Millions of British pensioners will not receive the full Triple Lock pension boost on their entire state pension payment from next April, a government decision that has sparked criticism from experts and campaigners. The Department for Work and Pensions (DWP) will use a lower inflation figure to calculate increases for certain components of the state pension, creating a two-tier uprating that will leave many older pensioners with less than they expected.

Millions to Lose Out on Triple Lock Pension Boost

| Key Fact | Detail/Statistic | Implication |

| Two-Tier Uprating | The basic and new State Pension will rise by 8.5% (September CPI figure). | Older pensioners with earnings-related top-ups will not see their entire pension rise by this amount. |

| Affected Components | Additional State Pension (SERPS/S2P) and Guaranteed Minimum Pension will rise by only 6.7% (October earnings growth figure). | Creates an income gap, disproportionately affecting those who retired before April 2016. |

| Number Affected | Estimated to affect several million pensioners, particularly women and the very elderly. | A significant portion of the pensioner population will receive a smaller real-terms increase. |

How the Uprating Change Works

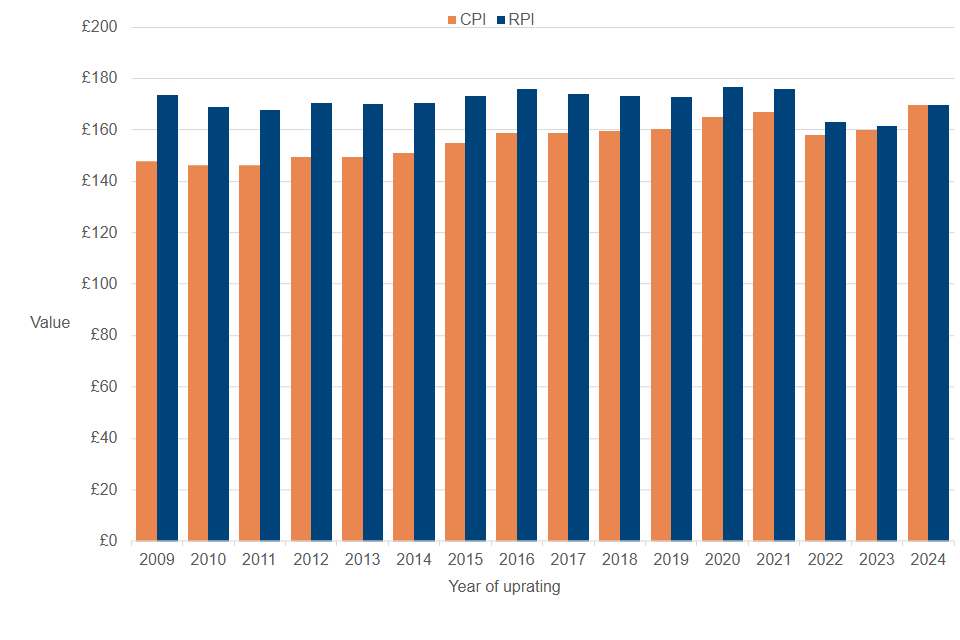

The government confirmed in its Autumn Statement that the State Pension would be honoured by the triple lock formula, resulting in an 8.5% increase for the main pension rates. This figure is based on the Consumer Prices Index (CPI) inflation rate from September. However, the Department for Work and Pensions (DWP) later quietly legislated to use a different, lower figure for other crucial pension components.

Elements such as the Additional State Pension—accrued by millions under the old State Earnings-Related Pension Scheme (SERPS)—and deferred pension increments will only be uprated by 6.7%. This figure is based on the annual growth in average earnings recorded in October. This discrepancy means that while the core pension payment rises significantly, these additional entitlements will lag behind.

According to analysis by pension consultancy LCP, this decision will primarily impact pensioners who reached state pension age before 6 April 2016. These individuals have pension structures that include these complex, earnings-related additions which are now set to be uprated at a lower rate.

The Financial Impact on Pensioners

The financial shortfall for individuals could be substantial over time, even if the weekly amount appears small. Experts warn that this creates a “stealth cut” that undermines the principle of the triple lock, which was designed to protect pensioner incomes against the rising cost of living.

Sir Steve Webb, a former Pensions Minister and now partner at LCP, heavily criticised the move. “The government has tried to pull the wool over people’s eyes,” he stated in an LCP press release. “Whilst it has boasted about an 8.5% increase in the State Pension, it has quietly cut the inflation protection on the state pensions of millions of older people.”

For example, a pensioner with a weekly Additional State Pension of £50 would have expected an increase of £4.25 under an 8.5% uplift. Instead, the 6.7% rise will give them only £3.35, resulting in a loss of nearly £50 over a year. The cumulative effect of such shortfalls can become significant over the course of a retirement.

Tired of Tax Season Stress? UK Users Say This 2025 Software Is a Total Game-Changer

Your August 2025 Benefits Could Arrive Sooner Than Expected — Here’s the Full Schedule

DWP’s Justification and Widespread Criticism

The DWP maintains that its approach is consistent with legal requirements. In a statement, a government spokesperson said: “We have a statutory duty to increase the Additional State Pension and Guaranteed Minimum Pension by earnings growth, which was the highest applicable figure.” They argue that different parts of the state pension have always been subject to different uprating rules by law.

However, critics say this technical justification ignores the spirit of the triple lock promise. Pensioner advocacy groups have voiced their anger, arguing that the complexity of the system is being used to deliver a cut in real terms.

Caroline Abrahams, Charity Director at Age UK, told The Telegraph: “Many older people will be shocked to learn that some of their State Pension is set to rise by a smaller amount than they were led to believe. This is a bitter pill to swallow, especially at a time when millions are struggling with high living costs.” The decision has led to calls for greater transparency and a simplification of the annual uprating process to ensure all pensioners are treated fairly.

The debate now centres on whether the legislation governing these secondary pension components should be revised to align with the main triple lock pledge. As it stands, the policy is set to proceed from April, leaving millions of older individuals to contend with a pension increase that is less generous than publicly proclaimed. The government has not indicated any plans to review the decision.