provide financial relief to households amid persistent global inflation and rising domestic expenses. Payments are scheduled to be disbursed primarily in June 2025.

Singapore $1300 Government Payout Soon in 2025

| Key Component | Details |

| Maximum Payout | S$1,300 per eligible Singapore Citizen. Ministry of Finance |

| Primary Eligibility | Singapore Citizens aged 21 and above in 2025, with Assessable Income not exceeding S$100,000 for YA2024. |

| Main Payment Date | June 2025 |

| Application Process | Automatic for most; no application required. Gov.sg Portal |

Government Addresses Rising Costs with New Support Measures

The 2025 support package aims to directly address the financial pressures faced by Singaporean families. In a press statement released on Thursday, Deputy Prime Minister and Minister for Finance, Lawrence Wong, stated the government’s commitment to assisting citizens.

“We understand the concerns of Singaporeans regarding the higher cost of living,” Minister Wong said. “This targeted Cost-of-Living Support Package is designed to provide meaningful relief to households, particularly for lower- and middle-income families, while we continue to focus on long-term economic stability.”

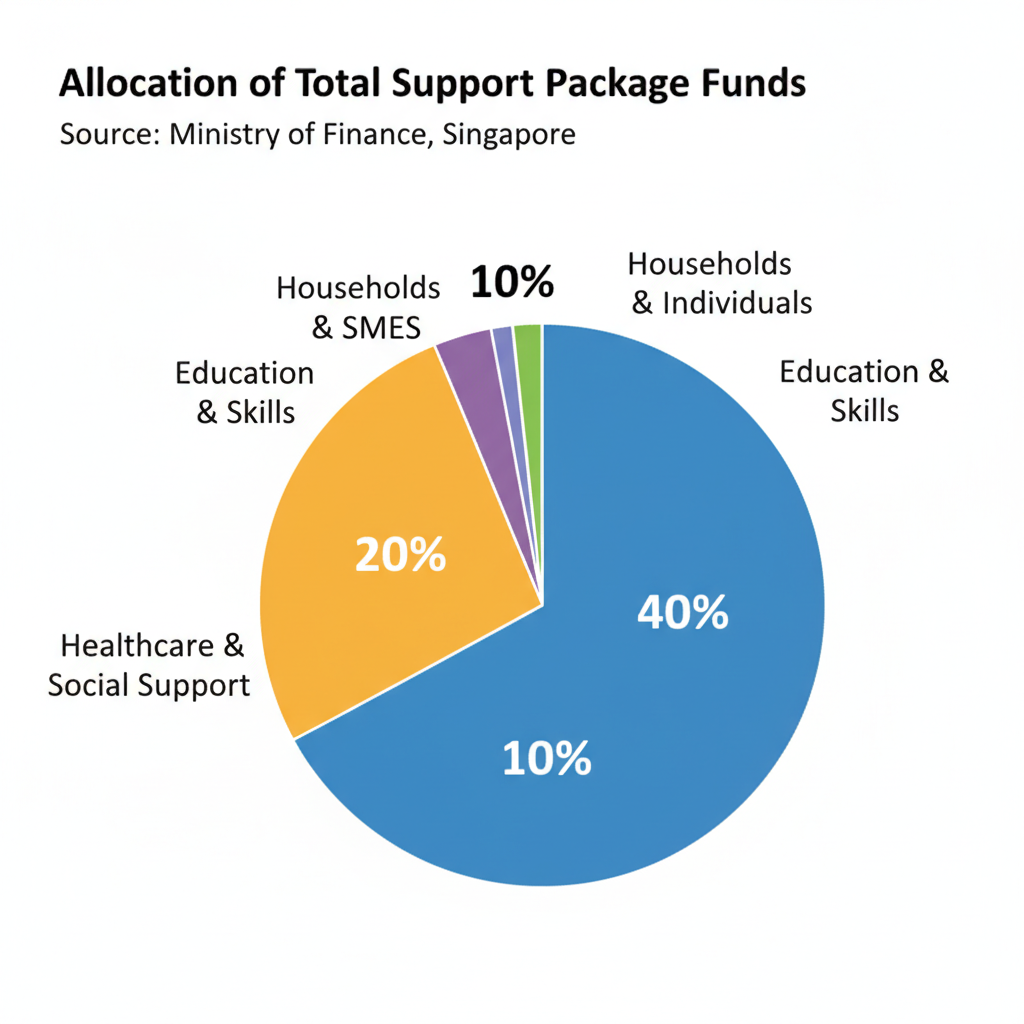

The package is the latest in a series of government interventions following a period of heightened global economic uncertainty and supply chain disruptions. It builds upon previous initiatives like the Assurance Package, aiming to offset the impact of the Goods and Services Tax (GST) increase and general inflation.

Who is Eligible for the Payout?

Eligibility for the full benefits of the support package is based on several criteria. The MOF has emphasised that the support is tiered to ensure that more help is directed to those who need it most.

Citizenship and Age

To qualify, individuals must be Singapore Citizens aged 21 or older in the calendar year 2025. This is a standard requirement for most government support schemes.

Income and Property Ownership Criteria

The amount of the payout is determined by two key financial indicators:

- Assessable Income (AI): Individuals must have an AI of no more than S$100,000 for the Year of Assessment 2024. This information is based on tax filings with the Inland Revenue Authority of Singapore (IRAS).

- Property Ownership: The MOF has stated that individuals who own more than one property will not be eligible for the cash component of the package.

The ministry advises citizens to check their eligibility details through the official Singpass application.

