Parents across Canada are receiving an important financial boost this August 20, 2025, with the Canada Child Benefit (CCB) payments increasing to up to $666 per child under six years old. This tax-free monthly payment from the Canadian government is designed to help families with the costs of raising children. As living expenses climb, this adjustment comes at a crucial time for parents seeking to manage household budgets, childcare expenses, and children’s needs more effectively.

In this article, you will find a comprehensive guide on the Canada Child Benefit August 2025 payment — including eligibility, how payments are calculated, practical advice for maximizing benefits, and answers to common questions. Whether you’re a parent or a professional advising families, this detailed explanation breaks down everything you need to know in clear, friendly language, paired with expert insights and actionable tips.

Up to $666 per Child Arriving August 20

| Key Point | Details |

|---|---|

| Payment Date | August 20, 2025 |

| Maximum Monthly Payment | $666.41 per child under 6 years; $562.33 per child aged 6-17 |

| Annual Max Benefit | Up to $7,962 per child under 6; $6,729 per child aged 6-17 |

| Eligibility | Canadian residents with children under 18 who file 2024 tax returns |

| Taxable? | No, CCB is a tax-free benefit |

| Application | Streamlined; new Canadians can apply during birth registration or via CRA My Account |

| Additional Benefits | Disability Tax Credit increases; provincial top-ups available in some regions |

| Payment Method | Direct deposit or mailed cheque |

| Official Information | Canada Revenue Agency (CRA) CCB page |

The upcoming Canada Child Benefit payment on August 20, 2025, offers a welcomed increase to help Canadian families manage the rising cost of living. With payments up to $666.41 per child under six, this tax-free assistance provides essential financial relief for parents nationwide. By understanding the eligibility criteria, ensuring timely tax filing, and using available resources, families can maximize their benefits with confidence.

Stay informed, update your CRA information promptly, and take advantage of this supportive program to help your children thrive in a secure and healthy environment.

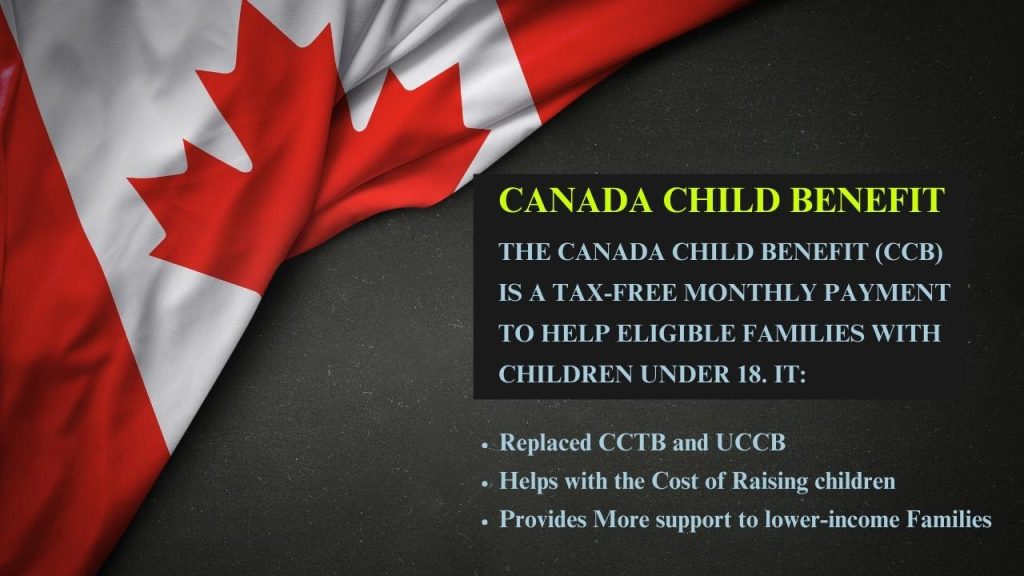

What Is the Canada Child Benefit (CCB)?

