The government has announced the launch of the Calamity Loan Program 2025, a new financial assistance scheme designed to support individuals and small businesses in regions recently affected by natural disasters. Applications are set to open in October, providing a critical channel for recovery funds following a series of devastating floods and wildfires.

Calamity Loan Program 2025

| Feature | Details |

| Loan Purpose | Home repairs, business recovery, and agricultural losses, NDMA Official |

| Interest Rate | Fixed at 1.5% per annum |

| Application Opens | 1 October 2025 |

| Maximum Loan Amount | Up to ₹5 lakh for individuals; up to ₹25 lakh for small businesses |

What is the Calamity Loan Program 2025?

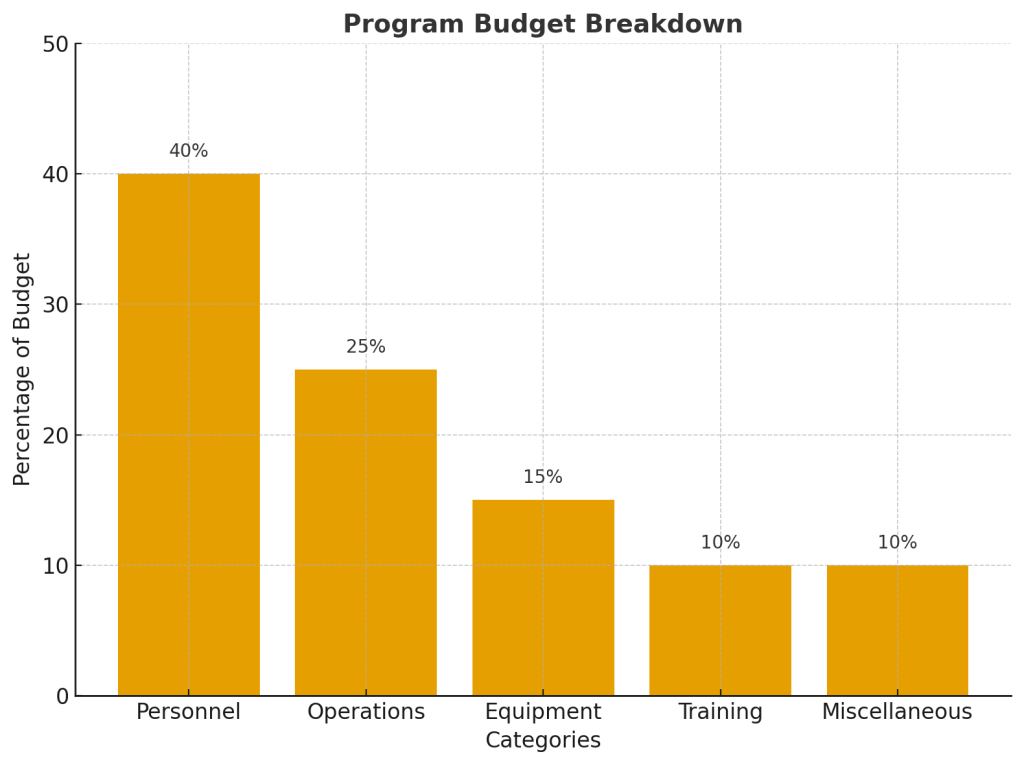

The Calamity Loan Program 2025 is a government initiative managed by the National Disaster Management Agency (NDMA). It aims to provide low-interest, accessible loans to citizens whose homes or livelihoods have been severely impacted by events in officially declared disaster zones. The program has been allocated a preliminary budget of ₹50 billion, according to the Ministry of Finance.

“This program is a crucial lifeline for families and entrepreneurs struggling to rebuild,” said Priya Singh, Director-General of the NDMA, in a statement released Thursday. “Our focus is on providing swift, accessible, and meaningful government financial aid to those who need it most.”

The loans are intended to cover costs not met by insurance or other forms of aid, such as structural home repairs, replacement of essential business equipment, and replenishment of lost agricultural stock.