Payment Dates and Distribution Details

The primary cash component of the Cost-of-Living Support Package is scheduled for disbursement in June 2025. The government strongly encourages all eligible citizens to link their NRIC to PayNow, as this will be the default and fastest method for receiving the payment.

According to the MOF, citizens who have not linked their NRIC to PayNow but have previously provided their bank account details for other government schemes will receive the payout via direct bank transfer. Those without these arrangements will receive cheques mailed to their NRIC-registered address, which may result in a longer processing time.

Beyond the cash payout, the package will also include other forms of assistance, such as additional Community Development Council (CDC) Vouchers and U-Save rebates to help with utility bills, which will be distributed throughout the second half of 2025.

Economic Context and Expert Analysis

Economists suggest that such government payouts provide a necessary, short-term cushion for households. Dr. Kelvin Tan, a senior economics lecturer at the National University of Singapore (NUS), commented on the measure.

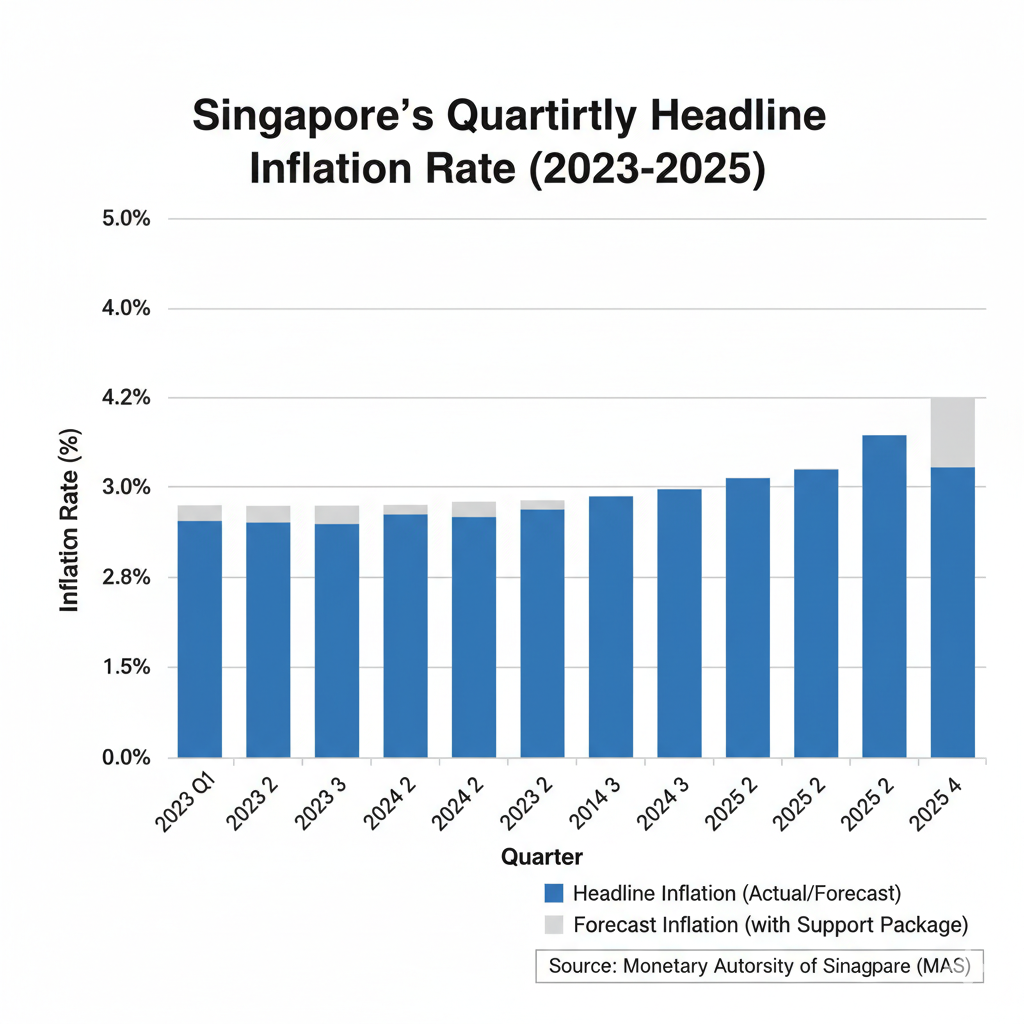

“Direct cash transfers are an effective tool for immediate relief, helping families manage their daily expenses without delay,” Dr. Tan explained. “However, the key challenge for policymakers is to balance this support with broader inflationary pressures. The targeted nature of this package, based on income and property ownership, is a prudent approach to mitigate its inflationary impact.”

The government has indicated that it will continue to monitor economic conditions closely. Officials have not ruled out further support measures if global economic headwinds persist or if inflation does not moderate as projected in the coming year. Citizens are advised to rely on official government websites for the latest and most accurate information.

DWP Confirms Thousands Will Miss Out on £300 Winter Fuel Payment

FAQs

1. Do I need to apply for the Singapore government payout?

No. For the vast majority of eligible Singaporeans, the payout is automatic. Your eligibility will be assessed based on government records from agencies like IRAS.

2. What if I do not have a PayNow-NRIC linked account?

If you have previously received government payouts, the payment will be credited to the bank account you registered. If not, you will receive a cheque by mail, which will take longer. To ensure swift payment, linking your NRIC to PayNow is recommended.

3. Is the S$1,300 payout taxable?

No. Government support payments and cost-of-living assistance of this nature are not considered taxable income.

4. How is my Assessable Income (AI) determined for eligibility?

Your AI is based on your tax declaration to IRAS for the Year of Assessment 2024 (reflecting income earned in 2023).