The Canada Child Benefit is a tax-free monthly payment provided by the federal government to help families with children under 18 years of age cover the costs of raising them. Introduced in 2016, the CCB replaced earlier child benefit programs to provide more targeted and predictable support based on family income. The benefit is calculated based on factors such as the number of children, their age, the family’s net income, and eligibility for the Disability Tax Credit (DTC).

This government assistance can make a significant difference for families, particularly in today’s climate where costs like groceries, rent, childcare, and schooling continue to rise.

What’s New for August 2025?

For the 2025–2026 benefit year, the Canada Revenue Agency (CRA) has increased CCB monthly payments by approximately 2.7% to keep up with inflation. The new rates become effective with the payment issued on August 20, 2025.

The adjusted maximum monthly payment amounts are:

- $666.41 per child under 6 years old

- $562.33 per child aged 6 to 17 years

Families with a lower adjusted family net income (AFNI) — $37,487 or less — will receive the full maximum payment, while others with higher incomes will receive a reduced amount based on a tiered reduction formula. The payment increase means more families, including many middle-income earners, may see a larger amount deposited to help ease financial pressure.

How Is the Canada Child Benefit Calculated?

The CRA calculates your benefit based on:

- Number of eligible children and their ages

- Adjusted family net income (AFNI) from your latest tax return (2024 return for the 2025–26 payment year)

- Child’s eligibility for the Disability Tax Credit (DTC) if applicable

Incomes above certain thresholds experience a gradual reduction in payments. For example, the benefit starts reducing for families with AFNI above $37,487, at rates varying with the number of children (e.g., 7% for one child, 13.5% for two children).

Who Is Eligible for the Canada Child Benefit?

To qualify for the CCB, you must:

- Be a resident of Canada for tax purposes

- Live with the child and be primarily responsible for their care and upbringing

- Have a child under 18 years old

- File your 2024 income tax return (even if you had no income)

- Your spouse or common-law partner, if applicable, must also file taxes

Newcomers to Canada can apply for the benefit when registering a birth or through their CRA My Account. It’s important for all eligible families to file taxes promptly, even those with no tax owing, to avoid missing out on benefit payments.

Practical Tips to Maximize Your Canada Child Benefit

- File Your Taxes Early and On Time

The CRA uses your latest tax return to calculate your benefit. Filing early ensures timely payments and avoids delays. - Keep Your Personal Information Up to Date

Notify CRA as soon as possible about any changes in family situation, such as adding a newborn, change of address, or separation. - Sign Up for Direct Deposit

This is the fastest and safest way to receive your payments on the scheduled date. - Check Eligibility for Additional Benefits

If your child qualifies for the Disability Tax Credit, you may be eligible for additional monthly amounts. Some provinces also offer top-up benefits. - Use CRA’s Online Calculator

To estimate your monthly payments, use the official CRA Child and Family Benefits Calculator for a personalized estimate based on your income and number of children.

What to Expect on August 20, 2025

On August 20th, Canadian families will receive their CCB payments, reflecting any increases for the new benefit year. Payments are generally directly deposited into bank accounts on the payment date. If you receive cheques by mail, allow a few extra days for delivery.

New Benefit Cheques Are Coming in August & September Across Canada — Are You Getting One?

New Cheques Are Coming in August and September Across Canada — Are You on the List?

3 New CRA Benefit Payments Coming to Ontario in August 2025 — See If You Qualify

FAQs About Up to $666 per Child Arriving August 20

Q1: Is the Canada Child Benefit taxable income?

A: No. The CCB is a tax-free benefit and does not affect your taxes or income reporting.

Q2: What happens if I haven’t filed my 2024 taxes yet?

A: You must file your 2024 tax return for the CRA to determine your eligibility and payment amount.

Q3: Can I get retroactive payments if I was eligible but didn’t apply?

A: Yes. You can request up to three years of retroactive payments from CRA.

Q4: Who can apply for the CCB?

A: Canadian residents who live with children under 18 and are primarily responsible for their care.

Q5: How do the payment reductions work for higher income families?

A: Payments gradually reduce starting at an adjusted family net income threshold, decreasing based on income and number of children.