The Singapore government will continue to offer a significant financial support package for parents of newborns in 2025, aimed at encouraging parenthood and mitigating the nation’s low birth rate. The multi-layered Singapore Child Bonus 2025 combines cash gifts and grants that can exceed S$16,000 for a first child, provided through the enhanced Baby Bonus Scheme.

Singapore Child Bonus 2025

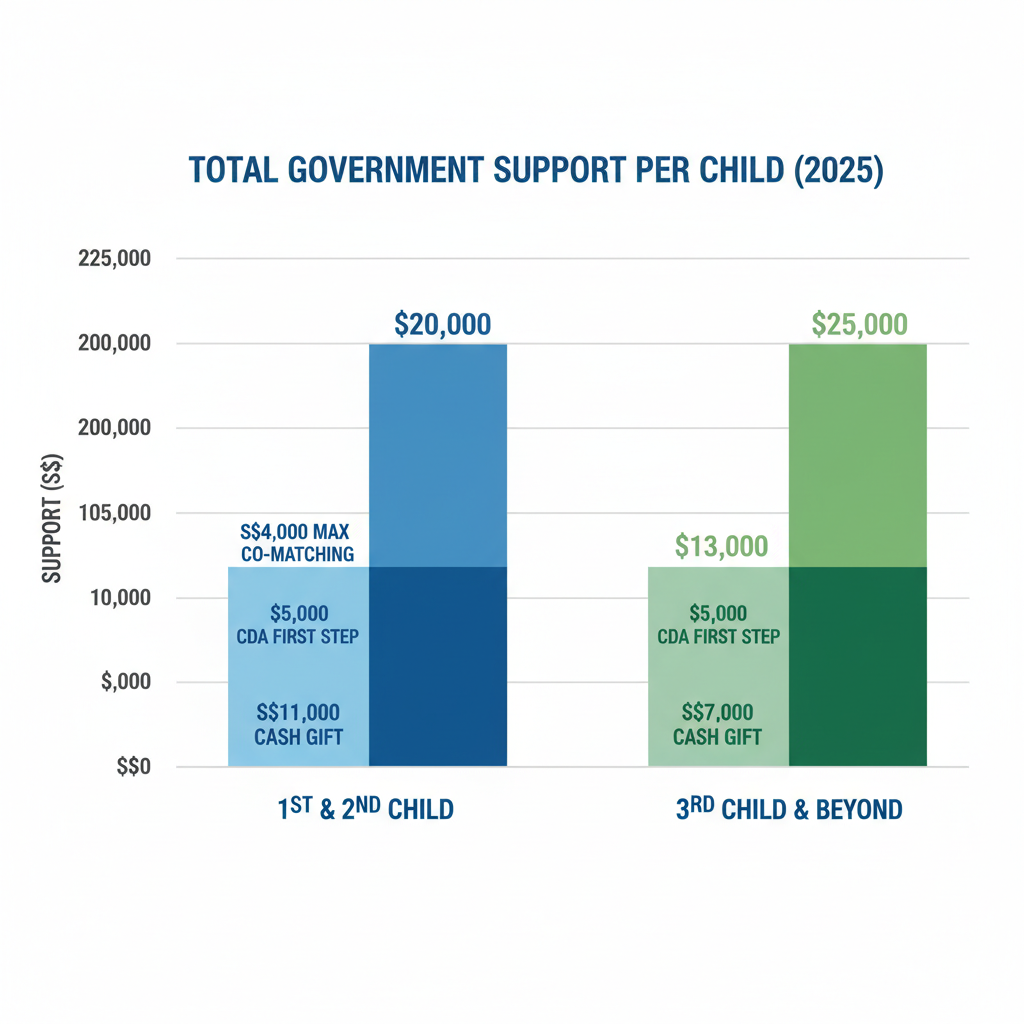

| Component | Amount for 1st/2nd Child | Amount for 3rd/Subsequent Child |

| Baby Bonus Cash Gift | S$11,000 | S$13,000, Made for Families |

| CDA First Step Grant | S$5,000 | S$5,000 |

| Max. Govt Co-Matching | S$4,000 | S$7,000 |

| Total Potential Support | Up to S$20,000 | Up to S$25,000 |

Understanding the Singapore Child Bonus 2025 Eligibility

To qualify for the full suite of benefits, including the cash gift and Child Development Account grants, several key criteria must be met. The scheme is designed to primarily support families with Singaporean citizenship.

Core Eligibility Requirements:

- Child’s Citizenship: The child must be a Singapore Citizen at birth. If the child is not a citizen at birth but becomes one later, they may qualify for benefits from the point of citizenship.

- Parents’ Marital Status: The child’s parents must be lawfully married. However, children of single parents may still qualify for the Child Development Account (CDA) benefits, including the S$5,000 First Step Grant and government co-matching, according to the Ministry of Social and Family Development (MSF).

The enhanced benefits, announced in Singapore’s Budget 2023, apply to all eligible children born on or after 14 February 2023. This policy is expected to remain in place for children born throughout 2025.

