LONDON – Pension experts and financial advisers are cautioning savers approaching retirement to urgently review their options regarding the tax-free pension lump sum. The advice comes amid growing speculation that the government may target this long-standing relief in the upcoming Autumn Budget as it seeks to bolster public finances.

Pension Experts Advise

| Key Point | Detail | Context |

| Urgent Advice | Experts advise those near or in retirement to consider if taking their tax-free cash now is appropriate. | This is a response to fears of potential negative changes in the next UK budget. |

| Current Rule | Most individuals can withdraw up to 25% of their defined contribution pension pot tax-free. | This is officially known as the Pension Commencement Lump Sum (PCLS). |

| Potential Changes | Speculated reforms include lowering the 25% limit or introducing a lifetime cap on the total amount. | The government is under pressure to raise tax revenue without increasing headline rates. |

| Official Stance | HM Treasury has not commented on the speculation, which is standard policy before a Budget. | The lack of denial has fuelled concern within the pensions industry. |

Why Experts Are Issuing Warnings on the Tax-Free Pension Lump Sum

For decades, the ability to withdraw a quarter of one’s pension savings without paying tax has been a cornerstone of retirement planning in the United Kingdom. However, with the government facing significant fiscal pressures, analysts believe this valuable benefit could be scaled back.

“The tax-free pension lump sum is exceptionally generous and, therefore, an obvious target for a Chancellor looking for revenue,” said Dr. Alistair Brown, a senior policy adviser at the pension consultancy firm Lane Clark & Peacock (LCP). “While nothing is confirmed, the direction of travel for fiscal policy means savers cannot afford to be complacent.”

This sentiment has been echoed by numerous financial planners. They stress that while hasty decisions should be avoided, individuals eligible to access their pensions should model the financial impact of a potential change to pension tax rules and discuss their circumstances with a qualified adviser.

Mounting Fiscal Pressure Ahead of the UK Budget

The warnings are rooted in the UK’s current economic climate. Following extensive government spending during recent economic shocks, public debt remains high. Reports from organisations like the Institute for Fiscal Studies (IFS) have highlighted the difficult choices facing the Chancellor, who must balance stabilising the economy with funding public services.

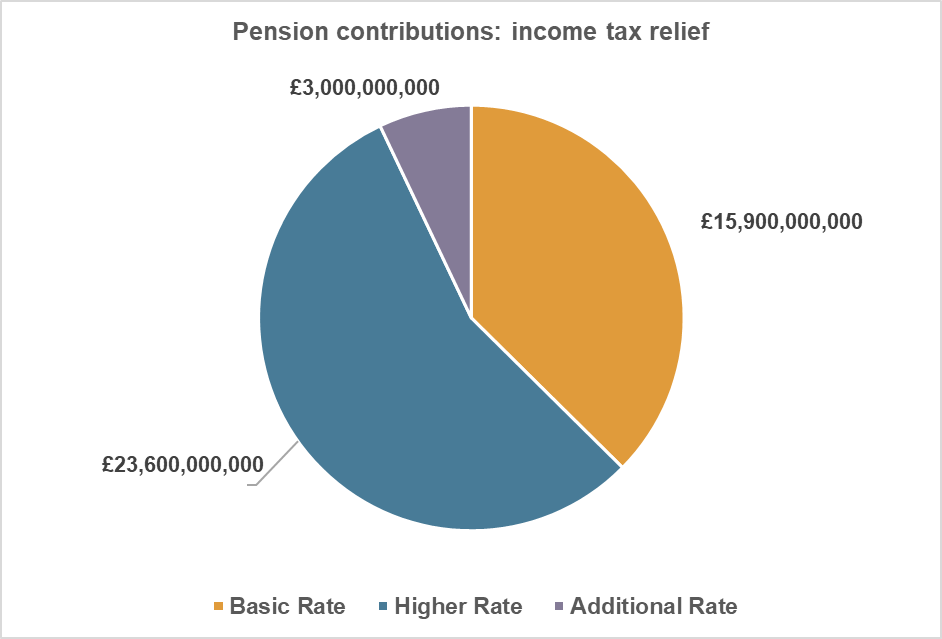

According to a recent IFS analysis, restricting pension tax reliefs is one of the few politically viable options available to raise substantial funds without breaking manifesto pledges on income tax, national insurance, or VAT. The tax relief on pension contributions and tax-free lump sums costs the Exchequer tens of billions of pounds annually.

What Changes Could Be on the Table?

While any potential policy is purely speculative at this stage, experts have outlined several ways the government could reform the pension commencement lump sum.

- Reducing the Percentage: The 25% allowance could be lowered to 20% or 15%.

- Introducing a Monetary Cap: A lifetime cap could be implemented, for instance at £100,000, limiting the tax-free amount savers with larger pots can withdraw.

- Aligning with Income Tax Rates: The lump sum could be taxed at the basic rate of income tax, removing its completely tax-free status.

“A lifetime cap on the total tax-free amount seems a plausible route for the government,” commented Sarah Jones, Head of Pensions at the financial services company Aegon. “This would be framed as a measure promoting fairness, as it would predominantly affect the wealthiest savers with the largest pension pots.”

Analysis and Advice for Savers

Financial advisers are urging caution and stressing that any decision must be based on individual circumstances. Taking a lump sum before it is needed can have significant drawbacks, such as losing out on potential investment growth within the tax-efficient pension wrapper.

“No one should rush into a decision that isn’t part of a considered retirement plan,” warned the Pensions and Lifetime Savings Association (PLSA) in a statement. “However, for those who were already planning to access their pension in the near future, this speculation may accelerate their timeline. Professional advice is crucial.”

The key demographic affected are those aged 55 and over (rising to 57 from 2028), who are eligible to begin drawing from their private pensions. For these individuals, the potential disappearance of a significant tax-free sum could alter their retirement income plans substantially.

The government has so far declined to comment on the speculation. A spokesperson for HM Treasury stated, “We do not comment on speculation about tax changes outside of fiscal events.” This standard response has done little to calm nerves in the pensions industry as the Autumn Budget approaches.

As the date of the fiscal statement nears, all eyes will be on the Chancellor. For now, savers are left to weigh the risk of a policy change against the potential consequences of accessing their retirement funds earlier than planned.

£114/Week UK Child Disability Allowance in Sep 2025: Only these will get it? Check Eligibility

UK ESA Payment 2025: £72.90 Boost Coming soon, Who will get it?

UK Income Support Rates 2025: Check September Rates, Date & Amount

FAQs

1. What is the tax-free pension lump sum?

The tax-free pension lump sum, or Pension Commencement Lump Sum (PCLS), allows most people to take up to 25% of their defined contribution pension pot as a one-off payment without paying any tax once they reach pension access age (currently 55).

2. Why are experts suggesting people consider taking it now?

Experts are concerned that the UK government may reduce or remove this tax relief in the next UK budget to raise money. They are advising those near retirement to review their options, not necessarily to act immediately.

3. What are the risks of taking my lump sum early?

Taking your money out of the pension wrapper means it will no longer benefit from tax-free investment growth. It could also push you into a higher income tax bracket for the year, and there is a risk of spending the money too soon, leaving you with less for later in retirement.

4. Should I take my lump sum now?

This is a complex financial decision that depends entirely on your personal circumstances, including your age, health, other savings, and retirement plans. It is highly recommended that you consult a regulated financial adviser before making any decision.