A debate over UK tax policy has intensified as the Conservative Party claims Labour’s fiscal plans could leave average workers nearly £900 worse off. The accusation centres on the policy of freezing National Insurance thresholds, a move critics label a “stealth tax.” Labour has firmly pledged not to raise the headline rates of key taxes, but its position on thresholds remains a key point of contention.

Tax Debate

| Claim/Fact | Details |

| The “Stealth Tax” Claim | Conservatives argue that by not raising tax thresholds with inflation, Rachel Reeves’ National Insurance policy will cost an average earner an extra £899 by 2028-29. |

| Labour’s Core Pledge | Labour has guaranteed it will not increase the rates of National Insurance, income tax, or VAT. |

| The Economic Mechanism | The effect, known as fiscal drag, occurs when wage growth pulls more people into paying tax or pushes them into higher brackets as tax-free thresholds remain static. |

| Current Government Policy | Tax thresholds are already frozen by the current Conservative government until April 2028, a policy that is currently raising significant revenue for the Treasury. |

The Heart of the Dispute: Frozen Tax Thresholds

The core of the issue lies not with the percentage rate of National Insurance (NI) but with the income levels, or thresholds, at which people start paying it. The Conservative Party has put forward analysis suggesting that if Labour keeps the current freeze on these thresholds in place, the effect of wage inflation will significantly increase the tax burden on working people.

This phenomenon is known as fiscal drag. As wages rise to keep up with the cost of living, a frozen tax-free allowance means a larger portion of an individual’s salary becomes subject to tax. Economists at the Institute for Fiscal Studies (IFS) have repeatedly highlighted that this is a powerful, if subtle, way for governments to increase tax revenue without announcing explicit rate hikes.

“Threshold freezes are a stealthy way of raising taxes,” said Paul Johnson, Director of the IFS, in a recent analysis. “They are less transparent than rate increases, but they can raise very large sums of money from taxpayers.” The current freeze on income tax and NI thresholds was introduced by the Conservatives and is projected by the Office for Budget Responsibility (OBR) to be a major source of government revenue over the next few years.

Labour’s Position on Rachel Reeves’ National Insurance Policy

In response to the accusations, the Labour Party has reiterated its central fiscal promise. Shadow Chancellor Rachel Reeves has repeatedly stated that a government she leads would not increase the rates of income tax, National Insurance, or VAT. This pledge is designed to provide stability and reassurance to households and businesses.

However, Labour has not committed to unfreezing the tax thresholds, stating it cannot make unfunded spending or tax-cut commitments. “I have been very clear that I will not make any commitment where I can’t say where the money is coming from,” Reeves told the BBC. This stance reflects the party’s cautious approach to Labour Party economics, aiming to project fiscal responsibility. The party argues it needs to assess the full state of the public finances before finalising detailed plans on thresholds.

Independent Analysis and Broader Economic Context

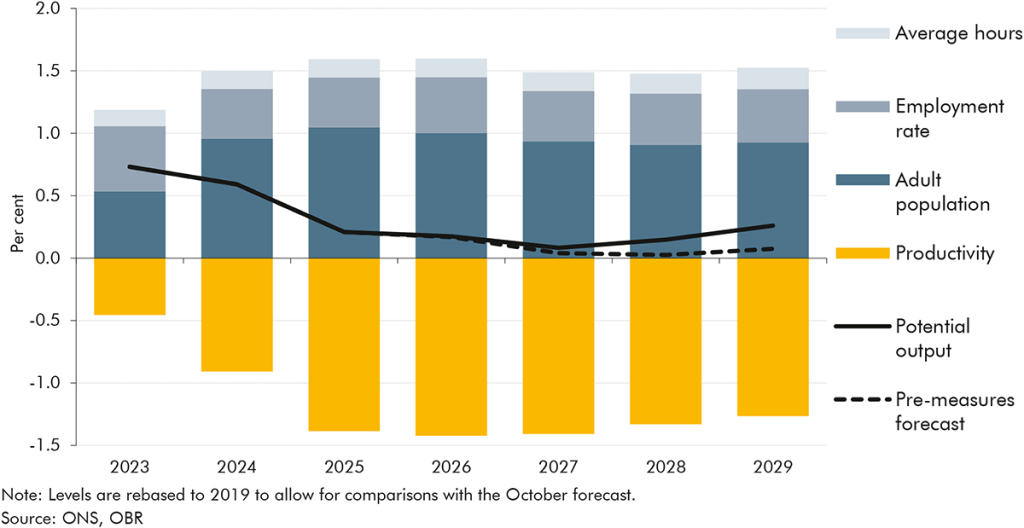

Independent bodies confirm that fiscal drag is a significant factor in the UK’s current tax landscape. According to the OBR, the ongoing freeze on personal tax thresholds is expected to create 3.2 million new income taxpayers and pull 2.6 million people into the higher rate of tax by 2028–29. This is a continuation of a policy enacted by the current government.

The debate, therefore, is not about a new tax being introduced by Labour but about whether the party would continue a policy set by the Conservatives. The IFS notes that any government will face a difficult choice: unfreezing the thresholds would provide relief to households but would also create a substantial hole in the public finances that would need to be filled by other means, such as spending cuts or different tax rises.

The Conservative government has itself cut the main rate of National Insurance twice in the last year, arguing this offsets the impact of frozen thresholds. Their long-term stated ambition is to abolish employee NI contributions entirely. Labour has criticised this plan as an unfunded commitment that would threaten state pension funding.

The situation leaves the British public weighing two different approaches to UK tax policy. As the political conversation continues, the focus will remain on whether future tax burdens are altered through transparent rate changes or the less visible effects of frozen thresholds.

Reeves’s £50bn Problem: Cut Pension Tax Relief to Balance the Books

Cost of Living Help & Pension Payments Coming in September 2025 – Are You on the List?

Tired of Tax Season Stress? UK Users Say This 2025 Software Is a Total Game-Changer

FAQs

1. What is fiscal drag?

Fiscal drag is an economic term for when inflation or wage growth pushes people into higher tax brackets or makes more of their income subject to tax because tax thresholds are not increased in line with rising incomes. Essentially, you pay more tax without the government officially raising tax rates.

2. What are the current National Insurance thresholds?

As of the 2024/25 tax year in the UK, employees start paying Class 1 National Insurance when they earn above £12,570 a year. These thresholds are currently frozen at this level until April 2028 under existing government policy.