How the Enhanced Support Package is Structured

The government support is not a single lump-sum payment. It is divided into two main components: a direct cash gift paid out over time and funds deposited into a special savings account for the child.

The Baby Bonus Cash Gift

This component is disbursed in five instalments over the child’s first 18 months. The structure is intended to assist parents with recurring expenses during the crucial early stages of a child’s life. According to the Made for Families portal, payouts are scheduled as follows:

- At 7-10 working days after birth registration: S$3,000

- At 6 months of age: S$1,500

- At 12 months of age: S$1,500

- At 15 months of age: S$1,000

- At 18 months of age: S$1,000

The total cash gift is S11,000forthefirstandsecondchildandincreasestoS13,000 for the third child and any subsequent children.

The Child Development Account (CDA)

The CDA is a special savings account that can be used for the child’s educational and healthcare expenses at approved institutions. The government’s contribution consists of two parts:

- First Step Grant: An initial S$5,000 is automatically deposited into the child’s CDA without any initial deposit from the parents.

- Dollar-for-Dollar Co-Matching: The government matches every dollar parents deposit into the CDA, up to a specified cap. This cap is S4,000forthefirstchildandS7,000 for the third and subsequent children.

This co-matching system effectively doubles parental savings for their child’s future needs, providing a powerful incentive for long-term financial planning.

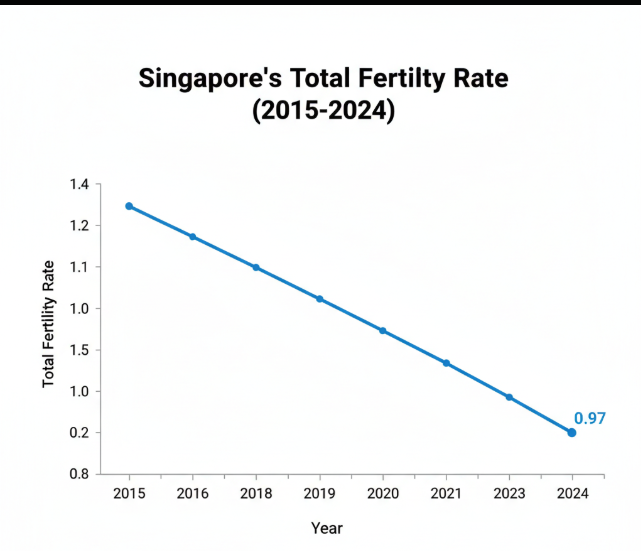

Context: A National Strategy to Address Demographic Headwinds

The generous support package is a core part of Singapore’s long-term strategy to tackle its persistently low total fertility rate (TFR). In 2023, Singapore’s TFR fell below 1.0 for the first time in its history, reaching a record low of 0.97, as reported by the National Population and Talent Division (NPTD). This figure is significantly below the replacement rate of 2.1 needed to maintain a stable population.

“We hope that this and other government support for parents will help to lighten their financial loads and provide a conducive environment for them to start and raise families,” said Indranee Rajah, Minister in the Prime Minister’s Office, in a statement regarding family support measures.

Experts note that while financial incentives can alleviate the cost of raising children, they are part of a broader set of solutions. Dr. Tan Poh Lin, an assistant professor at the Lee Kuan Yew School of Public Policy, has previously commented that addressing societal pressures, workplace culture, and childcare accessibility are also critical factors in influencing family planning decisions.

How to Apply for the Benefits

The application process has been streamlined for parents. Families can join the Baby Bonus Scheme as part of the birth registration process. This can be done online through the LifeSG application or website.

Once the child’s birth is registered, the cash gift is processed automatically, and parents will receive instructions on how to open a CDA with one of the local banks (DBS/POSB, OCBC, or UOB).

The ongoing enhancements and government focus underscore the policy’s importance. As Singapore continues to face its demographic reality, the support framework for new parents is likely to remain a central pillar of its national agenda, with potential reviews in future government budgets to ensure its effectiveness.

DWP Confirms £628 Monthly Payment for One Group – Check If You Qualify

FAQs

1. What is the total cash amount a first-time parent can expect in 2025?

For a first child, a parent can receive S11,000 in a direct cash gift and an additional S5,000 in the CDA as a grant. By saving S4,000 in to the CDA, they can unlock another S4,000 from the government, bringing the total potential support to S$20,000.

2. Are single parents eligible for the Singapore Child Bonus 2025?

Single parents are not eligible for the Baby Bonus Cash Gift. However, their Singaporean child is eligible for the CDA benefits, which include the S$5,000 First Step Grant and the government’s dollar-for-dollar co-matching.

3. How can the funds in the Child Development Account (CDA) be used?

CDA funds can be used to pay for expenses at Approved Institutions (AIs). These include school fees at registered kindergartens and special education schools, medical expenses at healthcare institutions, and approved assistive technology devices.

4. When do CDA benefits end?

The CDA remains open until 31 December of the year the child turns 12. Any remaining funds can then be transferred to the child’s Post-Secondary Education Account (PSEA).