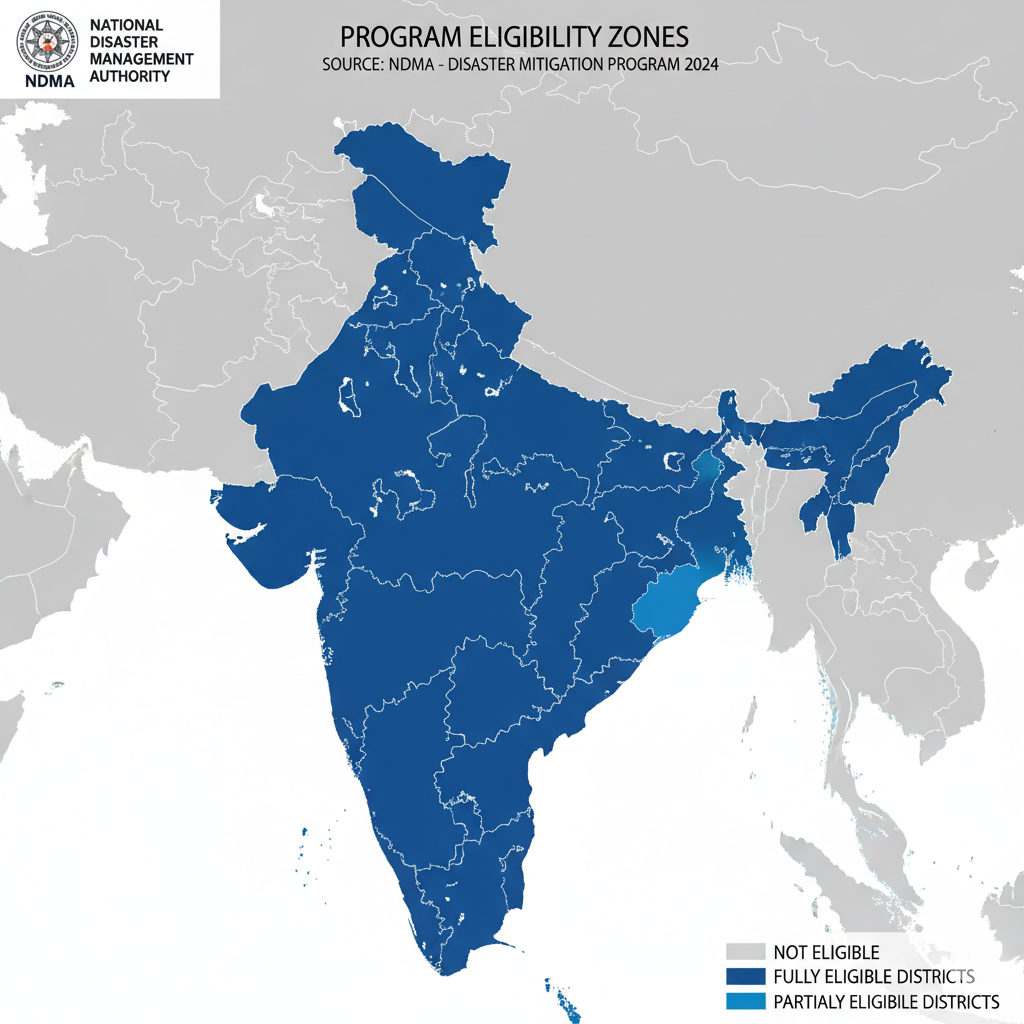

Who is Eligible for the Disaster Relief Financing?

Officials have outlined specific loan eligibility criteria for different applicants to ensure the aid is distributed effectively. All applicants must reside or operate within a postcode officially designated as a disaster area by the government.

Eligibility for Individuals and Homeowners

To qualify, individuals must provide proof of property ownership or primary residence in an affected area. They must also demonstrate that their property sustained significant damage directly attributable to the disaster. While there is no strict income ceiling, priority may be given to low and middle-income households, according to documents released by the agency.

Criteria for Small Businesses

Small and medium-sized enterprises (SMEs) with fewer than 50 employees are eligible to apply. Business owners must submit documentation proving a minimum of 25% revenue loss following the disaster. They will also need to provide records showing their business was operational for at least one year prior to the calamitous event.

Loan Amounts, Terms, and How to Apply

The program offers different loan structures based on the applicant’s needs. Understanding these terms is crucial for anyone seeking this government financial aid.

Loan Limits and Repayment

For individuals, loans are capped at ₹5 lakh, intended for rebuilding homes and replacing essential belongings. Small businesses can apply for up to ₹25 lakh to aid in operational recovery. All loans under the scheme feature a fixed interest rate of 1.5% with a repayment period of up to 10 years. A one-year moratorium on payments will be offered to all successful applicants to provide immediate

The Application Process

Applications will be accepted exclusively through a dedicated online portal, which is scheduled to go live on 1 October 2025. The deadline for submissions is 15 December 2025. The NDMA stated that the process will involve four key steps:

- Online Submission: Applicants will fill out a form and upload required documents.

- Initial Verification: An automated system will check for completeness and basic eligibility.

- Damage Assessment: A field officer may conduct an on-site inspection to verify the extent of the damage claimed.

- Final Approval and Disbursement: Funds are expected to be disbursed directly to the applicant’s bank account within 30 days of final approval.

Expert Analysis and Potential Hurdles

While the program has been widely welcomed, economic analysts caution that implementation will be key to its success. The main challenge lies in balancing rapid fund distribution with the necessary checks to prevent fraud.

“The challenge with any such program is balancing speed with due diligence,” said Dr. Alistair Finch, an economist at the Centre for Economic Policy Research. “The loan eligibility criteria must be clear to prevent fraud while ensuring aid reaches the intended recipients without bureaucratic delays.”

Concerns have also been raised about the capacity of the online portal to handle the expected high volume of traffic and the potential for administrative backlogs in processing applications. The NDMA has assured the public that it has invested in robust digital infrastructure to manage the process smoothly. For many, like shop owner Ravi Kumar whose business was flooded last month, the program offers a glimmer of hope. “We lost everything,” he said. “A loan like this could be the difference between reopening our doors and shutting down for good.”

Odisha Gold Loan Scam EXPOSED: ₹24 Lakh Fraud Involving Fake Gold Rocks Banking Sector

FAQs

1. Can I apply for the Calamity Loan Program 2025 if I have already received an insurance payout?

Yes, you can still apply. However, the loan is intended to cover expenses not covered by your insurance settlement. You will need to provide details of your insurance claim during the application.

2. What are the primary documents required for the application?

Individuals will typically need proof of identity, proof of residence, property ownership documents, and evidence of damage (e.g., photos, repair estimates). Businesses will need their registration documents, tax returns, and records demonstrating financial loss.

3. How long will it take to receive the funds after applying?

The NDMA aims to disburse funds within 30 days of final application approval. However, the timeline may vary depending on the complexity of the case and the volume of applications.