Understanding how much of your Social Security benefits may be taxed is crucial as you plan your retirement. In 2025, up to 50% of your Social Security retirement check can be taken by the federal government in taxes — and for some, this figure could rise to 85%. This article will break down who is most at risk, explain how the taxes are calculated in simple terms, and offer practical advice to help you prepare.

Whether you’re nearing retirement or already collecting benefits, knowing the rules around Social Security taxation can save surprises when tax season arrives. Here’s a friendly, clear, and authoritative guide designed to help anyone understand this important topic—breaking down complex tax rules into easy steps and offering tools to manage your retirement income effectively.

Social Security May Keep Up to 50% of Your Retirement Check

| Aspect | Details |

|---|---|

| Taxable Portion of Benefits | 0% to 50% of Social Security benefits may be taxed, rising to 85% for higher incomes |

| Combined Income Threshold (Single Filers) | $25,000 to $34,000 combined income triggers up to 50% taxation |

| Combined Income Threshold (Married Filing Jointly) | $32,000 to $44,000 combined income triggers up to 50% taxation |

| Maximum Social Security Wage Base | $176,100 income is the maximum subject to 6.2% Social Security tax in 2025 |

| Cost of Living Adjustment (COLA) | 2.5% increase in Social Security benefits for 2025 |

| Tax Filing Form | Taxable benefits included on IRS Form 1040, Line 6b |

Social Security may keep up to 50% (or even 85%) of your retirement benefits for taxes if your income reaches certain thresholds. For many retirees with modest income, Social Security benefits remain tax-free. However, for those with pensions, savings, or continued earnings, taxes on benefits can be substantial.

Understanding how the combined income formula works—and staying informed about 2025’s tax thresholds and Social Security limits—can help you make strategic decisions. Planning taxes and retirement income carefully with professional advice will help you keep more of your hard-earned benefits.

Social Security remains a vital cornerstone for millions of retirees, and knowing how taxation affects it will empower you to build a stronger, tax-savvy retirement plan.

Up to 50% of Social Security retirement benefits may be subject to federal taxes in 2025, with some individuals facing up to 85% taxation. This article explains who is most at risk, how taxation is calculated, and offers practical advice to minimize tax burdens. Understanding combined income thresholds and strategic retirement income planning can help protect your Social Security check and ensure greater financial security in retirement.

What Is Social Security Taxation and Why Does It Matter?

Social Security provides monthly benefits to millions of retirees, disabled individuals, and survivors of deceased workers. The money comes from payroll taxes paid by current workers. However, your Social Security benefits may be partially taxable, depending on other income you receive during retirement.

This taxation was introduced decades ago to ensure the solvency of the Social Security program by collecting revenue from retirees with higher overall income. Understanding how your combined income affects your benefits’ taxability is essential to avoid unexpected tax bills.

How Is the Tax on Social Security Benefits Calculated?

The IRS uses a calculation called combined income to determine how much of your Social Security benefits will be taxed. Here’s how it works in a straightforward way:

Step 1: Calculate Your Combined Income

Combined Income =

Adjusted Gross Income (AGI)

- Nontaxable interest

- 50% of your Social Security benefits

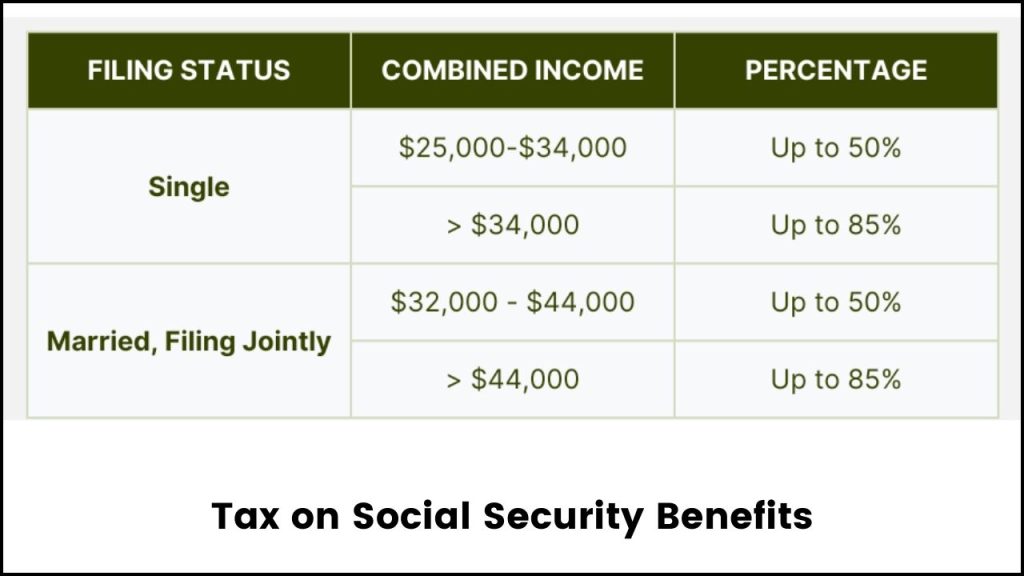

Step 2: Compare Combined Income to IRS Thresholds

- For single filers:

- If combined income is below $25,000, your benefits are not taxable.

- Between $25,000 and $34,000, up to 50% of benefits could be taxable.

- Over $34,000, up to 85% of benefits could be taxable.

- For married couples filing jointly:

- If combined income is below $32,000, no taxes are due on benefits.

- Between $32,000 and $44,000, up to 50% of benefits may be taxable.

- Over $44,000, up to 85% of benefits may be taxable.

Step 3: Taxable Portion Included on Your Tax Return

The amount determined as taxable is reported on Line 6b of IRS Form 1040, mixed in with your other taxable income and taxed at your income tax bracket.

Who Is Most at Risk of Paying Up to 50% or More?

- Retirees with Other Income Sources: If you have pensions, 401(k) distributions, rental income, or investment earnings that push your combined income over the IRS thresholds, you will likely pay taxes on a portion of your Social Security.

- Married Couples with Combined Income: Couples who jointly earn above $32,000 risk having half their benefits taxed, and above $44,000 risk up to 85% tax.

- Higher Earners in Retirement: Those with higher Social Security benefits due to larger historic earnings and who continue to work or receive significant retirement income may be impacted.

- Self-Employed Individuals: Pay the full Social Security tax rate on the taxable wage base, which is $176,100 for 2025, plus Medicare tax without limit.

Important 2025 Social Security Tax Data

- Wage Cap for Social Security Tax: The tax applies only on the first $176,100 of income in 2025, at a rate of 6.2% for employees (matched by employers). Self-employed individuals pay both halves.

- Cost of Living Adjustment: Social Security benefits increased by 2.5% in 2025, helping retirees keep pace with inflation.

- Medicare Tax: Unlike Social Security, Medicare tax has no income cap. It is charged at 1.45% on all earnings, with an additional 0.9% tax for incomes over $200,000 (single filers).

Practical Tips to Manage Your Social Security Tax Burden

- Plan Your Withdrawals Wisely: Coordinate distributions from tax-deferred retirement accounts to manage your combined income and avoid pushing yourself into a higher taxable bracket.

- Consider Filing Status: If possible, consider the tax implications of filing jointly versus separately; sometimes filing separately can minimize tax on benefits, although it could increase overall taxes.

- Use Tax-Advantaged Accounts: Roth IRAs, which allow tax-free withdrawals, can reduce your combined income and lower taxes on your Social Security.

- Consult a Tax Professional: Rules can be complicated, especially with multiple income streams. A tax expert can help tailor a strategy to your unique financial situation.

- Stay Updated: IRS thresholds and Social Security limits often change annually due to inflation adjustments—keep informed for current-year planning.

Social Security’s Future Uncertain – 5 Backup Income Sources Every Retiree Should Consider

AARP Report Reveals Why More Americans Are Claiming Social Security Early – Should You Do the Same?

Six Key Changes to Social Security Coming in 2026 – What Retirees Need to Know Now

FAQs About Social Security May Keep Up to 50% of Your Retirement Check

Q1: Are Social Security benefits always taxable?

A: No. Only beneficiaries above certain income thresholds pay tax on benefits. Many retirees pay no tax on their Social Security.

Q2: Can Social Security benefits be taxed by states?

A: Some states tax Social Security benefits, but many states do not. Check your state’s tax laws.

Q3: How can I find out if my benefits are taxable?

A: Use the IRS worksheet in Publication 915 or online calculators available through trusted financial websites.

Q4: What forms do I need to report Social Security income?

A: You’ll receive Form SSA-1099 annually for your benefits. Include taxable amounts on your federal return, usually on Form 1040.

Q5: Does working after retirement affect Social Security taxation?

A: Yes. Earnings can increase your combined income, potentially making more of your benefits taxable.